Annual Report 2011 - Ford Motor Company

Annual Report 2011 - Ford Motor Company

Annual Report 2011 - Ford Motor Company

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

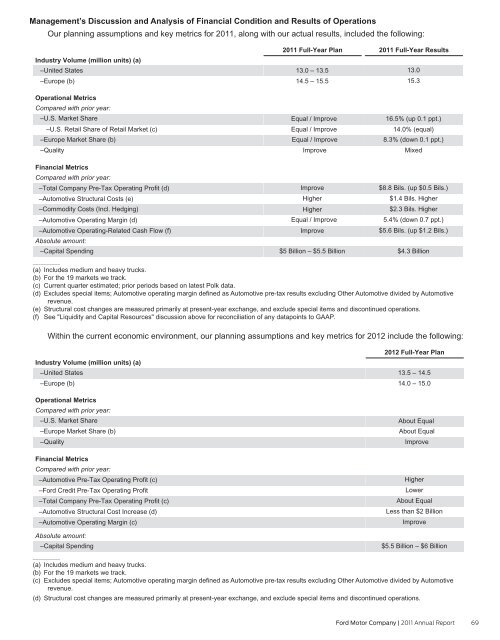

Management’s Discussion and Analysis of Financial Condition and Results of Operations<br />

Our planning assumptions and key metrics for <strong>2011</strong>, along with our actual results, included the following:<br />

Industry Volume (million units) (a)<br />

–United States<br />

–Europe (b)<br />

Operational Metrics<br />

Compared with prior year:<br />

–U.S. Market Share<br />

–U.S. Retail Share of Retail Market (c)<br />

–Europe Market Share (b)<br />

–Quality<br />

Financial Metrics<br />

Compared with prior year:<br />

–Total <strong>Company</strong> Pre-Tax Operating Profit (d)<br />

–Automotive Structural Costs (e)<br />

–Commodity Costs (Incl. Hedging)<br />

–Automotive Operating Margin (d)<br />

–Automotive Operating-Related Cash Flow (f)<br />

Absolute amount:<br />

–Capital Spending<br />

<strong>2011</strong> Full-Year Plan<br />

13.0 – 13.5<br />

14.5 – 15.5<br />

Equal / Improve<br />

Equal / Improve<br />

Equal / Improve<br />

Improve<br />

Improve<br />

Higher<br />

Higher<br />

Equal / Improve<br />

Improve<br />

$5 Billion – $5.5 Billion<br />

<strong>2011</strong> Full-Year Results<br />

13.0<br />

15.3<br />

16.5% (up 0.1 ppt.)<br />

14.0% (equal)<br />

8.3% (down 0.1 ppt.)<br />

Mixed<br />

$8.8 Bils. (up $0.5 Bils.)<br />

$1.4 Bils. Higher<br />

$2.3 Bils. Higher<br />

5.4% (down 0.7 ppt.)<br />

$5.6 Bils. (up $1.2 Bils.)<br />

$4.3 Billion<br />

__________<br />

(a) Includes medium and heavy trucks.<br />

(b) For the 19 markets we track.<br />

(c) Current quarter estimated; prior periods based on latest Polk data.<br />

(d) Excludes special items; Automotive operating margin defined as Automotive pre-tax results excluding Other Automotive divided by Automotive<br />

revenue.<br />

(e) Structural cost changes are measured primarily at present-year exchange, and exclude special items and discontinued operations.<br />

(f) See "Liquidity and Capital Resources" discussion above for reconciliation of any datapoints to GAAP.<br />

Within the current economic environment, our planning assumptions and key metrics for 2012 include the following:<br />

Industry Volume (million units) (a)<br />

–United States<br />

–Europe (b)<br />

Operational Metrics<br />

Compared with prior year:<br />

–U.S. Market Share<br />

–Europe Market Share (b)<br />

–Quality<br />

Financial Metrics<br />

Compared with prior year:<br />

–Automotive Pre-Tax Operating Profit (c)<br />

–<strong>Ford</strong> Credit Pre-Tax Operating Profit<br />

–Total <strong>Company</strong> Pre-Tax Operating Profit (c)<br />

–Automotive Structural Cost Increase (d)<br />

–Automotive Operating Margin (c)<br />

Absolute amount:<br />

–Capital Spending<br />

2012 Full-Year Plan<br />

13.5 – 14.5<br />

14.0 – 15.0<br />

About Equal<br />

About Equal<br />

Improve<br />

Higher<br />

Lower<br />

About Equal<br />

Less than $2 Billion<br />

Improve<br />

$5.5 Billion – $6 Billion<br />

__________<br />

(a) Includes medium and heavy trucks.<br />

(b) For the 19 markets we track.<br />

(c) Excludes special items; Automotive operating margin defined as Automotive pre-tax results excluding Other Automotive divided by Automotive<br />

revenue.<br />

(d) Structural cost changes are measured primarily at present-year exchange, and exclude special items and discontinued operations.<br />

<strong>Ford</strong> <strong>Motor</strong> <strong>Company</strong> | <strong>2011</strong> <strong>Annual</strong> <strong>Report</strong> 69