Gazprom-AR2014

Gazprom-AR2014

Gazprom-AR2014

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

48<br />

Trends and Developments on Oil and Gas Markets<br />

In the challenging environment, <strong>Gazprom</strong> kept its financial stability and ability to run largescale<br />

projects.<br />

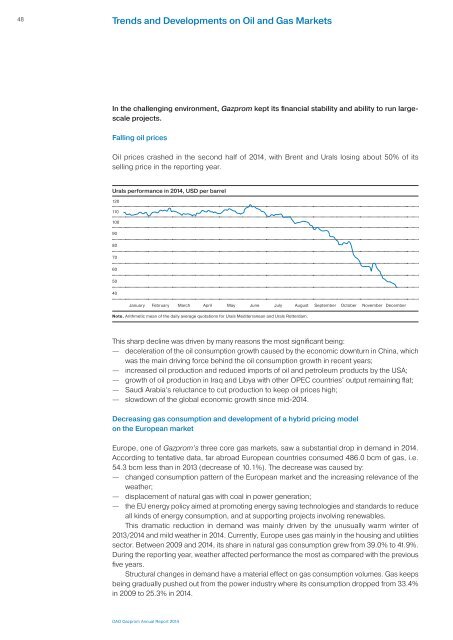

Falling oil prices<br />

Oil prices crashed in the second half of 2014, with Brent and Urals losing about 50% of its<br />

selling price in the reporting year.<br />

Urals performance in 2014, USD per barrel<br />

120<br />

110<br />

100<br />

90<br />

80<br />

70<br />

60<br />

50<br />

40<br />

January February March April May June July August September October November December<br />

Note. Arithmetic mean of the daily average quotations for Urals Mediterranean and Urals Rotterdam.<br />

This sharp decline was driven by many reasons the most significant being:<br />

— deceleration of the oil consumption growth caused by the economic downturn in China, which<br />

was the main driving force behind the oil consumption growth in recent years;<br />

— increased oil production and reduced imports of oil and petroleum products by the USA;<br />

— growth of oil production in Iraq and Libya with other OPEC countries’ output remaining flat;<br />

— Saudi Arabia’s reluctance to cut production to keep oil prices high;<br />

— slowdown of the global economic growth since mid-2014.<br />

Decreasing gas consumption and development of a hybrid pricing model<br />

on the European market<br />

Europe, one of <strong>Gazprom</strong>’s three core gas markets, saw a substantial drop in demand in 2014.<br />

According to tentative data, far abroad European countries consumed 486.0 bcm of gas, i.e.<br />

54.3 bcm less than in 2013 (decrease of 10.1%). The decrease was caused by:<br />

— changed consumption pattern of the European market and the increasing relevance of the<br />

weather;<br />

— displacement of natural gas with coal in power generation;<br />

— the EU energy policy aimed at promoting energy saving technologies and standards to reduce<br />

all kinds of energy consumption, and at supporting projects involving renewables.<br />

This dramatic reduction in demand was mainly driven by the unusually warm winter of<br />

2013/2014 and mild weather in 2014. Currently, Europe uses gas mainly in the housing and utilities<br />

sector. Between 2009 and 2014, its share in natural gas consumption grew from 39.0% to 41.9%.<br />

During the reporting year, weather affected performance the most as compared with the previous<br />

five years.<br />

Structural changes in demand have a material effect on gas consumption volumes. Gas keeps<br />

being gradually pushed out from the power industry where its consumption dropped from 33.4%<br />

in 2009 to 25.3% in 2014.<br />

OAO <strong>Gazprom</strong> Annual Report 2014