A4 für Copyshop GB.indd - Bayerische Landesbank

A4 für Copyshop GB.indd - Bayerische Landesbank

A4 für Copyshop GB.indd - Bayerische Landesbank

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

96 Report on the Bank and the Group<br />

} Return to satisfactory<br />

operating<br />

result after difficult<br />

years<br />

} Improved return<br />

on equity<br />

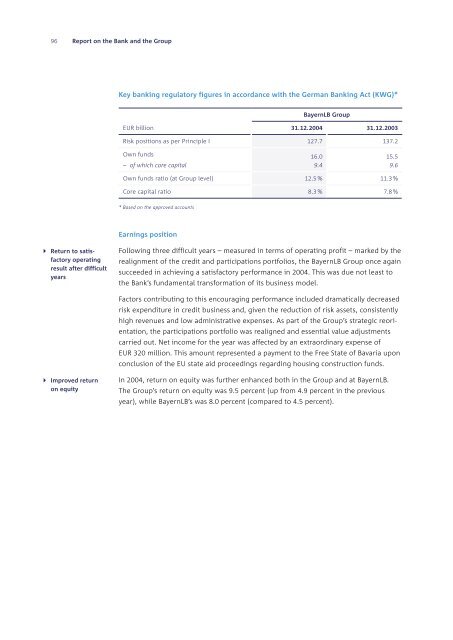

Key banking regulatory figures in accordance with the German Banking Act (KWG)*<br />

EUR billion<br />

BayernLB Group<br />

31.12.2004 31.12.2003<br />

Risk positions as per Principle I 127.7 137.2<br />

Own funds<br />

– of which core capital<br />

Own funds ratio (at Group level) 12.5 % 11.3 %<br />

Core capital ratio 8.3 % 7.8 %<br />

* Based on the approved accounts<br />

Earnings position<br />

Following three difficult years – measured in terms of operating profit – marked by the<br />

realignment of the credit and participations portfolios, the BayernLB Group once again<br />

succeeded in achieving a satisfactory performance in 2004. This was due not least to<br />

the Bank’s fundamental transformation of its business model.<br />

Factors contributing to this encouraging performance included dramatically decreased<br />

risk expenditure in credit business and, given the reduction of risk assets, consistently<br />

high revenues and low administrative expenses. As part of the Group’s strategic reori-<br />

entation, the participations portfolio was realigned and essential value adjustments<br />

16.0<br />

9.4<br />

carried out. Net income for the year was affected by an extraordinary expense of<br />

EUR 320 million. This amount represented a payment to the Free State of Bavaria upon<br />

conclusion of the EU state aid proceedings regarding housing construction funds.<br />

In 2004, return on equity was further enhanced both in the Group and at BayernLB.<br />

The Group’s return on equity was 9.5 percent (up from 4.9 percent in the previous<br />

year), while BayernLB’s was 8.0 percent (compared to 4.5 percent).<br />

15.5<br />

9.6