Annual Report 2011 - Ford Motor Company

Annual Report 2011 - Ford Motor Company

Annual Report 2011 - Ford Motor Company

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

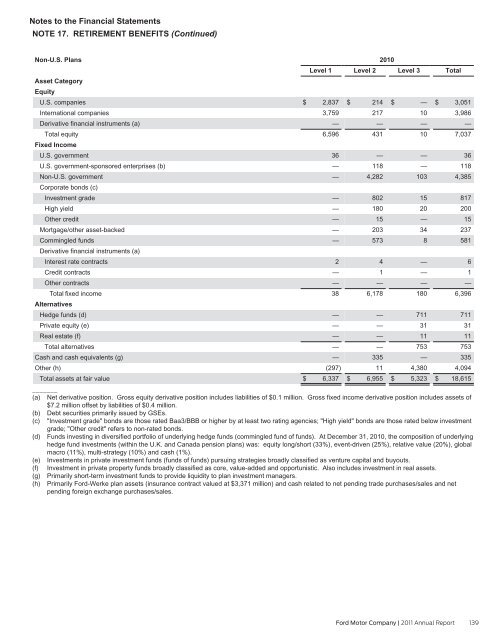

Notes to the Financial Statements<br />

NOTE 17. RETIREMENT BENEFITS (Continued)<br />

Non-U.S. Plans<br />

2010<br />

Level 1 Level 2 Level 3 Total<br />

Asset Category<br />

Equity<br />

U.S. companies<br />

$ 2,837 $ 214 $ — $ 3,051<br />

International companies<br />

3,759<br />

217<br />

10 3,986<br />

Derivative financial instruments (a)<br />

—<br />

—<br />

—<br />

—<br />

Total equity<br />

Fixed Income<br />

6,596<br />

431<br />

10 7,037<br />

U.S. government<br />

36<br />

—<br />

—<br />

36<br />

U.S. government-sponsored enterprises (b)<br />

—<br />

118<br />

—<br />

118<br />

Non-U.S. government<br />

Corporate bonds (c)<br />

— 4,282<br />

103 4,385<br />

Investment grade<br />

—<br />

802<br />

15<br />

817<br />

High yield<br />

—<br />

180<br />

20<br />

200<br />

Other credit<br />

—<br />

15<br />

—<br />

15<br />

Mortgage/other asset-backed<br />

—<br />

203<br />

34<br />

237<br />

Commingled funds<br />

Derivative financial instruments (a)<br />

—<br />

573<br />

8<br />

581<br />

Interest rate contracts<br />

2<br />

4<br />

—<br />

6<br />

Credit contracts<br />

—<br />

1<br />

—<br />

1<br />

Other contracts<br />

—<br />

—<br />

—<br />

—<br />

Total fixed income<br />

Alternatives<br />

38 6,178<br />

180 6,396<br />

Hedge funds (d)<br />

—<br />

—<br />

711<br />

711<br />

Private equity (e)<br />

—<br />

—<br />

31<br />

31<br />

Real estate (f)<br />

—<br />

—<br />

11<br />

11<br />

Total alternatives<br />

—<br />

—<br />

753<br />

753<br />

Cash and cash equivalents (g)<br />

—<br />

335<br />

—<br />

335<br />

Other (h)<br />

(297)<br />

11 4,380 4,094<br />

Total assets at fair value<br />

_______<br />

$ 6,337 $ 6,955 $ 5,323 $ 18,615<br />

(a) Net derivative position. Gross equity derivative position includes liabilities of $0.1 million. Gross fixed income derivative position includes assets of<br />

$7.2 million offset by liabilities of $0.4 million.<br />

(b) Debt securities primarily issued by GSEs.<br />

(c) "Investment grade" bonds are those rated Baa3/BBB or higher by at least two rating agencies; "High yield" bonds are those rated below investment<br />

grade; "Other credit" refers to non-rated bonds.<br />

(d) Funds investing in diversified portfolio of underlying hedge funds (commingled fund of funds). At December 31, 2010, the composition of underlying<br />

hedge fund investments (within the U.K. and Canada pension plans) was: equity long/short (33%), event-driven (25%), relative value (20%), global<br />

macro (11%), multi-strategy (10%) and cash (1%).<br />

(e) Investments in private investment funds (funds of funds) pursuing strategies broadly classified as venture capital and buyouts.<br />

(f) Investment in private property funds broadly classified as core, value-added and opportunistic. Also includes investment in real assets.<br />

(g) Primarily short-term investment funds to provide liquidity to plan investment managers.<br />

(h) Primarily <strong>Ford</strong>-Werke plan assets (insurance contract valued at $3,371 million) and cash related to net pending trade purchases/sales and net<br />

pending foreign exchange purchases/sales.<br />

<strong>Ford</strong> <strong>Motor</strong> <strong>Company</strong> | <strong>2011</strong> <strong>Annual</strong> <strong>Report</strong> 139