Annual Report 2011 - Ford Motor Company

Annual Report 2011 - Ford Motor Company

Annual Report 2011 - Ford Motor Company

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Management’s Discussion and Analysis of Financial Condition and Results of Operations<br />

Total costs and expenses for our Automotive sector for 2010 and 2009 was $113.5 billion and $107.2 billion,<br />

respectively, a difference of $6.3 billion. An explanation of the change as reconciled to our income statement is shown<br />

below (in billions):<br />

2010<br />

Better/(Worse)<br />

2009<br />

Explanation of change:<br />

Volume and mix, exchange, and other<br />

$ (12.1)<br />

Material costs excluding commodity costs (a)<br />

1.1<br />

Commodity costs (a)<br />

(1.0)<br />

Structural costs (a)<br />

(1.2)<br />

Warranty/Other (a)<br />

0.1<br />

Special items (b)<br />

6.8<br />

Total<br />

_________<br />

$ (6.3)<br />

(a) Our key cost change elements are measured primarily at present-year exchange; in addition, costs that vary directly with volume, such as material,<br />

freight and warranty costs, are measured at present-year volume and mix. Excludes special items (primarily changes in Volvo costs and expenses<br />

reflecting the sale of these operations).<br />

(b) Primarily reflects changes in Volvo costs and expenses.<br />

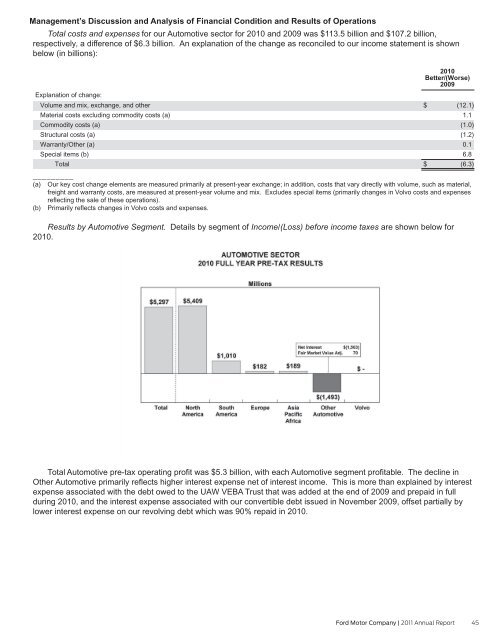

Results by Automotive Segment. Details by segment of Income/(Loss) before income taxes are shown below for<br />

2010.<br />

Total Automotive pre-tax operating profit was $5.3 billion, with each Automotive segment profitable. The decline in<br />

Other Automotive primarily reflects higher interest expense net of interest income. This is more than explained by interest<br />

expense associated with the debt owed to the UAW VEBA Trust that was added at the end of 2009 and prepaid in full<br />

during 2010, and the interest expense associated with our convertible debt issued in November 2009, offset partially by<br />

lower interest expense on our revolving debt which was 90% repaid in 2010.<br />

<strong>Ford</strong> <strong>Motor</strong> <strong>Company</strong> | <strong>2011</strong> <strong>Annual</strong> <strong>Report</strong> 45