Annual Report 2011 - Ford Motor Company

Annual Report 2011 - Ford Motor Company

Annual Report 2011 - Ford Motor Company

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

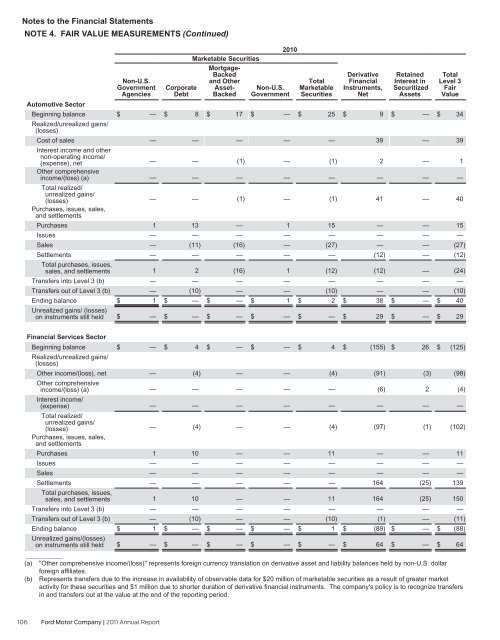

Notes to the Financial Statements<br />

NOTE 4. FAIR VALUE MEASUREMENTS (Continued)<br />

Non-U.S.<br />

Government<br />

Agencies<br />

Automotive Sector<br />

Beginning balance<br />

Realized/unrealized gains/<br />

(losses)<br />

$ —<br />

Cost of sales<br />

Interest income and other<br />

—<br />

non-operating income/<br />

(expense), net<br />

—<br />

Other comprehensive<br />

income/(loss) (a)<br />

Total realized/<br />

—<br />

unrealized gains/<br />

(losses)<br />

Purchases, issues, sales,<br />

and settlements<br />

—<br />

Purchases<br />

1<br />

Issues<br />

—<br />

Sales<br />

—<br />

Settlements<br />

—<br />

Total purchases, issues,<br />

sales, and settlements<br />

1<br />

Transfers into Level 3 (b)<br />

—<br />

Transfers out of Level 3 (b)<br />

—<br />

Ending balance<br />

$ 1<br />

Unrealized gains/ (losses)<br />

on instruments still held $ —<br />

Financial Services Sector<br />

Beginning balance<br />

Realized/unrealized gains/<br />

(losses)<br />

$ — $ 4 $ — $ — $ 4 $ (155) $ 26 $ (125)<br />

Other income/(loss), net<br />

—<br />

(4)<br />

—<br />

—<br />

(4)<br />

(91)<br />

(3) (98)<br />

Other comprehensive<br />

income/(loss) (a)<br />

—<br />

—<br />

—<br />

—<br />

—<br />

(6)<br />

2 (4)<br />

Interest income/<br />

(expense)<br />

Total realized/<br />

—<br />

—<br />

—<br />

—<br />

—<br />

—<br />

— —<br />

unrealized gains/<br />

(losses)<br />

Purchases, issues, sales,<br />

and settlements<br />

—<br />

(4)<br />

—<br />

—<br />

(4)<br />

(97)<br />

(1) (102)<br />

Purchases<br />

1<br />

10<br />

—<br />

—<br />

11<br />

—<br />

— 11<br />

Issues<br />

—<br />

—<br />

—<br />

—<br />

—<br />

—<br />

— —<br />

Sales<br />

—<br />

—<br />

—<br />

—<br />

—<br />

—<br />

— —<br />

Settlements<br />

—<br />

—<br />

—<br />

—<br />

—<br />

164<br />

(25) 139<br />

Total purchases, issues,<br />

sales, and settlements<br />

1<br />

10<br />

—<br />

—<br />

11<br />

164<br />

(25) 150<br />

Transfers into Level 3 (b)<br />

—<br />

—<br />

—<br />

—<br />

—<br />

—<br />

— —<br />

Transfers out of Level 3 (b)<br />

—<br />

(10)<br />

—<br />

—<br />

(10)<br />

(1)<br />

— (11)<br />

Ending balance<br />

$ 1 $ — $ — $ — $ 1 $ (89) $ — $ (88)<br />

Unrealized gains/(losses)<br />

on instruments still held<br />

__________<br />

$ — $ — $ — $ — $ — $ 64 $ — $ 64<br />

(a) "Other comprehensive income/(loss)" represents foreign currency translation on derivative asset and liability balances held by non-U.S. dollar<br />

foreign affiliates.<br />

(b) Represents transfers due to the increase in availability of observable data for $20 million of marketable securities as a result of greater market<br />

activity for these securities and $1 million due to shorter duration of derivative financial instruments. The company's policy is to recognize transfers<br />

in and transfers out at the value at the end of the reporting period.<br />

106 <strong>Ford</strong> <strong>Motor</strong> <strong>Company</strong> | <strong>2011</strong> <strong>Annual</strong> <strong>Report</strong><br />

Corporate<br />

Debt<br />

$ 8<br />

Marketable Securities<br />

—<br />

—<br />

—<br />

—<br />

13<br />

—<br />

(11)<br />

—<br />

2<br />

—<br />

(10)<br />

$ —<br />

$ —<br />

Mortgage-<br />

Backed<br />

and Other<br />

Asset-<br />

Backed<br />

$ 17<br />

—<br />

(1)<br />

—<br />

(1)<br />

—<br />

—<br />

(16)<br />

—<br />

(16)<br />

—<br />

—<br />

$ —<br />

$ —<br />

2010<br />

Non-U.S.<br />

Government<br />

$ —<br />

—<br />

—<br />

—<br />

—<br />

1<br />

—<br />

—<br />

—<br />

1<br />

—<br />

—<br />

$ 1<br />

$ —<br />

Total<br />

Marketable<br />

Securities<br />

$ 25<br />

—<br />

(1)<br />

—<br />

(1)<br />

15<br />

—<br />

(27)<br />

—<br />

(12)<br />

—<br />

(10)<br />

$ 2<br />

$ —<br />

Derivative<br />

Financial<br />

Instruments,<br />

Net<br />

$ 9<br />

39<br />

2<br />

—<br />

41<br />

—<br />

—<br />

—<br />

(12)<br />

(12)<br />

—<br />

—<br />

$ 38<br />

$ 29<br />

Retained<br />

Interest in<br />

Securitized<br />

Assets<br />

$ —<br />

—<br />

—<br />

—<br />

—<br />

—<br />

—<br />

—<br />

—<br />

—<br />

—<br />

—<br />

$ —<br />

$ —<br />

Total<br />

Level 3<br />

Fair<br />

Value<br />

$ 34<br />

39<br />

1<br />

—<br />

40<br />

15<br />

—<br />

(27)<br />

(12)<br />

(24)<br />

—<br />

(10)<br />

$ 40<br />

$ 29