A4 für Copyshop GB.indd - Bayerische Landesbank

A4 für Copyshop GB.indd - Bayerische Landesbank

A4 für Copyshop GB.indd - Bayerische Landesbank

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

116 Report on the Bank and the Group<br />

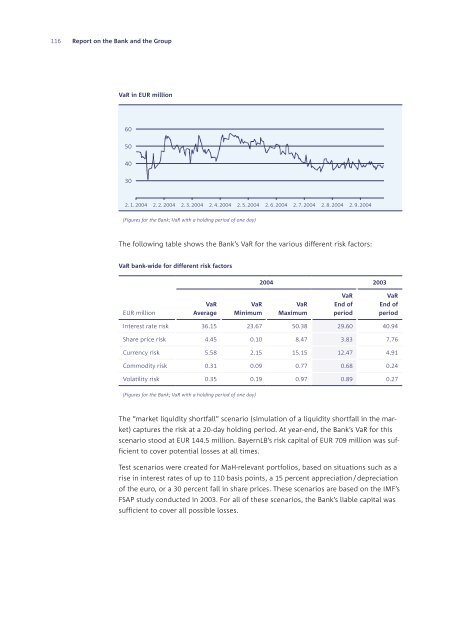

VaR in EUR million<br />

60<br />

50<br />

40<br />

30<br />

2. 1. 2004 2. 2. 2004 2. 3. 2004 2. 4. 2004 2. 5. 2004 2. 6. 2004 2. 7. 2004 2. 8. 2004 2. 9. 2004<br />

(Figures for the Bank; VaR with a holding period of one day)<br />

The following table shows the Bank’s VaR for the various different risk factors:<br />

VaR bank-wide for different risk factors<br />

EUR million<br />

VaR<br />

Average<br />

VaR<br />

Minimum<br />

2004 2003<br />

VaR<br />

Maximum<br />

VaR<br />

End of<br />

period<br />

VaR<br />

End of<br />

period<br />

Interest rate risk 36.15 23.67 50.38 29.60 40.94<br />

Share price risk 4.45 0.10 8.47 3.83 7.76<br />

Currency risk 5.58 2.15 15.15 12.47 4.91<br />

Commodity risk 0.31 0.09 0.77 0.68 0.24<br />

Volatility risk 0.35 0.19 0.97 0.89 0.27<br />

(Figures for the Bank; VaR with a holding period of one day)<br />

The “market liquidity shortfall” scenario (simulation of a liquidity shortfall in the mar-<br />

ket) captures the risk at a 20-day holding period. At year-end, the Bank’s VaR for this<br />

scenario stood at EUR 144.5 million. BayernLB’s risk capital of EUR 709 million was suf-<br />

ficient to cover potential losses at all times.<br />

Test scenarios were created for MaH-relevant portfolios, based on situations such as a<br />

rise in interest rates of up to 110 basis points, a 15 percent appreciation / depreciation<br />

of the euro, or a 30 percent fall in share prices. These scenarios are based on the IMF’s<br />

FSAP study conducted in 2003. For all of these scenarios, the Bank’s liable capital was<br />

sufficient to cover all possible losses.