A4 für Copyshop GB.indd - Bayerische Landesbank

A4 für Copyshop GB.indd - Bayerische Landesbank

A4 für Copyshop GB.indd - Bayerische Landesbank

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

110 Report on the Bank and the Group<br />

} Derivatives<br />

business in 2004<br />

} Risk provisioning<br />

in 2004<br />

BayernLB uses derivative instruments in order to reduce price and / or interest rate risks<br />

associated with the conclusion of customer transactions, as well as those arising from<br />

asset / liability management and the issuance of structured bonds. After these instru-<br />

ments have been used, any residual risks are subject to the risk limit and risk capital<br />

controlling. Derivatives are principally used to diversify credit risks or as hedging<br />

instruments. In addition to the use of derivatives, risk hedging is also carried out by<br />

the active syndication of loans, or with the help of structured products such as asset<br />

backed securities (ABS).<br />

At Group level, the credit equivalent amount from derivative transactions, taking<br />

account of netting agreements, totalled EUR 3.8 billion at year-end, which corresponds<br />

to 0.38 percent of the nominal contract volumes (for detailed information on the entire<br />

scope of derivatives business, see “Notes to the Accounts” in Section V).<br />

All counterparty risks identified in this period were covered appropriately through risk<br />

provisions. In 2004 on balance, EUR 222 million was allocated to provisions for coun-<br />

terparty and country risks at Group level (write-backs totalling EUR 92 million at Bank<br />

level). Allocations were thus reduced by 83.5 percent year on year. In relation to the<br />

average credit volume, the default rate in the credit business at Group level was 0.36<br />

percent (0.38 percent at BayernLB alone). Direct write-offs on claims came to EUR 87<br />

million at Group level and EUR 58 million at Bank level.<br />

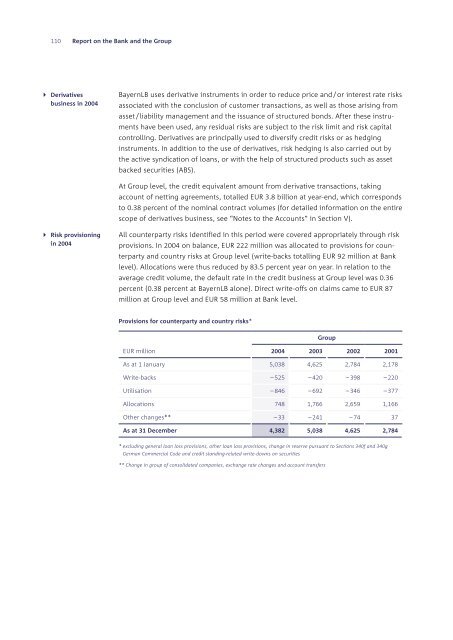

Provisions for counterparty and country risks*<br />

EUR million<br />

Group<br />

2004 2003 2002 2001<br />

As at 1 January 5,038 4,625 2,784 2,178<br />

Write-backs – 525 – 420 – 398 – 220<br />

Utilisation – 846 – 692 – 346 – 377<br />

Allocations 748 1,766 2,659 1,166<br />

Other changes** – 33 – 241 – 74 37<br />

As at 31 December 4,382 5,038 4,625 2,784<br />

* excluding general loan loss provisions, other loan loss provisions, change in reserve pursuant to Sections 340f and 340g<br />

German Commercial Code and credit standing-related write-downs on securities<br />

** Change in group of consolidated companies, exchange rate changes and account transfers