Annual Report 2011 - Ford Motor Company

Annual Report 2011 - Ford Motor Company

Annual Report 2011 - Ford Motor Company

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Notes to the Financial Statements<br />

NOTE 20. SHARE-BASED COMPENSATION (Continued)<br />

Outstanding RSU-stock are either strictly time-based or a combination of performance and time-based awards.<br />

Expenses associated with RSU-stock are recorded in Selling, administrative, and other expense.<br />

• Time-based RSU-stock generally have a graded vesting feature whereby one-third of each RSU-stock vests after<br />

the first anniversary of the grant date, one-third after the second anniversary, and one-third after the third<br />

anniversary. The expense is recognized using the graded vesting method.<br />

• Performance RSU-stock have a performance period (usually 1-3 years) and usually a restriction period (usually<br />

1-3 years). Compensation expense for performance RSU-stock is recognized when it is probable and estimable<br />

as measured against the performance metrics. Expense is then recognized over the performance and restriction<br />

periods, if any, based on the fair market value of <strong>Ford</strong> Common Stock at grant date.<br />

We also grant stock options to our employees. We measure the fair value of the majority of our stock options using<br />

the Black-Scholes option-pricing model, using historical volatility and our determination of the expected term. The<br />

expected term of stock options is the time period that the stock options are expected to be outstanding. Historical data<br />

are used to estimate option exercise behaviors and employee termination experience.<br />

Stock options generally have a vesting feature whereby one-third of the stock options are exercisable after the first<br />

anniversary of the grant date, one-third after the second anniversary, and one-third after the third anniversary. Stock<br />

options expire ten years from the grant date and are expensed in Selling, administrative, and other expenses using a<br />

three-year graded vesting methodology.<br />

We issue new shares of Common Stock upon settlement of RSU-stock and options settleable in shares. During 2012,<br />

we intend to implement a modest anti-dilutive share repurchase plan to offset share-based compensation.<br />

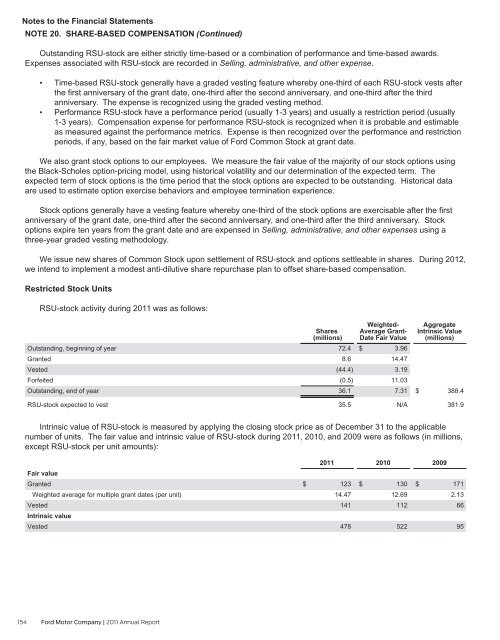

Restricted Stock Units<br />

RSU-stock activity during <strong>2011</strong> was as follows:<br />

Outstanding, beginning of year<br />

Granted<br />

Vested<br />

Forfeited<br />

Outstanding, end of year<br />

RSU-stock expected to vest<br />

154 <strong>Ford</strong> <strong>Motor</strong> <strong>Company</strong> | <strong>2011</strong> <strong>Annual</strong> <strong>Report</strong><br />

Shares<br />

(millions)<br />

72.4<br />

8.6<br />

(44.4)<br />

(0.5)<br />

36.1<br />

35.5<br />

Weighted-<br />

Average Grant-<br />

Date Fair Value<br />

$ 3.96<br />

14.47<br />

3.19<br />

11.03<br />

7.31<br />

N/A<br />

Aggregate<br />

Intrinsic Value<br />

(millions)<br />

$ 388.4<br />

Intrinsic value of RSU-stock is measured by applying the closing stock price as of December 31 to the applicable<br />

number of units. The fair value and intrinsic value of RSU-stock during <strong>2011</strong>, 2010, and 2009 were as follows (in millions,<br />

except RSU-stock per unit amounts):<br />

Fair value<br />

Granted<br />

Weighted average for multiple grant dates (per unit)<br />

Vested<br />

Intrinsic value<br />

Vested<br />

<strong>2011</strong><br />

$ 123<br />

14.47<br />

141<br />

478<br />

2010<br />

$ 130<br />

12.69<br />

112<br />

522<br />

2009<br />

381.9<br />

$ 171<br />

2.13<br />

66<br />

95