Annual Report 2011 - Ford Motor Company

Annual Report 2011 - Ford Motor Company

Annual Report 2011 - Ford Motor Company

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Notes to the Financial Statements<br />

NOTE 22. INCOME TAXES (Continued)<br />

We historically have provided deferred taxes for the presumed repatriation to the United States of earnings from<br />

nearly all non-U.S. subsidiaries. During <strong>2011</strong>, we determined that $6.9 billion of these non-U.S. subsidiaries' undistributed<br />

earnings are now indefinitely reinvested outside the United States. As management has determined that the earnings of<br />

these subsidiaries are not required as a source of funding for U.S. operations, such earnings are not planned to be<br />

distributed to the U.S. in the foreseeable future. As a result of this change in assertion, deferred tax liabilities related to<br />

undistributed foreign earnings decreased by $63 million.<br />

As of December 31, <strong>2011</strong>, $8.4 billion of non-U.S. earnings are considered indefinitely reinvested in operations<br />

outside the United States, for which deferred taxes have not been provided. These earnings have been subject to<br />

significant non-U.S. taxes; repatriation in their entirety would result in a residual U.S. tax liability of about $300 million.<br />

At the end of <strong>2011</strong>, our U.S. operations had returned to a position of cumulative profits for the most recent three-year<br />

period. We concluded that this record of cumulative profitability in recent years, our ten consecutive quarters of pre-tax<br />

operating profits, our successful completion of labor negotiations with the UAW, and our business plan showing continued<br />

profitability, provide assurance that our future tax benefits more likely than not will be realized. Accordingly, at year-end<br />

<strong>2011</strong>, we released almost all of our valuation allowance against net deferred tax assets for entities in the United States,<br />

Canada, and Spain.<br />

At December 31, <strong>2011</strong>, we have retained a valuation allowance against approximately $500 million in North America<br />

related to various state and local operating loss carryforwards that are subject to restrictive rules for future utilization, and<br />

a valuation allowance totaling $1 billion primarily against deferred tax assets for our South American operations.<br />

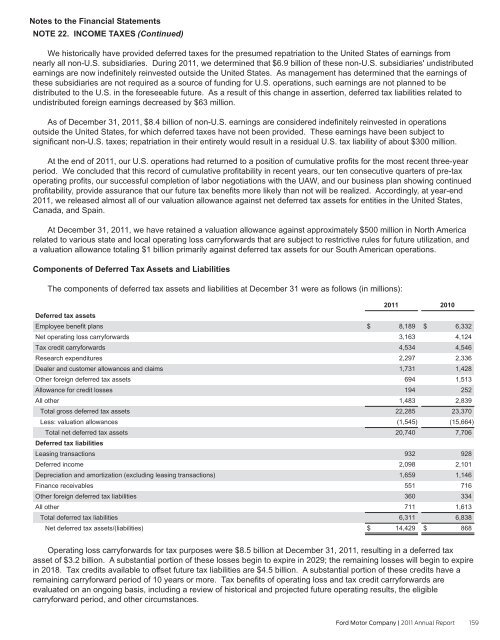

Components of Deferred Tax Assets and Liabilities<br />

The components of deferred tax assets and liabilities at December 31 were as follows (in millions):<br />

Deferred tax assets<br />

Employee benefit plans<br />

Net operating loss carryforwards<br />

Tax credit carryforwards<br />

Research expenditures<br />

Dealer and customer allowances and claims<br />

Other foreign deferred tax assets<br />

Allowance for credit losses<br />

All other<br />

Total gross deferred tax assets<br />

Less: valuation allowances<br />

Total net deferred tax assets<br />

Deferred tax liabilities<br />

Leasing transactions<br />

Deferred income<br />

Depreciation and amortization (excluding leasing transactions)<br />

Finance receivables<br />

Other foreign deferred tax liabilities<br />

All other<br />

Total deferred tax liabilities<br />

Net deferred tax assets/(liabilities)<br />

<strong>2011</strong><br />

$ 8,189<br />

3,163<br />

4,534<br />

2,297<br />

1,731<br />

694<br />

194<br />

1,483<br />

22,285<br />

(1,545)<br />

20,740<br />

932<br />

2,098<br />

1,659<br />

551<br />

360<br />

711<br />

6,311<br />

$ 14,429<br />

2010<br />

$ 6,332<br />

4,124<br />

4,546<br />

2,336<br />

1,428<br />

1,513<br />

252<br />

2,839<br />

23,370<br />

(15,664)<br />

7,706<br />

928<br />

2,101<br />

1,146<br />

716<br />

334<br />

1,613<br />

6,838<br />

$ 868<br />

Operating loss carryforwards for tax purposes were $8.5 billion at December 31, <strong>2011</strong>, resulting in a deferred tax<br />

asset of $3.2 billion. A substantial portion of these losses begin to expire in 2029; the remaining losses will begin to expire<br />

in 2018. Tax credits available to offset future tax liabilities are $4.5 billion. A substantial portion of these credits have a<br />

remaining carryforward period of 10 years or more. Tax benefits of operating loss and tax credit carryforwards are<br />

evaluated on an ongoing basis, including a review of historical and projected future operating results, the eligible<br />

carryforward period, and other circumstances.<br />

<strong>Ford</strong> <strong>Motor</strong> <strong>Company</strong> | <strong>2011</strong> <strong>Annual</strong> <strong>Report</strong> 159