Annual Report 2011 - Ford Motor Company

Annual Report 2011 - Ford Motor Company

Annual Report 2011 - Ford Motor Company

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Notes to the Financial Statements<br />

NOTE 20. SHARE-BASED COMPENSATION (Continued)<br />

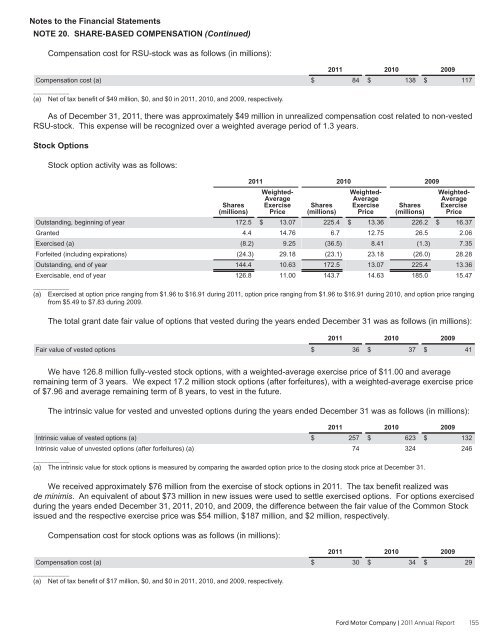

Compensation cost for RSU-stock was as follows (in millions):<br />

Compensation cost (a)<br />

__________<br />

(a) Net of tax benefit of $49 million, $0, and $0 in <strong>2011</strong>, 2010, and 2009, respectively.<br />

<strong>2011</strong><br />

$ 84<br />

2010<br />

$ 138<br />

2009<br />

$ 117<br />

As of December 31, <strong>2011</strong>, there was approximately $49 million in unrealized compensation cost related to non-vested<br />

RSU-stock. This expense will be recognized over a weighted average period of 1.3 years.<br />

Stock Options<br />

Stock option activity was as follows:<br />

<strong>2011</strong><br />

Shares<br />

(millions)<br />

Weighted-<br />

Average<br />

Exercise<br />

Price<br />

Shares<br />

(millions)<br />

Weighted-<br />

Average<br />

Exercise<br />

Price<br />

Shares<br />

(millions)<br />

Weighted-<br />

Average<br />

Exercise<br />

Price<br />

Outstanding, beginning of year<br />

172.5 $ 13.07 225.4 $ 13.36 226.2 $ 16.37<br />

Granted<br />

4.4 14.76<br />

6.7 12.75 26.5 2.06<br />

Exercised (a)<br />

(8.2) 9.25 (36.5) 8.41<br />

(1.3) 7.35<br />

Forfeited (including expirations)<br />

(24.3) 29.18 (23.1) 23.18 (26.0) 28.28<br />

Outstanding, end of year<br />

144.4 10.63 172.5 13.07 225.4 13.36<br />

Exercisable, end of year<br />

__________<br />

126.8 11.00 143.7 14.63 185.0 15.47<br />

(a) Exercised at option price ranging from $1.96 to $16.91 during <strong>2011</strong>, option price ranging from $1.96 to $16.91 during 2010, and option price ranging<br />

from $5.49 to $7.83 during 2009.<br />

The total grant date fair value of options that vested during the years ended December 31 was as follows (in millions):<br />

Fair value of vested options<br />

2010<br />

<strong>2011</strong><br />

$ 36<br />

2010<br />

$ 37<br />

2009<br />

2009<br />

$ 41<br />

We have 126.8 million fully-vested stock options, with a weighted-average exercise price of $11.00 and average<br />

remaining term of 3 years. We expect 17.2 million stock options (after forfeitures), with a weighted-average exercise price<br />

of $7.96 and average remaining term of 8 years, to vest in the future.<br />

The intrinsic value for vested and unvested options during the years ended December 31 was as follows (in millions):<br />

<strong>2011</strong><br />

2010<br />

2009<br />

Intrinsic value of vested options (a)<br />

$ 257 $ 623 $ 132<br />

Intrinsic value of unvested options (after forfeitures) (a)<br />

__________<br />

74<br />

324<br />

246<br />

(a) The intrinsic value for stock options is measured by comparing the awarded option price to the closing stock price at December 31.<br />

We received approximately $76 million from the exercise of stock options in <strong>2011</strong>. The tax benefit realized was<br />

de minimis. An equivalent of about $73 million in new issues were used to settle exercised options. For options exercised<br />

during the years ended December 31, <strong>2011</strong>, 2010, and 2009, the difference between the fair value of the Common Stock<br />

issued and the respective exercise price was $54 million, $187 million, and $2 million, respectively.<br />

Compensation cost for stock options was as follows (in millions):<br />

Compensation cost (a)<br />

__________<br />

(a) Net of tax benefit of $17 million, $0, and $0 in <strong>2011</strong>, 2010, and 2009, respectively.<br />

<strong>2011</strong><br />

$ 30<br />

2010<br />

$ 34<br />

2009<br />

$ 29<br />

<strong>Ford</strong> <strong>Motor</strong> <strong>Company</strong> | <strong>2011</strong> <strong>Annual</strong> <strong>Report</strong> 155