Annual Report 2011 - Ford Motor Company

Annual Report 2011 - Ford Motor Company

Annual Report 2011 - Ford Motor Company

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Notes to the Financial Statements<br />

NOTE 13. VARIABLE INTEREST ENTITIES (Continued)<br />

We have no obligation to repurchase or replace any securitized asset that subsequently becomes delinquent in<br />

payment or otherwise is in default, except under standard representations and warranties such as good and marketable<br />

title to the assets, or when certain changes are made to the underlying asset contracts. Securitization investors have no<br />

recourse to our Financial Services sector or its other assets for credit losses on the securitized assets, and have no right<br />

to require us to repurchase the investments. We generally have no obligation to provide liquidity or contribute cash or<br />

additional assets to the VIEs and do not guarantee any asset-backed securities, although <strong>Ford</strong> Credit is the co-obligor of<br />

the debt of a consolidated VIE up to $250 million for two of its securitization transactions. <strong>Ford</strong> Credit may be required to<br />

support the performance of certain securitization transactions, however, by increasing cash reserves.<br />

Although not contractually required, <strong>Ford</strong> Credit regularly supports its wholesale securitization programs by<br />

repurchasing receivables of a dealer from the VIEs when the dealer's performance is at risk, which transfers the<br />

corresponding risk of loss from the VIE to <strong>Ford</strong> Credit. In order to continue to fund the wholesale receivables, <strong>Ford</strong> Credit<br />

also may contribute additional cash or wholesale receivables if the collateral falls below the required levels. The balances<br />

of cash related to these contributions were $0 at December 31, <strong>2011</strong> and 2010, and ranged from $0 to $490 million during<br />

<strong>2011</strong> and ranged from $0 to $1.4 billion during 2010. In addition, while not contractually required, <strong>Ford</strong> Credit may<br />

purchase the commercial paper issued by <strong>Ford</strong> Credit's FCAR Owner Trust asset-backed commercial paper program<br />

("FCAR").<br />

VIEs that are exposed to interest rate or currency risk have reduced their risks by entering into derivative transactions.<br />

In certain instances, <strong>Ford</strong> Credit has entered into offsetting derivative transactions with the VIE to protect the VIE from the<br />

risks that are not mitigated through the derivative transactions between the VIE and its external counterparty. In other<br />

instances, <strong>Ford</strong> Credit has entered into derivative transactions with the counterparty to protect the counterparty from risks<br />

absorbed through derivative transactions with the VIEs. See Note 4 and Note 25 for additional information regarding<br />

derivatives.<br />

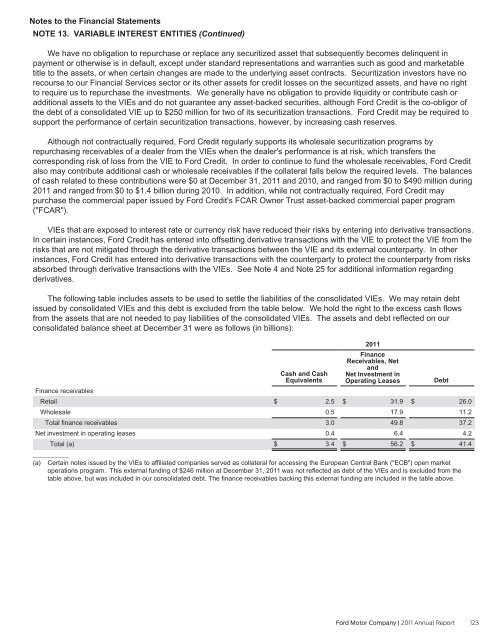

The following table includes assets to be used to settle the liabilities of the consolidated VIEs. We may retain debt<br />

issued by consolidated VIEs and this debt is excluded from the table below. We hold the right to the excess cash flows<br />

from the assets that are not needed to pay liabilities of the consolidated VIEs. The assets and debt reflected on our<br />

consolidated balance sheet at December 31 were as follows (in billions):<br />

Finance<br />

Receivables, Net<br />

and<br />

Cash and Cash<br />

Equivalents<br />

Net Investment in<br />

Operating Leases<br />

Debt<br />

Finance receivables<br />

Retail<br />

$ 2.5 $ 31.9 $ 26.0<br />

Wholesale<br />

0.5<br />

17.9<br />

11.2<br />

Total finance receivables<br />

3.0<br />

49.8<br />

37.2<br />

Net investment in operating leases<br />

0.4<br />

6.4<br />

4.2<br />

Total (a)<br />

__________<br />

$ 3.4 $ 56.2 $ 41.4<br />

(a) Certain notes issued by the VIEs to affiliated companies served as collateral for accessing the European Central Bank ("ECB") open market<br />

operations program. This external funding of $246 million at December 31, <strong>2011</strong> was not reflected as debt of the VIEs and is excluded from the<br />

table above, but was included in our consolidated debt. The finance receivables backing this external funding are included in the table above.<br />

<strong>2011</strong><br />

<strong>Ford</strong> <strong>Motor</strong> <strong>Company</strong> | <strong>2011</strong> <strong>Annual</strong> <strong>Report</strong> 123