A4 für Copyshop GB.indd - Bayerische Landesbank

A4 für Copyshop GB.indd - Bayerische Landesbank

A4 für Copyshop GB.indd - Bayerische Landesbank

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

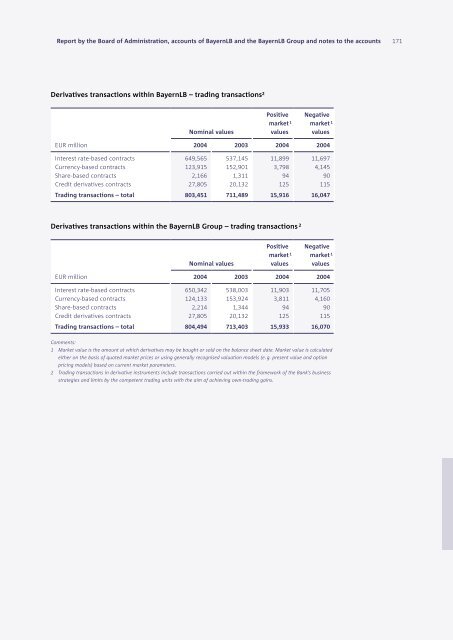

Report by the Board of Administration, accounts of BayernLB and the BayernLB Group and notes to the accounts<br />

Derivatives transactions within BayernLB – trading transactions 2<br />

EUR million<br />

Interest rate-based contracts<br />

Currency-based contracts<br />

Share-based contracts<br />

Credit derivatives contracts<br />

Trading transactions – total<br />

Nominal values<br />

Positive<br />

market 1<br />

values<br />

Negative<br />

market 1<br />

values<br />

2004 2003 2004 2004<br />

649,565<br />

123,915<br />

2,166<br />

27,805<br />

803,451<br />

537,145<br />

152,901<br />

1,311<br />

20,132<br />

711,489<br />

11,899<br />

3,798<br />

94<br />

125<br />

15,916<br />

Derivatives transactions within the BayernLB Group – trading transactions 2<br />

EUR million<br />

Interest rate-based contracts<br />

Currency-based contracts<br />

Share-based contracts<br />

Credit derivatives contracts<br />

Trading transactions – total<br />

Comments:<br />

Nominal values<br />

Positive<br />

market 1<br />

values<br />

11,697<br />

4,145<br />

90<br />

115<br />

16,047<br />

Negative<br />

market 1<br />

values<br />

2004 2003 2004 2004<br />

650,342<br />

124,133<br />

2,214<br />

27,805<br />

804,494<br />

538,003<br />

153,924<br />

1,344<br />

20,132<br />

713,403<br />

11,903<br />

3,811<br />

94<br />

125<br />

15,933<br />

11,705<br />

4,160<br />

90<br />

115<br />

16,070<br />

1 Market value is the amount at which derivatives may be bought or sold on the balance sheet date. Market value is calculated<br />

either on the basis of quoted market prices or using generally recognised valuation models (e. g. present value and option<br />

pricing models) based on current market parameters.<br />

2 Trading transactions in derivative instruments include transactions carried out within the framework of the Bank’s business<br />

strategies and limits by the competent trading units with the aim of achieving own-trading gains.<br />

171