Annual Report 2011 - Ford Motor Company

Annual Report 2011 - Ford Motor Company

Annual Report 2011 - Ford Motor Company

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

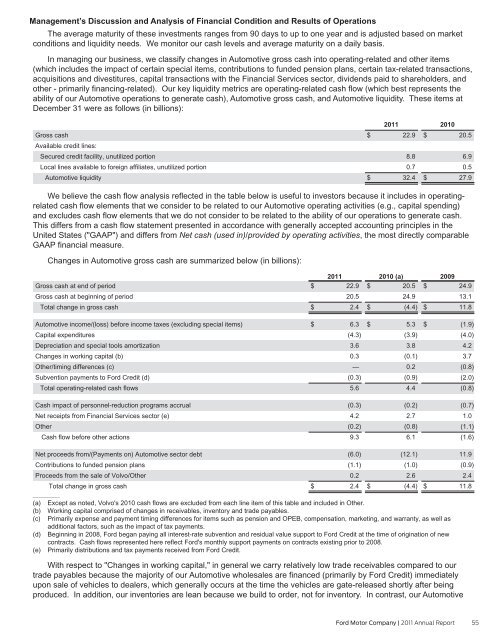

Management’s Discussion and Analysis of Financial Condition and Results of Operations<br />

The average maturity of these investments ranges from 90 days to up to one year and is adjusted based on market<br />

conditions and liquidity needs. We monitor our cash levels and average maturity on a daily basis.<br />

In managing our business, we classify changes in Automotive gross cash into operating-related and other items<br />

(which includes the impact of certain special items, contributions to funded pension plans, certain tax-related transactions,<br />

acquisitions and divestitures, capital transactions with the Financial Services sector, dividends paid to shareholders, and<br />

other - primarily financing-related). Our key liquidity metrics are operating-related cash flow (which best represents the<br />

ability of our Automotive operations to generate cash), Automotive gross cash, and Automotive liquidity. These items at<br />

December 31 were as follows (in billions):<br />

Gross cash<br />

Available credit lines:<br />

Secured credit facility, unutilized portion<br />

Local lines available to foreign affiliates, unutilized portion<br />

Automotive liquidity<br />

<strong>2011</strong><br />

$ 22.9<br />

8.8<br />

0.7<br />

$ 32.4<br />

2010<br />

$ 20.5<br />

6.9<br />

0.5<br />

$ 27.9<br />

We believe the cash flow analysis reflected in the table below is useful to investors because it includes in operatingrelated<br />

cash flow elements that we consider to be related to our Automotive operating activities (e.g., capital spending)<br />

and excludes cash flow elements that we do not consider to be related to the ability of our operations to generate cash.<br />

This differs from a cash flow statement presented in accordance with generally accepted accounting principles in the<br />

United States ("GAAP") and differs from Net cash (used in)/provided by operating activities, the most directly comparable<br />

GAAP financial measure.<br />

Changes in Automotive gross cash are summarized below (in billions):<br />

Gross cash at end of period<br />

Gross cash at beginning of period<br />

Total change in gross cash<br />

Automotive income/(loss) before income taxes (excluding special items)<br />

Capital expenditures<br />

Depreciation and special tools amortization<br />

Changes in working capital (b)<br />

Other/timing differences (c)<br />

Subvention payments to <strong>Ford</strong> Credit (d)<br />

Total operating-related cash flows<br />

Cash impact of personnel-reduction programs accrual<br />

Net receipts from Financial Services sector (e)<br />

Other<br />

Cash flow before other actions<br />

Net proceeds from/(Payments on) Automotive sector debt<br />

Contributions to funded pension plans<br />

Proceeds from the sale of Volvo/Other<br />

Total change in gross cash<br />

<strong>2011</strong><br />

$ 22.9<br />

20.5<br />

$ 2.4<br />

$ 6.3<br />

(4.3)<br />

3.6<br />

0.3<br />

—<br />

(0.3)<br />

5.6<br />

(0.3)<br />

4.2<br />

(0.2)<br />

9.3<br />

(6.0)<br />

(1.1)<br />

0.2<br />

$ 2.4<br />

2010 (a)<br />

$ 20.5<br />

24.9<br />

$ (4.4)<br />

$ 5.3<br />

(3.9)<br />

3.8<br />

(0.1)<br />

0.2<br />

(0.9)<br />

4.4<br />

(0.2)<br />

2.7<br />

(0.8)<br />

6.1<br />

(12.1)<br />

(1.0)<br />

2.6<br />

$ (4.4)<br />

2009<br />

$ 24.9<br />

13.1<br />

$ 11.8<br />

$ (1.9)<br />

(4.0)<br />

4.2<br />

3.7<br />

(0.8)<br />

(2.0)<br />

(0.8)<br />

(0.7)<br />

1.0<br />

(1.1)<br />

(1.6)<br />

11.9<br />

(0.9)<br />

2.4<br />

$ 11.8<br />

__________<br />

(a) Except as noted, Volvo's 2010 cash flows are excluded from each line item of this table and included in Other.<br />

(b) Working capital comprised of changes in receivables, inventory and trade payables.<br />

(c) Primarily expense and payment timing differences for items such as pension and OPEB, compensation, marketing, and warranty, as well as<br />

additional factors, such as the impact of tax payments.<br />

(d) Beginning in 2008, <strong>Ford</strong> began paying all interest-rate subvention and residual value support to <strong>Ford</strong> Credit at the time of origination of new<br />

contracts. Cash flows represented here reflect <strong>Ford</strong>'s monthly support payments on contracts existing prior to 2008.<br />

(e) Primarily distributions and tax payments received from <strong>Ford</strong> Credit.<br />

With respect to "Changes in working capital," in general we carry relatively low trade receivables compared to our<br />

trade payables because the majority of our Automotive wholesales are financed (primarily by <strong>Ford</strong> Credit) immediately<br />

upon sale of vehicles to dealers, which generally occurs at the time the vehicles are gate-released shortly after being<br />

produced. In addition, our inventories are lean because we build to order, not for inventory. In contrast, our Automotive<br />

<strong>Ford</strong> <strong>Motor</strong> <strong>Company</strong> | <strong>2011</strong> <strong>Annual</strong> <strong>Report</strong> 55