A4 für Copyshop GB.indd - Bayerische Landesbank

A4 für Copyshop GB.indd - Bayerische Landesbank

A4 für Copyshop GB.indd - Bayerische Landesbank

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

BayernLB’s subsidiaries (Hungarian Foreign Trade Bank, Budapest; Banque LBLux S.A.,<br />

Luxembourg; <strong>Landesbank</strong> Saar, Saarbrücken; Deutsche Kreditbank AG, Berlin) imple-<br />

ment risk controlling processes, strategies and procedures as well as risk management<br />

in accordance with their own individual purposes.<br />

The Group Audit Division supports the Board of Management in its capacity as a proc-<br />

ess-independent unit within the internal monitoring system. Its activities are defined<br />

by the Minimum Requirements for the Structure of Internal Audits at Banking Institu-<br />

tions (MaIR) issued by the BaFin.<br />

Monitoring and controlling the various risk types<br />

Counterparty risk<br />

BayernLB defines counterparty risk as the potential loss resulting from a counterparty’s<br />

default or from a decreased value owing to an unforeseeable deterioration in a coun-<br />

terparty’s credit standing. Counterparty risks may be broken down into risks arising<br />

from traditional credit business, issuer risks resulting from securities transactions and<br />

counterparty risks from trading transactions.<br />

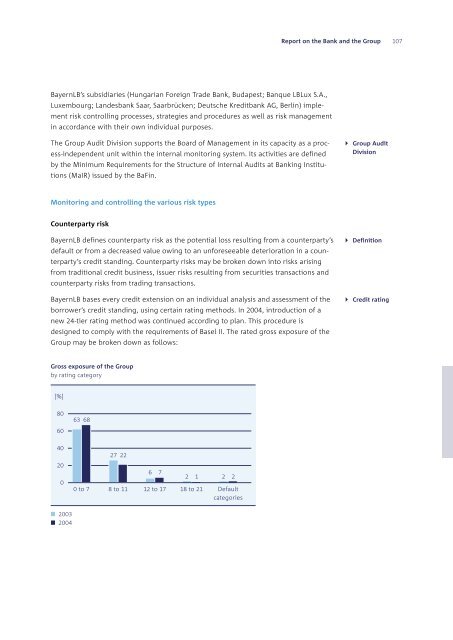

BayernLB bases every credit extension on an individual analysis and assessment of the<br />

borrower’s credit standing, using certain rating methods. In 2004, introduction of a<br />

new 24-tier rating method was continued according to plan. This procedure is<br />

designed to comply with the requirements of Basel II. The rated gross exposure of the<br />

Group may be broken down as follows:<br />

Gross exposure of the Group<br />

by rating category<br />

[%]<br />

80<br />

60<br />

40<br />

20<br />

0<br />

2003<br />

2004<br />

63 68<br />

27 22<br />

6 7<br />

2 1 2 2<br />

0 to 7 8 to 11 12 to 17 18 to 21 Default<br />

categories<br />

Report on the Bank and the Group<br />

} Group Audit<br />

Division<br />

} Definition<br />

} Credit rating<br />

107