Annual Report 2011 - Ford Motor Company

Annual Report 2011 - Ford Motor Company

Annual Report 2011 - Ford Motor Company

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Notes to the Financial Statements<br />

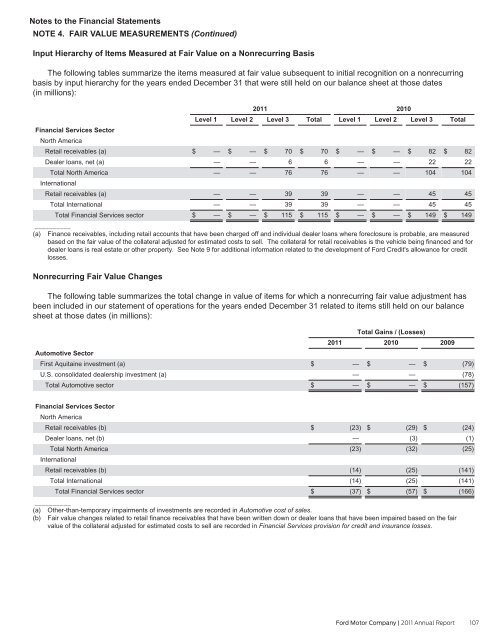

NOTE 4. FAIR VALUE MEASUREMENTS (Continued)<br />

Input Hierarchy of Items Measured at Fair Value on a Nonrecurring Basis<br />

The following tables summarize the items measured at fair value subsequent to initial recognition on a nonrecurring<br />

basis by input hierarchy for the years ended December 31 that were still held on our balance sheet at those dates<br />

(in millions):<br />

<strong>2011</strong><br />

2010<br />

Level 1 Level 2 Level 3 Total Level 1 Level 2 Level 3 Total<br />

Financial Services Sector<br />

North America<br />

Retail receivables (a)<br />

$ — $ — $ 70 $ 70 $ — $ — $ 82 $ 82<br />

Dealer loans, net (a)<br />

— — 6 6 — — 22 22<br />

Total North America<br />

International<br />

— — 76 76 — — 104 104<br />

Retail receivables (a)<br />

— — 39 39 — — 45 45<br />

Total International<br />

— — 39 39 — — 45 45<br />

Total Financial Services sector<br />

__________<br />

$ — $ — $ 115 $ 115 $ — $ — $ 149 $ 149<br />

(a) Finance receivables, including retail accounts that have been charged off and individual dealer loans where foreclosure is probable, are measured<br />

based on the fair value of the collateral adjusted for estimated costs to sell. The collateral for retail receivables is the vehicle being financed and for<br />

dealer loans is real estate or other property. See Note 9 for additional information related to the development of <strong>Ford</strong> Credit's allowance for credit<br />

losses.<br />

Nonrecurring Fair Value Changes<br />

The following table summarizes the total change in value of items for which a nonrecurring fair value adjustment has<br />

been included in our statement of operations for the years ended December 31 related to items still held on our balance<br />

sheet at those dates (in millions):<br />

Automotive Sector<br />

First Aquitaine investment (a)<br />

U.S. consolidated dealership investment (a)<br />

Total Automotive sector<br />

Total Gains / (Losses)<br />

Financial Services Sector<br />

North America<br />

Retail receivables (b)<br />

$ (23) $ (29) $ (24)<br />

Dealer loans, net (b)<br />

—<br />

(3)<br />

(1)<br />

Total North America<br />

International<br />

(23)<br />

(32)<br />

(25)<br />

Retail receivables (b)<br />

(14)<br />

(25)<br />

(141)<br />

Total International<br />

(14)<br />

(25)<br />

(141)<br />

Total Financial Services sector<br />

__________<br />

$ (37) $ (57) $ (166)<br />

(a) Other-than-temporary impairments of investments are recorded in Automotive cost of sales.<br />

(b) Fair value changes related to retail finance receivables that have been written down or dealer loans that have been impaired based on the fair<br />

value of the collateral adjusted for estimated costs to sell are recorded in Financial Services provision for credit and insurance losses.<br />

<strong>2011</strong><br />

$ —<br />

—<br />

$ —<br />

2010<br />

$ —<br />

—<br />

$ —<br />

2009<br />

$ (79)<br />

(78)<br />

$ (157)<br />

<strong>Ford</strong> <strong>Motor</strong> <strong>Company</strong> | <strong>2011</strong> <strong>Annual</strong> <strong>Report</strong> 107