Annual Report 2011 - Ford Motor Company

Annual Report 2011 - Ford Motor Company

Annual Report 2011 - Ford Motor Company

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Notes to the Financial Statements<br />

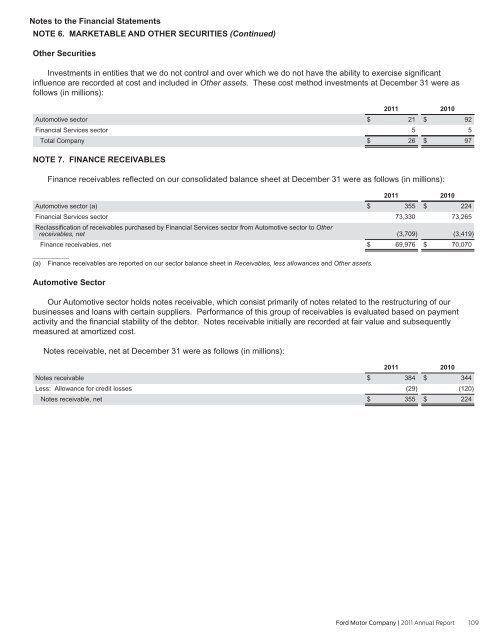

NOTE 6. MARKETABLE AND OTHER SECURITIES (Continued)<br />

Other Securities<br />

Investments in entities that we do not control and over which we do not have the ability to exercise significant<br />

influence are recorded at cost and included in Other assets. These cost method investments at December 31 were as<br />

follows (in millions):<br />

Automotive sector<br />

Financial Services sector<br />

Total <strong>Company</strong><br />

NOTE 7. FINANCE RECEIVABLES<br />

<strong>2011</strong><br />

$ 21<br />

5<br />

$ 26<br />

Finance receivables reflected on our consolidated balance sheet at December 31 were as follows (in millions):<br />

<strong>2011</strong><br />

Automotive sector (a)<br />

$ 355<br />

Financial Services sector<br />

73,330<br />

Reclassification of receivables purchased by Financial Services sector from Automotive sector to Other<br />

receivables, net<br />

(3,709)<br />

Finance receivables, net<br />

__________<br />

$ 69,976<br />

(a) Finance receivables are reported on our sector balance sheet in Receivables, less allowances and Other assets.<br />

Automotive Sector<br />

2010<br />

$ 92<br />

5<br />

$ 97<br />

2010<br />

$ 224<br />

73,265<br />

(3,419)<br />

$ 70,070<br />

Our Automotive sector holds notes receivable, which consist primarily of notes related to the restructuring of our<br />

businesses and loans with certain suppliers. Performance of this group of receivables is evaluated based on payment<br />

activity and the financial stability of the debtor. Notes receivable initially are recorded at fair value and subsequently<br />

measured at amortized cost.<br />

Notes receivable, net at December 31 were as follows (in millions):<br />

Notes receivable<br />

Less: Allowance for credit losses<br />

Notes receivable, net<br />

<strong>2011</strong><br />

2010<br />

$ 384 $ 344<br />

(29)<br />

(120)<br />

$ 355 $ 224<br />

<strong>Ford</strong> <strong>Motor</strong> <strong>Company</strong> | <strong>2011</strong> <strong>Annual</strong> <strong>Report</strong> 109