Annual Report 2011 - Ford Motor Company

Annual Report 2011 - Ford Motor Company

Annual Report 2011 - Ford Motor Company

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

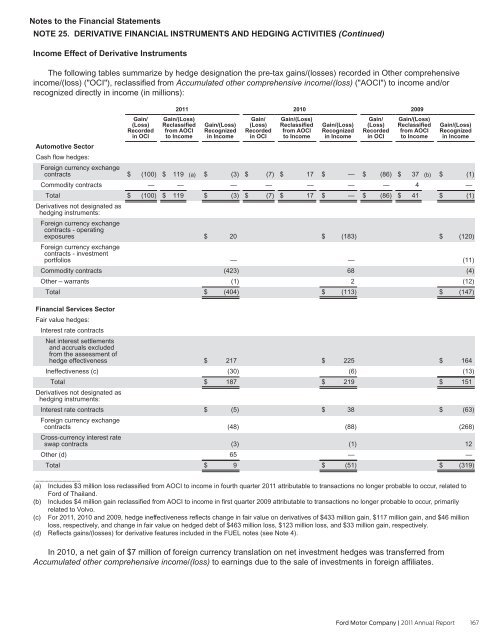

Notes to the Financial Statements<br />

NOTE 25. DERIVATIVE FINANCIAL INSTRUMENTS AND HEDGING ACTIVITIES (Continued)<br />

Income Effect of Derivative Instruments<br />

The following tables summarize by hedge designation the pre-tax gains/(losses) recorded in Other comprehensive<br />

income/(loss) ("OCI"), reclassified from Accumulated other comprehensive income/(loss) ("AOCI") to income and/or<br />

recognized directly in income (in millions):<br />

Gain/<br />

(Loss)<br />

Recorded<br />

in OCI<br />

<strong>2011</strong><br />

Gain/(Loss)<br />

Reclassified<br />

from AOCI<br />

to Income<br />

Automotive Sector<br />

Cash flow hedges:<br />

Foreign currency exchange<br />

contracts<br />

$ (100) $ 119 (a)<br />

Commodity contracts<br />

— —<br />

Total<br />

Derivatives not designated as<br />

hedging instruments:<br />

Foreign currency exchange<br />

contracts - operating<br />

exposures<br />

Foreign currency exchange<br />

contracts - investment<br />

portfolios<br />

Commodity contracts<br />

Other – warrants<br />

Total<br />

$ (100) $ 119<br />

Gain/(Loss)<br />

Recognized<br />

in Income<br />

$ (3)<br />

—<br />

$ (3)<br />

$ 20<br />

—<br />

(423)<br />

(1)<br />

$ (404)<br />

Gain/<br />

(Loss)<br />

Recorded<br />

in OCI<br />

$ (7)<br />

—<br />

$ (7)<br />

2010<br />

Gain/(Loss)<br />

Reclassified<br />

from AOCI<br />

to Income<br />

$ 17<br />

—<br />

$ 17<br />

Gain/(Loss)<br />

Recognized<br />

in Income<br />

$ —<br />

—<br />

$ —<br />

$ (183)<br />

—<br />

68<br />

2<br />

$ (113)<br />

Gain/<br />

(Loss)<br />

Recorded<br />

in OCI<br />

2009<br />

Gain/(Loss)<br />

Reclassified<br />

from AOCI<br />

to Income<br />

$ (86) $ 37 (b)<br />

— 4<br />

$ (86) $ 41<br />

Gain/(Loss)<br />

Recognized<br />

in Income<br />

$ (1)<br />

—<br />

$ (1)<br />

$ (120)<br />

(11)<br />

(4)<br />

(12)<br />

$ (147)<br />

Financial Services Sector<br />

Fair value hedges:<br />

Interest rate contracts<br />

Net interest settlements<br />

and accruals excluded<br />

from the assessment of<br />

hedge effectiveness<br />

$ 217<br />

$ 225<br />

$ 164<br />

Ineffectiveness (c)<br />

(30)<br />

(6)<br />

(13)<br />

Total<br />

Derivatives not designated as<br />

hedging instruments:<br />

$ 187<br />

$ 219<br />

$ 151<br />

Interest rate contracts<br />

$ (5)<br />

$ 38<br />

$ (63)<br />

Foreign currency exchange<br />

contracts<br />

(48)<br />

(88)<br />

(268)<br />

Cross-currency interest rate<br />

swap contracts<br />

(3)<br />

(1)<br />

12<br />

Other (d)<br />

65<br />

—<br />

—<br />

Total<br />

__________<br />

$ 9<br />

$ (51)<br />

$ (319)<br />

(a) Includes $3 million loss reclassified from AOCI to income in fourth quarter <strong>2011</strong> attributable to transactions no longer probable to occur, related to<br />

<strong>Ford</strong> of Thailand.<br />

(b) Includes $4 million gain reclassified from AOCI to income in first quarter 2009 attributable to transactions no longer probable to occur, primarily<br />

related to Volvo.<br />

(c) For <strong>2011</strong>, 2010 and 2009, hedge ineffectiveness reflects change in fair value on derivatives of $433 million gain, $117 million gain, and $46 million<br />

loss, respectively, and change in fair value on hedged debt of $463 million loss, $123 million loss, and $33 million gain, respectively.<br />

(d) Reflects gains/(losses) for derivative features included in the FUEL notes (see Note 4).<br />

In 2010, a net gain of $7 million of foreign currency translation on net investment hedges was transferred from<br />

Accumulated other comprehensive income/(loss) to earnings due to the sale of investments in foreign affiliates.<br />

<strong>Ford</strong> <strong>Motor</strong> <strong>Company</strong> | <strong>2011</strong> <strong>Annual</strong> <strong>Report</strong> 167