Gazprom-AR2014

Gazprom-AR2014

Gazprom-AR2014

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

50<br />

Trends and Developments on Oil and Gas Markets<br />

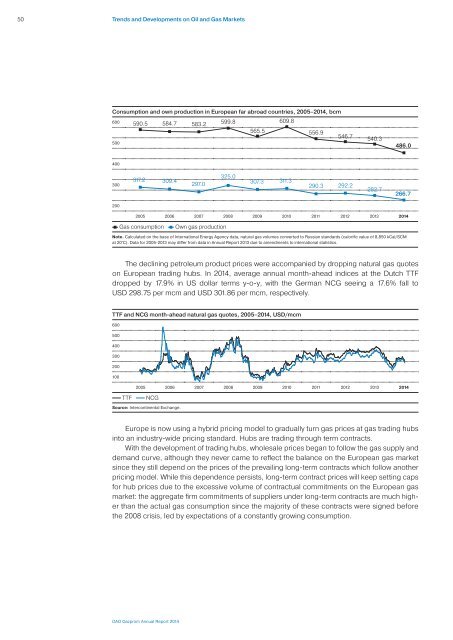

Consumption and own production in European far abroad countries, 2005–2014, bcm<br />

600 590.5 584.7 583.2<br />

599.8<br />

609.8<br />

565.5<br />

556.9<br />

546.7<br />

500<br />

540.3<br />

486.0<br />

400<br />

300<br />

317.2 309.4<br />

297.0<br />

325.0<br />

307.3 311.3<br />

290.3 292.2<br />

282.7<br />

266.7<br />

200<br />

2005 2006 2007 2008 2009 2010 2011 2012 2013 2014<br />

Gas consumption<br />

Own gas production<br />

Note. Calculated on the base of International Energy Agency data, natural gas volumes converted to Russian standards (calorific value of 8,850 kCal/SCM<br />

at 20°C). Data for 2005-2013 may differ from data in Annual Report 2013 due to amendments to international statistics.<br />

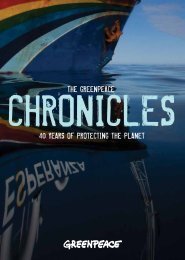

The declining petroleum product prices were accompanied by dropping natural gas quotes<br />

on European trading hubs. In 2014, average annual month-ahead indices at the Dutch TTF<br />

dropped by 17.9% in US dollar terms y-o-y, with the German NCG seeing a 17.6% fall to<br />

USD 298.75 per mcm and USD 301.86 per mcm, respectively.<br />

TTF and NCG month-ahead natural gas quotes, 2005–2014, USD/mcm<br />

600<br />

500<br />

400<br />

300<br />

200<br />

100<br />

2005 2006 2007 2008 2009 2010 2011 2012 2013 2014<br />

TTF<br />

NCG<br />

Source: Intercontinental Exchange.<br />

Europe is now using a hybrid pricing model to gradually turn gas prices at gas trading hubs<br />

into an industry-wide pricing standard. Hubs are trading through term contracts.<br />

With the development of trading hubs, wholesale prices began to follow the gas supply and<br />

demand curve, although they never came to reflect the balance on the European gas market<br />

since they still depend on the prices of the prevailing long-term contracts which follow another<br />

pricing model. While this dependence persists, long-term contract prices will keep setting caps<br />

for hub prices due to the excessive volume of contractual commitments on the European gas<br />

market: the aggregate firm commitments of suppliers under long-term contracts are much higher<br />

than the actual gas consumption since the majority of these contracts were signed before<br />

the 2008 crisis, led by expectations of a constantly growing consumption.<br />

OAO <strong>Gazprom</strong> Annual Report 2014