Annual Report 2011 - Ford Motor Company

Annual Report 2011 - Ford Motor Company

Annual Report 2011 - Ford Motor Company

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Management’s Discussion and Analysis of Financial Condition and Results of Operations<br />

Plan obligations and costs are based on existing retirement plan provisions. No assumption is made regarding any<br />

potential future changes to benefit provisions beyond those to which we are presently committed (e.g., in existing labor<br />

contracts).<br />

The effects of actual results differing from our assumptions and the effects of changing assumptions are included in<br />

unamortized net gains and losses. Unamortized gains and losses are amortized over future periods and, therefore,<br />

generally affect our recognized expense in future periods. Amounts are recognized as a component of net expense over<br />

the expected future years of service (approximately 12 years for the major U.S. plans). In <strong>2011</strong>, the U.S. actual return on<br />

assets was 7.7%, which was lower than the expected return of 8%. The year-end <strong>2011</strong> weighted average discount rates<br />

for the U.S. and non-U.S. plans decreased by 60 and 47 basis points, respectively. These differences resulted in<br />

unamortized losses of about $5 billion. Unamortized gains and losses are amortized only to the extent they exceed 10%<br />

of the higher of the market-related value of assets or the projected benefit obligation of the respective plan. For the major<br />

U.S. plans, unamortized losses exceed this threshold and recognition is continuing in 2012.<br />

See Note 17 of the Notes to the Financial Statements for more information regarding costs and assumptions for<br />

employee retirement benefits.<br />

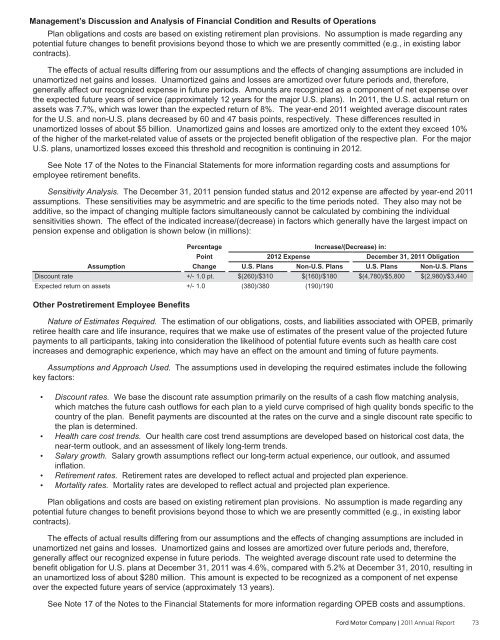

Sensitivity Analysis. The December 31, <strong>2011</strong> pension funded status and 2012 expense are affected by year-end <strong>2011</strong><br />

assumptions. These sensitivities may be asymmetric and are specific to the time periods noted. They also may not be<br />

additive, so the impact of changing multiple factors simultaneously cannot be calculated by combining the individual<br />

sensitivities shown. The effect of the indicated increase/(decrease) in factors which generally have the largest impact on<br />

pension expense and obligation is shown below (in millions):<br />

Assumption<br />

Discount rate<br />

Expected return on assets<br />

Other Postretirement Employee Benefits<br />

Percentage<br />

Point<br />

Change<br />

+/- 1.0 pt.<br />

+/- 1.0<br />

2012 Expense<br />

Increase/(Decrease) in:<br />

December 31, <strong>2011</strong> Obligation<br />

U.S. Plans Non-U.S. Plans U.S. Plans Non-U.S. Plans<br />

$(260)/$310 $(160)/$180 $(4,780)/$5,800 $(2,980)/$3,440<br />

(380)/380<br />

(190)/190<br />

Nature of Estimates Required. The estimation of our obligations, costs, and liabilities associated with OPEB, primarily<br />

retiree health care and life insurance, requires that we make use of estimates of the present value of the projected future<br />

payments to all participants, taking into consideration the likelihood of potential future events such as health care cost<br />

increases and demographic experience, which may have an effect on the amount and timing of future payments.<br />

Assumptions and Approach Used. The assumptions used in developing the required estimates include the following<br />

key factors:<br />

• Discount rates. We base the discount rate assumption primarily on the results of a cash flow matching analysis,<br />

which matches the future cash outflows for each plan to a yield curve comprised of high quality bonds specific to the<br />

country of the plan. Benefit payments are discounted at the rates on the curve and a single discount rate specific to<br />

the plan is determined.<br />

• Health care cost trends. Our health care cost trend assumptions are developed based on historical cost data, the<br />

near-term outlook, and an assessment of likely long-term trends.<br />

• Salary growth. Salary growth assumptions reflect our long-term actual experience, our outlook, and assumed<br />

inflation.<br />

• Retirement rates. Retirement rates are developed to reflect actual and projected plan experience.<br />

• Mortality rates. Mortality rates are developed to reflect actual and projected plan experience.<br />

Plan obligations and costs are based on existing retirement plan provisions. No assumption is made regarding any<br />

potential future changes to benefit provisions beyond those to which we are presently committed (e.g., in existing labor<br />

contracts).<br />

The effects of actual results differing from our assumptions and the effects of changing assumptions are included in<br />

unamortized net gains and losses. Unamortized gains and losses are amortized over future periods and, therefore,<br />

generally affect our recognized expense in future periods. The weighted average discount rate used to determine the<br />

benefit obligation for U.S. plans at December 31, <strong>2011</strong> was 4.6%, compared with 5.2% at December 31, 2010, resulting in<br />

an unamortized loss of about $280 million. This amount is expected to be recognized as a component of net expense<br />

over the expected future years of service (approximately 13 years).<br />

See Note 17 of the Notes to the Financial Statements for more information regarding OPEB costs and assumptions.<br />

<strong>Ford</strong> <strong>Motor</strong> <strong>Company</strong> | <strong>2011</strong> <strong>Annual</strong> <strong>Report</strong> 73