Annual Report 2011 - Ford Motor Company

Annual Report 2011 - Ford Motor Company

Annual Report 2011 - Ford Motor Company

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

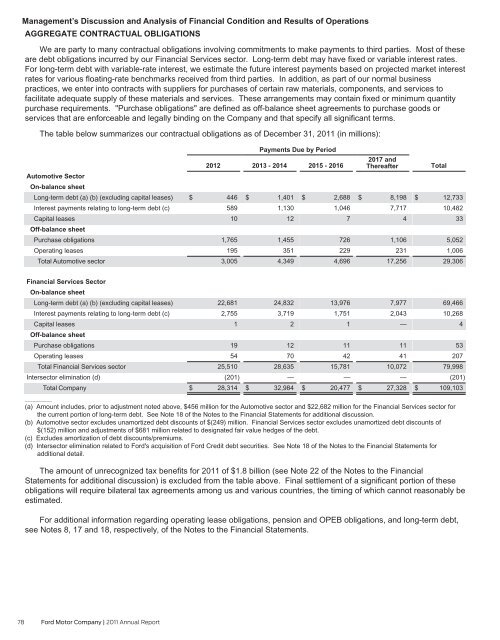

Management’s Discussion and Analysis of Financial Condition and Results of Operations<br />

AGGREGATE CONTRACTUAL OBLIGATIONS<br />

We are party to many contractual obligations involving commitments to make payments to third parties. Most of these<br />

are debt obligations incurred by our Financial Services sector. Long-term debt may have fixed or variable interest rates.<br />

For long-term debt with variable-rate interest, we estimate the future interest payments based on projected market interest<br />

rates for various floating-rate benchmarks received from third parties. In addition, as part of our normal business<br />

practices, we enter into contracts with suppliers for purchases of certain raw materials, components, and services to<br />

facilitate adequate supply of these materials and services. These arrangements may contain fixed or minimum quantity<br />

purchase requirements. "Purchase obligations" are defined as off-balance sheet agreements to purchase goods or<br />

services that are enforceable and legally binding on the <strong>Company</strong> and that specify all significant terms.<br />

The table below summarizes our contractual obligations as of December 31, <strong>2011</strong> (in millions):<br />

Automotive Sector<br />

On-balance sheet<br />

Long-term debt (a) (b) (excluding capital leases)<br />

Interest payments relating to long-term debt (c)<br />

Capital leases<br />

Off-balance sheet<br />

Purchase obligations<br />

Operating leases<br />

Total Automotive sector<br />

Financial Services Sector<br />

On-balance sheet<br />

Long-term debt (a) (b) (excluding capital leases)<br />

Interest payments relating to long-term debt (c)<br />

Capital leases<br />

Off-balance sheet<br />

Purchase obligations<br />

Operating leases<br />

Total Financial Services sector<br />

Intersector elimination (d)<br />

Total <strong>Company</strong><br />

78 <strong>Ford</strong> <strong>Motor</strong> <strong>Company</strong> | <strong>2011</strong> <strong>Annual</strong> <strong>Report</strong><br />

2012<br />

$ 446<br />

589<br />

10<br />

1,765<br />

195<br />

3,005<br />

22,681<br />

2,755<br />

1<br />

19<br />

54<br />

25,510<br />

(201)<br />

$ 28,314<br />

Payments Due by Period<br />

2013 - 2014<br />

$ 1,401<br />

1,130<br />

12<br />

1,455<br />

351<br />

4,349<br />

24,832<br />

3,719<br />

2<br />

12<br />

70<br />

28,635<br />

—<br />

$ 32,984<br />

2015 - 2016<br />

$ 2,688<br />

1,046<br />

7<br />

726<br />

229<br />

4,696<br />

13,976<br />

1,751<br />

1<br />

11<br />

42<br />

15,781<br />

—<br />

$ 20,477<br />

2017 and<br />

Thereafter<br />

$ 8,198<br />

7,717<br />

4<br />

1,106<br />

231<br />

17,256<br />

7,977<br />

2,043<br />

—<br />

11<br />

41<br />

10,072<br />

—<br />

$ 27,328<br />

Total<br />

$ 12,733<br />

10,482<br />

33<br />

5,052<br />

1,006<br />

29,306<br />

69,466<br />

10,268<br />

4<br />

53<br />

207<br />

79,998<br />

(201)<br />

$ 109,103<br />

__________<br />

(a) Amount includes, prior to adjustment noted above, $456 million for the Automotive sector and $22,682 million for the Financial Services sector for<br />

the current portion of long-term debt. See Note 18 of the Notes to the Financial Statements for additional discussion.<br />

(b) Automotive sector excludes unamortized debt discounts of $(249) million. Financial Services sector excludes unamortized debt discounts of<br />

$(152) million and adjustments of $681 million related to designated fair value hedges of the debt.<br />

(c) Excludes amortization of debt discounts/premiums.<br />

(d) Intersector elimination related to <strong>Ford</strong>'s acquisition of <strong>Ford</strong> Credit debt securities. See Note 18 of the Notes to the Financial Statements for<br />

additional detail.<br />

The amount of unrecognized tax benefits for <strong>2011</strong> of $1.8 billion (see Note 22 of the Notes to the Financial<br />

Statements for additional discussion) is excluded from the table above. Final settlement of a significant portion of these<br />

obligations will require bilateral tax agreements among us and various countries, the timing of which cannot reasonably be<br />

estimated.<br />

For additional information regarding operating lease obligations, pension and OPEB obligations, and long-term debt,<br />

see Notes 8, 17 and 18, respectively, of the Notes to the Financial Statements.