Gazprom-AR2014

Gazprom-AR2014

Gazprom-AR2014

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

80<br />

Performance Results<br />

In accordance with the applicable Russian laws, end consumers buy gas at regulated prices<br />

which are differentiated between consumer groups (households vs industrial consumers), as well<br />

as by price ranges, based on the relative distance from the gas production region to the consumer.<br />

Therefore, the regulated wholesale prices for gas supplied to households are 20% to 22%<br />

lower than those for gas supplied to industrial consumers. FTS of Russia revises regulated wholesale<br />

gas prices in accordance with the Forecast of Social and Economic Development of the<br />

Russian Federation prepared by the Ministry of Economic Development of the Russian Federation.<br />

The growth of domestic regulated gas prices is capped by the Forecast of Social and Economic<br />

Development of the Russian Federation prepared by the Ministry of Economic Development<br />

of the Russian Federation and approved by the Russian Federation Government in September<br />

2014.<br />

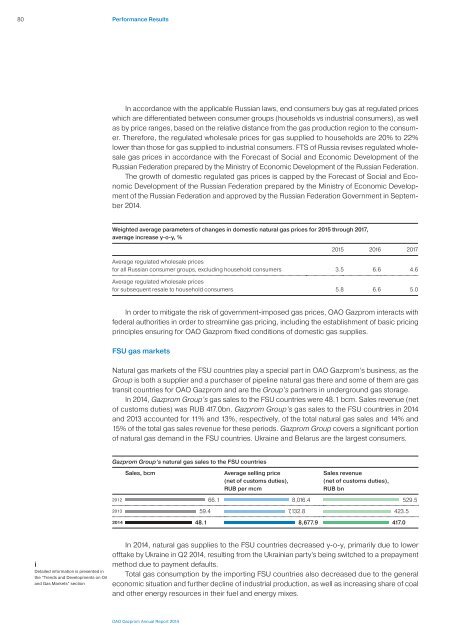

Weighted average parameters of changes in domestic natural gas prices for 2015 through 2017,<br />

average increase y-o-y, %<br />

2015 2016 2017<br />

Average regulated wholesale prices<br />

for all Russian consumer groups, excluding household consumers 3.5 6.6 4.6<br />

Average regulated wholesale prices<br />

for subsequent resale to household consumers 5.8 6.6 5.0<br />

In order to mitigate the risk of government-imposed gas prices, OAO <strong>Gazprom</strong> interacts with<br />

federal authorities in order to streamline gas pricing, including the establishment of basic pricing<br />

principles ensuring for OAO <strong>Gazprom</strong> fixed conditions of domestic gas supplies.<br />

FSU gas markets<br />

Natural gas markets of the FSU countries play a special part in OAO <strong>Gazprom</strong>’s business, as the<br />

Group is both a supplier and a purchaser of pipeline natural gas there and some of them are gas<br />

transit countries for OAO <strong>Gazprom</strong> and are the Group’s partners in underground gas storage.<br />

In 2014, <strong>Gazprom</strong> Group’s gas sales to the FSU countries were 48.1 bcm. Sales revenue (net<br />

of customs duties) was RUB 417.0bn. <strong>Gazprom</strong> Group’s gas sales to the FSU countries in 2014<br />

and 2013 accounted for 11% and 13%, respectively, of the total natural gas sales and 14% and<br />

15% of the total gas sales revenue for these periods. <strong>Gazprom</strong> Group covers a significant portion<br />

of natural gas demand in the FSU countries. Ukraine and Belarus are the largest consumers.<br />

<strong>Gazprom</strong> Group’s natural gas sales to the FSU countries<br />

Sales, bcm<br />

Average selling price<br />

(net of customs duties),<br />

RUB per mcm<br />

Sales revenue<br />

(net of customs duties),<br />

RUB bn<br />

2012 66.1 8,016.4 529.5<br />

2013 59.4 7,132.8 423.5<br />

2014 48.1 8,677.9 417.0<br />

i<br />

Detailed information is presented in<br />

the “Trends and Developments on Oil<br />

and Gas Markets” section<br />

In 2014, natural gas supplies to the FSU countries decreased y-o-y, primarily due to lower<br />

offtake by Ukraine in Q2 2014, resulting from the Ukrainian party’s being switched to a prepayment<br />

method due to payment defaults.<br />

Total gas consumption by the importing FSU countries also decreased due to the general<br />

economic situation and further decline of industrial production, as well as increasing share of coal<br />

and other energy resources in their fuel and energy mixes.<br />

OAO <strong>Gazprom</strong> Annual Report 2014