program plan - Entergy New Orleans, Inc.

program plan - Entergy New Orleans, Inc.

program plan - Entergy New Orleans, Inc.

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

This process culminated with a final measure list, which served as the primary input for the <strong>program</strong><br />

forecasting process.<br />

Program Forecasting & Portfolio Design<br />

Using the final measure list developed, the CLEAResult team then considered the overall <strong>program</strong> forecasts<br />

and design. This process takes into consideration both the goals established in the 2012 IRP, the results of<br />

the three year Energy Smart portfolio implementation, the 2014 – 2017 <strong>program</strong> designs, and the national<br />

implementation experience of the project team to establish participation estimates by measure. These<br />

estimates were considered against the incentive levels required to achieve significant and cost-effective<br />

<strong>program</strong> savings. The project team also evaluated under-represented market sectors to target in the new<br />

portfolio, and new service offerings that will continue to advance market development. The analysis<br />

concluded with <strong>program</strong>, sector and portfolio level cost-effectiveness, savings estimates and spending<br />

requirements for the 2014 – 2017 DSM Portfolio.<br />

Market Profile Summary<br />

<strong>Entergy</strong> <strong>New</strong> <strong>Orleans</strong> reviewed the existing market potential study included in the 2012 IRP, publicly<br />

available datasets from the US Census, the Federal Reserve and other sources, and internal data on<br />

customer sales by meter type. We compared these findings with results from the Energy Smart Program<br />

implementation to develop a market profile for use in this DSM Plan.<br />

The analysis found that although there is an overall upward trend in economic growth, the city labor force<br />

is still below the pre-Katrina levels, suggesting hardships experienced in the economy remain a factor<br />

within <strong>New</strong> <strong>Orleans</strong>. The analysis also looked at customer sales by market segments and primary<br />

technology end-uses within the territory. Overall, the findings are consistent with those reported<br />

previously; however, the residential new homes market findings suggest the current opportunity is more<br />

minimal than the 2012 IRP.<br />

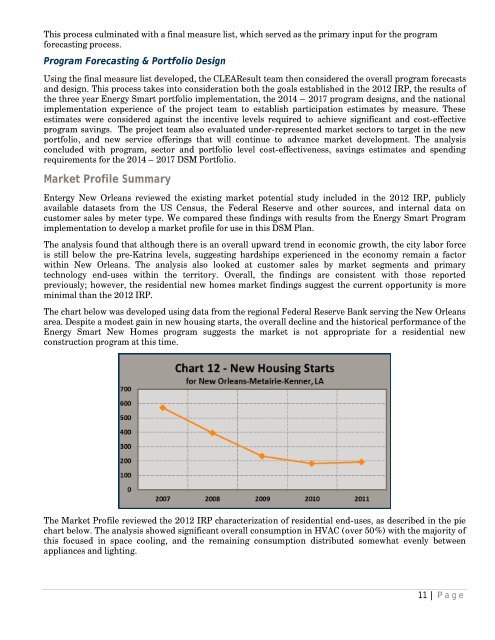

The chart below was developed using data from the regional Federal Reserve Bank serving the <strong>New</strong> <strong>Orleans</strong><br />

area. Despite a modest gain in new housing starts, the overall decline and the historical performance of the<br />

Energy Smart <strong>New</strong> Homes <strong>program</strong> suggests the market is not appropriate for a residential new<br />

construction <strong>program</strong> at this time.<br />

The Market Profile reviewed the 2012 IRP characterization of residential end-uses, as described in the pie<br />

chart below. The analysis showed significant overall consumption in HVAC (over 50%) with the majority of<br />

this focused in space cooling, and the remaining consumption distributed somewhat evenly between<br />

appliances and lighting.<br />

11 | P age