Annual Report 2011 - Ford Motor Company

Annual Report 2011 - Ford Motor Company

Annual Report 2011 - Ford Motor Company

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Notes to the Financial Statements<br />

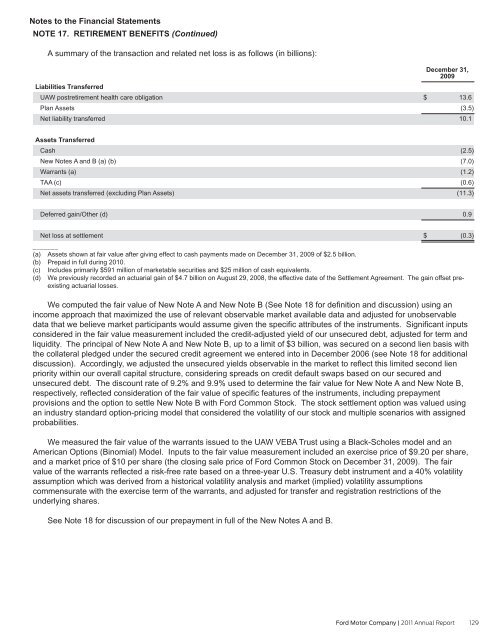

NOTE 17. RETIREMENT BENEFITS (Continued)<br />

A summary of the transaction and related net loss is as follows (in billions):<br />

Liabilities Transferred<br />

UAW postretirement health care obligation<br />

Plan Assets<br />

Net liability transferred<br />

Assets Transferred<br />

Cash<br />

New Notes A and B (a) (b)<br />

Warrants (a)<br />

TAA (c)<br />

Net assets transferred (excluding Plan Assets)<br />

Deferred gain/Other (d)<br />

December 31,<br />

2009<br />

$ 13.6<br />

(3.5)<br />

10.1<br />

Net loss at settlement<br />

_______<br />

(a) Assets shown at fair value after giving effect to cash payments made on December 31, 2009 of $2.5 billion.<br />

(b) Prepaid in full during 2010.<br />

$ (0.3)<br />

(c) Includes primarily $591 million of marketable securities and $25 million of cash equivalents.<br />

(d) We previously recorded an actuarial gain of $4.7 billion on August 29, 2008, the effective date of the Settlement Agreement. The gain offset preexisting<br />

actuarial losses.<br />

We computed the fair value of New Note A and New Note B (See Note 18 for definition and discussion) using an<br />

income approach that maximized the use of relevant observable market available data and adjusted for unobservable<br />

data that we believe market participants would assume given the specific attributes of the instruments. Significant inputs<br />

considered in the fair value measurement included the credit-adjusted yield of our unsecured debt, adjusted for term and<br />

liquidity. The principal of New Note A and New Note B, up to a limit of $3 billion, was secured on a second lien basis with<br />

the collateral pledged under the secured credit agreement we entered into in December 2006 (see Note 18 for additional<br />

discussion). Accordingly, we adjusted the unsecured yields observable in the market to reflect this limited second lien<br />

priority within our overall capital structure, considering spreads on credit default swaps based on our secured and<br />

unsecured debt. The discount rate of 9.2% and 9.9% used to determine the fair value for New Note A and New Note B,<br />

respectively, reflected consideration of the fair value of specific features of the instruments, including prepayment<br />

provisions and the option to settle New Note B with <strong>Ford</strong> Common Stock. The stock settlement option was valued using<br />

an industry standard option-pricing model that considered the volatility of our stock and multiple scenarios with assigned<br />

probabilities.<br />

We measured the fair value of the warrants issued to the UAW VEBA Trust using a Black-Scholes model and an<br />

American Options (Binomial) Model. Inputs to the fair value measurement included an exercise price of $9.20 per share,<br />

and a market price of $10 per share (the closing sale price of <strong>Ford</strong> Common Stock on December 31, 2009). The fair<br />

value of the warrants reflected a risk-free rate based on a three-year U.S. Treasury debt instrument and a 40% volatility<br />

assumption which was derived from a historical volatility analysis and market (implied) volatility assumptions<br />

commensurate with the exercise term of the warrants, and adjusted for transfer and registration restrictions of the<br />

underlying shares.<br />

See Note 18 for discussion of our prepayment in full of the New Notes A and B.<br />

(2.5)<br />

(7.0)<br />

(1.2)<br />

(0.6)<br />

(11.3)<br />

0.9<br />

<strong>Ford</strong> <strong>Motor</strong> <strong>Company</strong> | <strong>2011</strong> <strong>Annual</strong> <strong>Report</strong> 129