Annual Report 2011 - Ford Motor Company

Annual Report 2011 - Ford Motor Company

Annual Report 2011 - Ford Motor Company

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

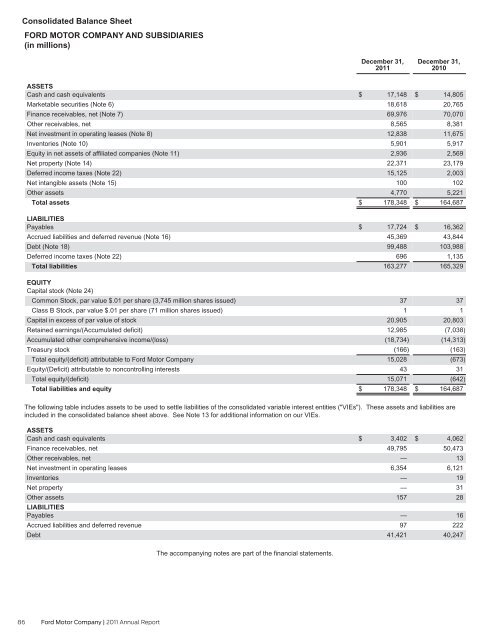

Consolidated Balance Sheet<br />

FORD MOTOR COMPANY AND SUBSIDIARIES<br />

(in millions)<br />

ASSETS<br />

Cash and cash equivalents<br />

Marketable securities (Note 6)<br />

Finance receivables, net (Note 7)<br />

Other receivables, net<br />

Net investment in operating leases (Note 8)<br />

Inventories (Note 10)<br />

Equity in net assets of affiliated companies (Note 11)<br />

Net property (Note 14)<br />

Deferred income taxes (Note 22)<br />

Net intangible assets (Note 15)<br />

Other assets<br />

Total assets<br />

LIABILITIES<br />

Payables<br />

Accrued liabilities and deferred revenue (Note 16)<br />

Debt (Note 18)<br />

Deferred income taxes (Note 22)<br />

Total liabilities<br />

EQUITY<br />

Capital stock (Note 24)<br />

Common Stock, par value $.01 per share (3,745 million shares issued)<br />

Class B Stock, par value $.01 per share (71 million shares issued)<br />

Capital in excess of par value of stock<br />

Retained earnings/(Accumulated deficit)<br />

Accumulated other comprehensive income/(loss)<br />

Treasury stock<br />

Total equity/(deficit) attributable to <strong>Ford</strong> <strong>Motor</strong> <strong>Company</strong><br />

Equity/(Deficit) attributable to noncontrolling interests<br />

Total equity/(deficit)<br />

Total liabilities and equity<br />

86 <strong>Ford</strong> <strong>Motor</strong> <strong>Company</strong> | <strong>2011</strong> <strong>Annual</strong> <strong>Report</strong><br />

December 31,<br />

<strong>2011</strong><br />

$ 17,148<br />

18,618<br />

69,976<br />

8,565<br />

12,838<br />

5,901<br />

2,936<br />

22,371<br />

15,125<br />

100<br />

4,770<br />

$ 178,348<br />

$ 17,724<br />

45,369<br />

99,488<br />

696<br />

163,277<br />

37<br />

1<br />

20,905<br />

12,985<br />

(18,734)<br />

(166)<br />

15,028<br />

43<br />

15,071<br />

$ 178,348<br />

December 31,<br />

2010<br />

$ 14,805<br />

20,765<br />

70,070<br />

8,381<br />

11,675<br />

5,917<br />

2,569<br />

23,179<br />

2,003<br />

102<br />

5,221<br />

$ 164,687<br />

$ 16,362<br />

43,844<br />

103,988<br />

1,135<br />

165,329<br />

37<br />

1<br />

20,803<br />

(7,038)<br />

(14,313)<br />

(163)<br />

(673)<br />

31<br />

(642)<br />

$ 164,687<br />

The following table includes assets to be used to settle liabilities of the consolidated variable interest entities ("VIEs"). These assets and liabilities are<br />

included in the consolidated balance sheet above. See Note 13 for additional information on our VIEs.<br />

ASSETS<br />

Cash and cash equivalents<br />

Finance receivables, net<br />

Other receivables, net<br />

Net investment in operating leases<br />

Inventories<br />

Net property<br />

Other assets<br />

LIABILITIES<br />

Payables<br />

Accrued liabilities and deferred revenue<br />

Debt<br />

The accompanying notes are part of the financial statements.<br />

$ 3,402<br />

49,795<br />

—<br />

6,354<br />

—<br />

—<br />

157<br />

—<br />

97<br />

41,421<br />

$ 4,062<br />

50,473<br />

13<br />

6,121<br />

19<br />

31<br />

28<br />

16<br />

222<br />

40,247