Annual Report 2011 - Ford Motor Company

Annual Report 2011 - Ford Motor Company

Annual Report 2011 - Ford Motor Company

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Management’s Discussion and Analysis of Financial Condition and Results of Operations<br />

For 2012, <strong>Ford</strong> Credit projects full-year public term funding in the range of $18 billion to $23 billion, consisting of<br />

$8 billion to $11 billion of unsecured debt and $10 billion to $12 billion of public securitizations. In addition to the public<br />

issuance, <strong>Ford</strong> Credit is projecting $10 billion to $13 billion of funding from its private sources. Through<br />

February 20, 2012, <strong>Ford</strong> Credit completed about $7 billion of public term funding transactions, including about $4 billion<br />

for retail and wholesale asset-backed securitization transactions in the United States and $3 billion of unsecured issuance<br />

in the United States, Europe, and Canada. <strong>Ford</strong> Credit also completed about $1 billion of private term funding<br />

transactions, primarily reflecting retail, lease and wholesale asset-backed transactions in the United States, Europe, and<br />

Mexico.<br />

Funding is expected to be relatively flat in 2012 despite the projected increase in managed receivables, largely<br />

reflecting fewer debt maturities.<br />

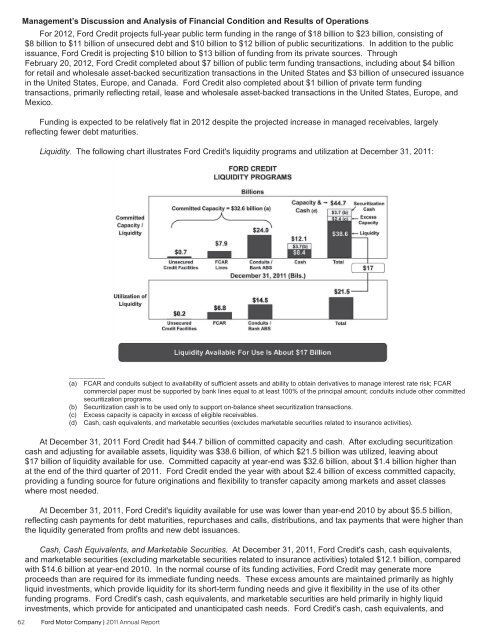

Liquidity. The following chart illustrates <strong>Ford</strong> Credit's liquidity programs and utilization at December 31, <strong>2011</strong>:<br />

__________<br />

(a) FCAR and conduits subject to availability of sufficient assets and ability to obtain derivatives to manage interest rate risk; FCAR<br />

commercial paper must be supported by bank lines equal to at least 100% of the principal amount; conduits include other committed<br />

securitization programs.<br />

(b) Securitization cash is to be used only to support on-balance sheet securitization transactions.<br />

(c) Excess capacity is capacity in excess of eligible receivables.<br />

(d) Cash, cash equivalents, and marketable securities (excludes marketable securities related to insurance activities).<br />

At December 31, <strong>2011</strong> <strong>Ford</strong> Credit had $44.7 billion of committed capacity and cash. After excluding securitization<br />

cash and adjusting for available assets, liquidity was $38.6 billion, of which $21.5 billion was utilized, leaving about<br />

$17 billion of liquidity available for use. Committed capacity at year-end was $32.6 billion, about $1.4 billion higher than<br />

at the end of the third quarter of <strong>2011</strong>. <strong>Ford</strong> Credit ended the year with about $2.4 billion of excess committed capacity,<br />

providing a funding source for future originations and flexibility to transfer capacity among markets and asset classes<br />

where most needed.<br />

At December 31, <strong>2011</strong>, <strong>Ford</strong> Credit's liquidity available for use was lower than year-end 2010 by about $5.5 billion,<br />

reflecting cash payments for debt maturities, repurchases and calls, distributions, and tax payments that were higher than<br />

the liquidity generated from profits and new debt issuances.<br />

Cash, Cash Equivalents, and Marketable Securities. At December 31, <strong>2011</strong>, <strong>Ford</strong> Credit's cash, cash equivalents,<br />

and marketable securities (excluding marketable securities related to insurance activities) totaled $12.1 billion, compared<br />

with $14.6 billion at year-end 2010. In the normal course of its funding activities, <strong>Ford</strong> Credit may generate more<br />

proceeds than are required for its immediate funding needs. These excess amounts are maintained primarily as highly<br />

liquid investments, which provide liquidity for its short-term funding needs and give it flexibility in the use of its other<br />

funding programs. <strong>Ford</strong> Credit's cash, cash equivalents, and marketable securities are held primarily in highly liquid<br />

investments, which provide for anticipated and unanticipated cash needs. <strong>Ford</strong> Credit's cash, cash equivalents, and<br />

62 <strong>Ford</strong> <strong>Motor</strong> <strong>Company</strong> | <strong>2011</strong> <strong>Annual</strong> <strong>Report</strong>