A4 für Copyshop GB.indd - Bayerische Landesbank

A4 für Copyshop GB.indd - Bayerische Landesbank

A4 für Copyshop GB.indd - Bayerische Landesbank

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

100 Report on the Bank and the Group<br />

} Payment settles<br />

EU state aid<br />

proceedings<br />

} Net income<br />

for the year<br />

} Corporates<br />

segment result<br />

The operating result does not include extraordinary expenses amounting to EUR 358<br />

million in the Group, and EUR 357 million at BayernLB. Of these figures, EUR 320 mil-<br />

lion relates to the payment to the Free State of Bavaria as part of the conclusion of the<br />

EU state aid proceedings.<br />

Due to the improvement of the result, tax expenses more than doubled both in the<br />

Group and at BayernLB. The former incurred tax expenses of EUR 252 million compared<br />

with EUR 104 million in the previous year; the latter EUR 175 million compared with<br />

EUR 80 million in the previous year.<br />

After partial profit transfer, which includes interest expenses for capital contributions<br />

of silent partners, and, standing at EUR 242 million in the Group and EUR 220 mil-<br />

lion at BayernLB, is comparable to the previous year’s levels of EUR 237 million and<br />

EUR 219 million respectively, net income for the year is EUR 98 million for the Group<br />

(compared with EUR 79 million in the previous year) and an unchanged EUR 63 million<br />

for BayernLB. This enables a distribution of 4 percent on the nominal capital for 2004.<br />

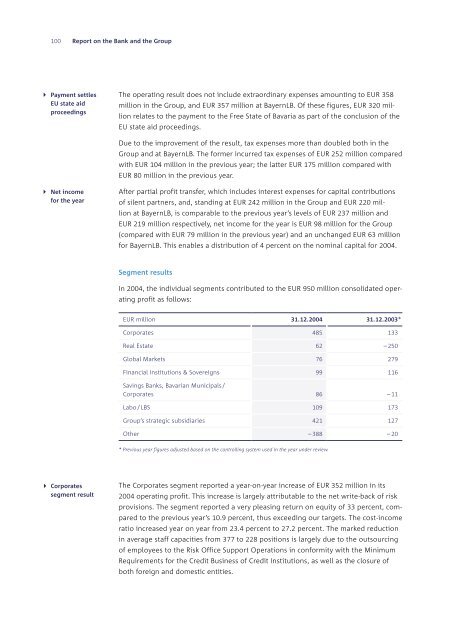

Segment results<br />

In 2004, the individual segments contributed to the EUR 950 million consolidated oper-<br />

ating profit as follows:<br />

EUR million 31.12.2004 31.12.2003*<br />

Corporates 485 133<br />

Real Estate 62 – 250<br />

Global Markets 76 279<br />

Financial Institutions & Sovereigns 99 116<br />

Savings Banks, Bavarian Municipals /<br />

Corporates 86 – 11<br />

Labo / LBS 109 173<br />

Group’s strategic subsidiaries 421 127<br />

Other – 388 – 20<br />

* Previous year figures adjusted based on the controlling system used in the year under review.<br />

The Corporates segment reported a year-on-year increase of EUR 352 million in its<br />

2004 operating profit. This increase is largely attributable to the net write-back of risk<br />

provisions. The segment reported a very pleasing return on equity of 33 percent, com-<br />

pared to the previous year’s 10.9 percent, thus exceeding our targets. The cost-income<br />

ratio increased year on year from 23.4 percent to 27.2 percent. The marked reduction<br />

in average staff capacities from 377 to 228 positions is largely due to the outsourcing<br />

of employees to the Risk Office Support Operations in conformity with the Minimum<br />

Requirements for the Credit Business of Credit Institutions, as well as the closure of<br />

both foreign and domestic entities.