Annual Report 2011 - Ford Motor Company

Annual Report 2011 - Ford Motor Company

Annual Report 2011 - Ford Motor Company

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Notes to the Financial Statements<br />

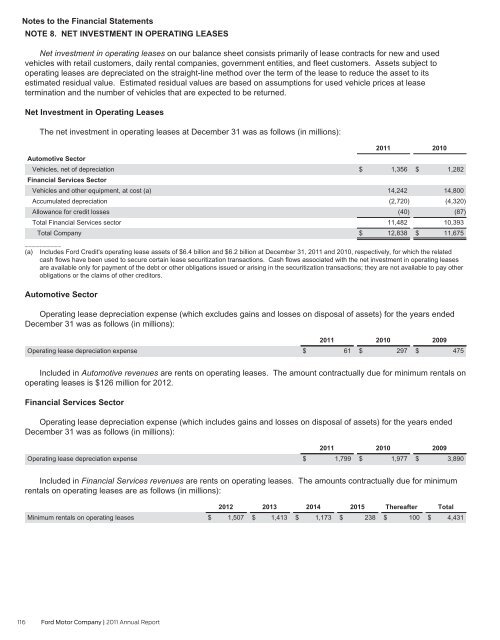

NOTE 8. NET INVESTMENT IN OPERATING LEASES<br />

Net investment in operating leases on our balance sheet consists primarily of lease contracts for new and used<br />

vehicles with retail customers, daily rental companies, government entities, and fleet customers. Assets subject to<br />

operating leases are depreciated on the straight-line method over the term of the lease to reduce the asset to its<br />

estimated residual value. Estimated residual values are based on assumptions for used vehicle prices at lease<br />

termination and the number of vehicles that are expected to be returned.<br />

Net Investment in Operating Leases<br />

The net investment in operating leases at December 31 was as follows (in millions):<br />

<strong>2011</strong><br />

2010<br />

Automotive Sector<br />

Vehicles, net of depreciation<br />

Financial Services Sector<br />

$ 1,356 $ 1,282<br />

Vehicles and other equipment, at cost (a)<br />

14,242<br />

14,800<br />

Accumulated depreciation<br />

(2,720)<br />

(4,320)<br />

Allowance for credit losses<br />

(40)<br />

(87)<br />

Total Financial Services sector<br />

11,482<br />

10,393<br />

Total <strong>Company</strong><br />

__________<br />

$ 12,838 $ 11,675<br />

(a) Includes <strong>Ford</strong> Credit's operating lease assets of $6.4 billion and $6.2 billion at December 31, <strong>2011</strong> and 2010, respectively, for which the related<br />

cash flows have been used to secure certain lease securitization transactions. Cash flows associated with the net investment in operating leases<br />

are available only for payment of the debt or other obligations issued or arising in the securitization transactions; they are not available to pay other<br />

obligations or the claims of other creditors.<br />

Automotive Sector<br />

Operating lease depreciation expense (which excludes gains and losses on disposal of assets) for the years ended<br />

December 31 was as follows (in millions):<br />

Operating lease depreciation expense<br />

116 <strong>Ford</strong> <strong>Motor</strong> <strong>Company</strong> | <strong>2011</strong> <strong>Annual</strong> <strong>Report</strong><br />

<strong>2011</strong><br />

$ 61<br />

2010<br />

$ 297<br />

2009<br />

$ 475<br />

Included in Automotive revenues are rents on operating leases. The amount contractually due for minimum rentals on<br />

operating leases is $126 million for 2012.<br />

Financial Services Sector<br />

Operating lease depreciation expense (which includes gains and losses on disposal of assets) for the years ended<br />

December 31 was as follows (in millions):<br />

Operating lease depreciation expense<br />

<strong>2011</strong><br />

$ 1,799<br />

2010<br />

$ 1,977<br />

2009<br />

$ 3,890<br />

Included in Financial Services revenues are rents on operating leases. The amounts contractually due for minimum<br />

rentals on operating leases are as follows (in millions):<br />

Minimum rentals on operating leases<br />

2012<br />

$ 1,507<br />

2013<br />

$ 1,413<br />

2014<br />

$ 1,173<br />

2015<br />

$ 238<br />

Thereafter<br />

$ 100<br />

Total<br />

$ 4,431