Annual Report 2011 - Ford Motor Company

Annual Report 2011 - Ford Motor Company

Annual Report 2011 - Ford Motor Company

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

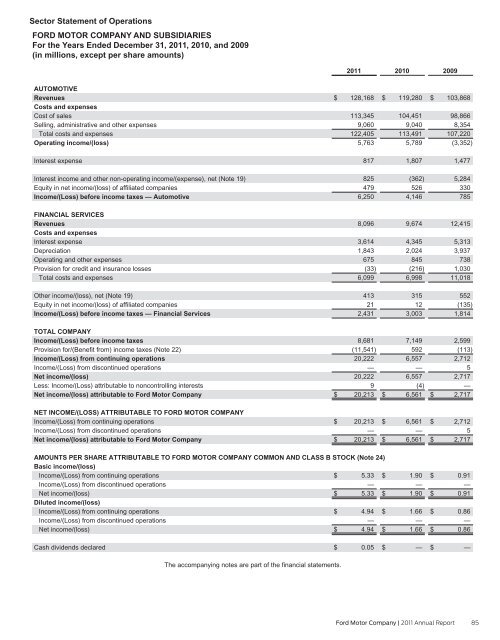

Sector Statement of Operations<br />

FORD MOTOR COMPANY AND SUBSIDIARIES<br />

For the Years Ended December 31, <strong>2011</strong>, 2010, and 2009<br />

(in millions, except per share amounts)<br />

AUTOMOTIVE<br />

Revenues<br />

Costs and expenses<br />

Cost of sales<br />

Selling, administrative and other expenses<br />

Total costs and expenses<br />

Operating income/(loss)<br />

Interest expense<br />

Interest income and other non-operating income/(expense), net (Note 19)<br />

Equity in net income/(loss) of affiliated companies<br />

Income/(Loss) before income taxes — Automotive<br />

FINANCIAL SERVICES<br />

Revenues<br />

Costs and expenses<br />

Interest expense<br />

Depreciation<br />

Operating and other expenses<br />

Provision for credit and insurance losses<br />

Total costs and expenses<br />

Other income/(loss), net (Note 19)<br />

Equity in net income/(loss) of affiliated companies<br />

Income/(Loss) before income taxes — Financial Services<br />

TOTAL COMPANY<br />

Income/(Loss) before income taxes<br />

Provision for/(Benefit from) income taxes (Note 22)<br />

Income/(Loss) from continuing operations<br />

Income/(Loss) from discontinued operations<br />

Net income/(loss)<br />

Less: Income/(Loss) attributable to noncontrolling interests<br />

Net income/(loss) attributable to <strong>Ford</strong> <strong>Motor</strong> <strong>Company</strong><br />

NET INCOME/(LOSS) ATTRIBUTABLE TO FORD MOTOR COMPANY<br />

Income/(Loss) from continuing operations<br />

Income/(Loss) from discontinued operations<br />

Net income/(loss) attributable to <strong>Ford</strong> <strong>Motor</strong> <strong>Company</strong><br />

AMOUNTS PER SHARE ATTRIBUTABLE TO FORD MOTOR COMPANY COMMON AND CLASS B STOCK (Note 24)<br />

Basic income/(loss)<br />

Income/(Loss) from continuing operations<br />

Income/(Loss) from discontinued operations<br />

Net income/(loss)<br />

Diluted income/(loss)<br />

Income/(Loss) from continuing operations<br />

Income/(Loss) from discontinued operations<br />

Net income/(loss)<br />

Cash dividends declared<br />

The accompanying notes are part of the financial statements.<br />

<strong>2011</strong><br />

$ 128,168<br />

113,345<br />

9,060<br />

122,405<br />

5,763<br />

817<br />

825<br />

479<br />

6,250<br />

8,096<br />

3,614<br />

1,843<br />

675<br />

(33)<br />

6,099<br />

413<br />

21<br />

2,431<br />

8,681<br />

(11,541)<br />

20,222<br />

—<br />

20,222<br />

9<br />

$ 20,213<br />

$ 20,213<br />

—<br />

$ 20,213<br />

$ 5.33<br />

—<br />

$ 5.33<br />

$ 4.94<br />

—<br />

$ 4.94<br />

$ 0.05<br />

2010<br />

$ 119,280<br />

104,451<br />

9,040<br />

113,491<br />

5,789<br />

1,807<br />

(362)<br />

526<br />

4,146<br />

9,674<br />

4,345<br />

2,024<br />

845<br />

(216)<br />

6,998<br />

315<br />

12<br />

3,003<br />

7,149<br />

592<br />

6,557<br />

—<br />

6,557<br />

(4)<br />

$ 6,561<br />

$ 6,561<br />

—<br />

$ 6,561<br />

$ 1.90<br />

—<br />

$ 1.90<br />

$ 1.66<br />

—<br />

$ 1.66<br />

$ —<br />

2009<br />

$ 103,868<br />

98,866<br />

8,354<br />

107,220<br />

(3,352)<br />

1,477<br />

5,284<br />

330<br />

785<br />

12,415<br />

5,313<br />

3,937<br />

738<br />

1,030<br />

11,018<br />

552<br />

(135)<br />

1,814<br />

2,599<br />

(113)<br />

2,712<br />

5<br />

2,717<br />

—<br />

$ 2,717<br />

$ 2,712<br />

5<br />

$ 2,717<br />

$ 0.91<br />

—<br />

$ 0.91<br />

$ 0.86<br />

—<br />

$ 0.86<br />

$ —<br />

<strong>Ford</strong> <strong>Motor</strong> <strong>Company</strong> | <strong>2011</strong> <strong>Annual</strong> <strong>Report</strong> 85