Annual Report 2011 - Ford Motor Company

Annual Report 2011 - Ford Motor Company

Annual Report 2011 - Ford Motor Company

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

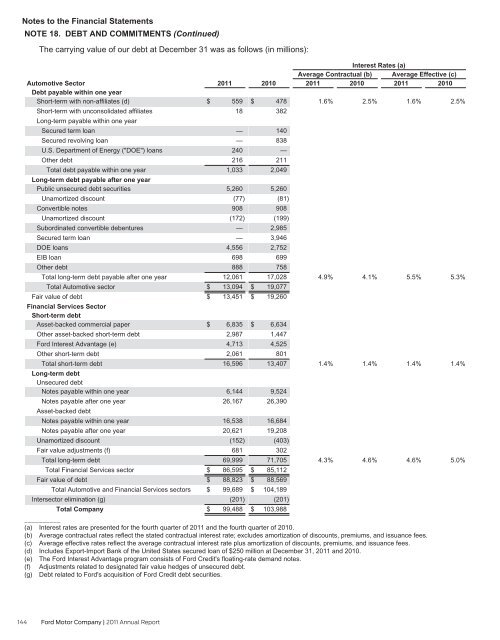

Notes to the Financial Statements<br />

NOTE 18. DEBT AND COMMITMENTS (Continued)<br />

The carrying value of our debt at December 31 was as follows (in millions):<br />

Interest Rates (a)<br />

Average Contractual (b) Average Effective (c)<br />

Automotive Sector<br />

Debt payable within one year<br />

<strong>2011</strong> 2010 <strong>2011</strong> 2010 <strong>2011</strong> 2010<br />

Short-term with non-affiliates (d)<br />

$ 559 $ 478 1.6% 2.5% 1.6% 2.5%<br />

Short-term with unconsolidated affiliates<br />

Long-term payable within one year<br />

18<br />

382<br />

Secured term loan<br />

—<br />

140<br />

Secured revolving loan<br />

—<br />

838<br />

U.S. Department of Energy ("DOE") loans<br />

240<br />

—<br />

Other debt<br />

216<br />

211<br />

Total debt payable within one year<br />

Long-term debt payable after one year<br />

1,033 2,049<br />

Public unsecured debt securities<br />

5,260 5,260<br />

Unamortized discount<br />

(77) (81)<br />

Convertible notes<br />

908<br />

908<br />

Unamortized discount<br />

(172) (199)<br />

Subordinated convertible debentures<br />

— 2,985<br />

Secured term loan<br />

— 3,946<br />

DOE loans<br />

4,556 2,752<br />

EIB loan<br />

698<br />

699<br />

Other debt<br />

888<br />

758<br />

Total long-term debt payable after one year<br />

12,061 17,028 4.9% 4.1% 5.5% 5.3%<br />

Total Automotive sector<br />

$ 13,094 $ 19,077<br />

Fair value of debt<br />

Financial Services Sector<br />

Short-term debt<br />

$ 13,451 $ 19,260<br />

Asset-backed commercial paper<br />

$ 6,835 $ 6,634<br />

Other asset-backed short-term debt<br />

2,987 1,447<br />

<strong>Ford</strong> Interest Advantage (e)<br />

4,713 4,525<br />

Other short-term debt<br />

2,061<br />

801<br />

Total short-term debt<br />

Long-term debt<br />

Unsecured debt<br />

16,596 13,407 1.4% 1.4% 1.4% 1.4%<br />

Notes payable within one year<br />

6,144 9,524<br />

Notes payable after one year<br />

Asset-backed debt<br />

26,167 26,390<br />

Notes payable within one year<br />

16,538 16,684<br />

Notes payable after one year<br />

20,621 19,208<br />

Unamortized discount<br />

(152) (403)<br />

Fair value adjustments (f)<br />

681<br />

302<br />

Total long-term debt<br />

69,999 71,705 4.3% 4.6% 4.6% 5.0%<br />

Total Financial Services sector<br />

$ 86,595 $ 85,112<br />

Fair value of debt<br />

$ 88,823 $ 88,569<br />

Total Automotive and Financial Services sectors $ 99,689 $ 104,189<br />

Intersector elimination (g)<br />

(201) (201)<br />

Total <strong>Company</strong><br />

__________<br />

$ 99,488 $ 103,988<br />

(a) Interest rates are presented for the fourth quarter of <strong>2011</strong> and the fourth quarter of 2010.<br />

(b) Average contractual rates reflect the stated contractual interest rate; excludes amortization of discounts, premiums, and issuance fees.<br />

(c) Average effective rates reflect the average contractual interest rate plus amortization of discounts, premiums, and issuance fees.<br />

(d) Includes Export-Import Bank of the United States secured loan of $250 million at December 31, <strong>2011</strong> and 2010.<br />

(e) The <strong>Ford</strong> Interest Advantage program consists of <strong>Ford</strong> Credit's floating-rate demand notes.<br />

(f) Adjustments related to designated fair value hedges of unsecured debt.<br />

(g) Debt related to <strong>Ford</strong>'s acquisition of <strong>Ford</strong> Credit debt securities.<br />

144 <strong>Ford</strong> <strong>Motor</strong> <strong>Company</strong> | <strong>2011</strong> <strong>Annual</strong> <strong>Report</strong>