A4 für Copyshop GB.indd - Bayerische Landesbank

A4 für Copyshop GB.indd - Bayerische Landesbank

A4 für Copyshop GB.indd - Bayerische Landesbank

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

144 Report by the Board of Administration, accounts of BayernLB and the BayernLB Group and notes to the accounts<br />

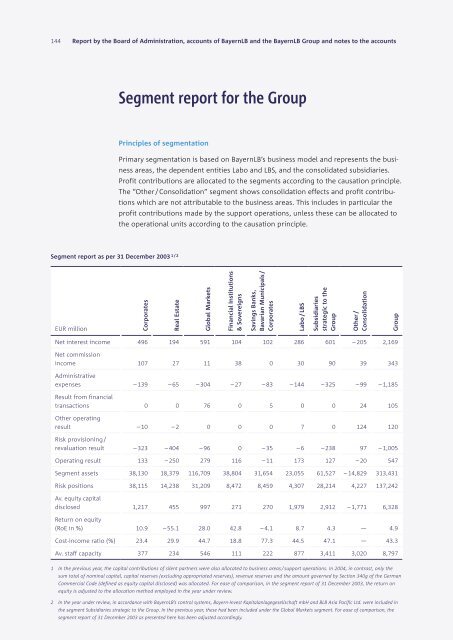

Segment report as per 31 December 2003 1 / 2<br />

EUR million Corporates<br />

Segment report for the Group<br />

Principles of segmentation<br />

Primary segmentation is based on BayernLB’s business model and represents the busi-<br />

ness areas, the dependent entities Labo and LBS, and the consolidated subsidiaries.<br />

Profit contributions are allocated to the segments according to the causation principle.<br />

The “Other / Consolidation” segment shows consolidation effects and profit contribu-<br />

tions which are not attributable to the business areas. This includes in particular the<br />

profit contributions made by the support operations, unless these can be allocated to<br />

the operational units according to the causation principle.<br />

Real Estate<br />

Global Markets<br />

Financial Institutions<br />

& Sovereigns<br />

Savings Banks,<br />

Bavarian Municipals /<br />

Corporates<br />

Labo / LBS<br />

Subsidiaries<br />

strategic to the<br />

Group<br />

Net interest income 496 194 591 104 102 286 601 – 205 2,169<br />

Net commission<br />

income 107 27 11 38 0 30 90 39 343<br />

Administrative<br />

expenses – 139 – 65 – 304 – 27 – 83 – 144 – 325 – 99 – 1,185<br />

Result from financial<br />

transactions 0 0 76 0 5 0 0 24 105<br />

Other operating<br />

result – 10 – 2 0 0 0 7 0 124 120<br />

Risk provisioning /<br />

revaluation result – 323 – 404 – 96 0 – 35 – 6 – 238 97 – 1,005<br />

Operating result 133 – 250 279 116 – 11 173 127 – 20 547<br />

Segment assets 38,130 18,379 116,709 38,804 31,654 23,055 61,527 – 14,829 313,431<br />

Risk positions 38,115 14,238 31,209 8,472 8,459 4,307 28,214 4,227 137,242<br />

Av. equity capital<br />

disclosed 1,217 455 997 271 270 1,979 2,912 – 1,771 6,328<br />

Return on equity<br />

(RoE in %) 10.9 – 55.1 28.0 42.8 – 4.1 8.7 4.3 — 4.9<br />

Cost-income ratio (%) 23.4 29.9 44.7 18.8 77.3 44.5 47.1 — 43.3<br />

Av. staff capacity 377 234 546 111 222 877 3,411 3,020 8,797<br />

1 In the previous year, the capital contributions of silent partners were also allocated to business areas / support operations. In 2004, in contrast, only the<br />

sum total of nominal capital, capital reserves (excluding appropriated reserves), revenue reserves and the amount governed by Section 340g of the German<br />

Commercial Code (defined as equity capital disclosed) was allocated. For ease of comparison, in the segment report of 31 December 2003, the return on<br />

equity is adjusted to the allocation method employed in the year under review.<br />

2 In the year under review, in accordance with BayernLB’s control systems, Bayern-Invest Kapitalanlagegesellschaft mbH and BLB Asia Pacific Ltd. were included in<br />

the segment Subsidiaries strategic to the Group. In the previous year, these had been included under the Global Markets segment. For ease of comparison, the<br />

segment report of 31 December 2003 as presented here has been adjusted accordingly.<br />

Other /<br />

Consolidation<br />

Group