A4 für Copyshop GB.indd - Bayerische Landesbank

A4 für Copyshop GB.indd - Bayerische Landesbank

A4 für Copyshop GB.indd - Bayerische Landesbank

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

40 BayernLB – our company<br />

Real Estate<br />

The Real Estate Business Area serves private and institutional investors, project devel-<br />

opers, residential property developers, retail customers and housing companies. The<br />

product range spans everything from traditional, long-term loans to the various types<br />

of structured financing instruments. Germany, Western and Eastern Europe and North<br />

America are the target regions. Together with its specialised subsidiaries, the business<br />

area offers comprehensive expertise in practically all areas of real estate business. Real<br />

Estate’s prime objective is to make its customers’ ideas reality using innovative solu-<br />

tions. In doing this, the business area makes a solid contribution to the Bank’s overall<br />

performance.<br />

Commercial real estate financing<br />

With a view to ensuring a sound level of earnings, the business area has focused on<br />

expanding low-risk, high-yield long-term commercial real estate financing both at<br />

home and abroad, in line with the target portfolio. Overall, real estate financing con-<br />

tinued to be marked by a difficult, fiercely competitive market environment. As in the<br />

previous year, the unfavourable market environment meant that relatively few large<br />

construction projects were launched by investors in Germany, while some existent<br />

large-scale plans were actually shelved. Pleasingly, though, new business volumes in<br />

domestic commercial real estate financing matched those of the previous year. Financ-<br />

ing activities were mainly focused on office, retail and special real estate, with consist-<br />

ently risk-oriented margins. In the context of cooperation with the savings banks, in<br />

commercial business there was increased demand for expertise with regard to special<br />

real estate, as well as qualified advisory services such as property valuation and real<br />

estate rating.<br />

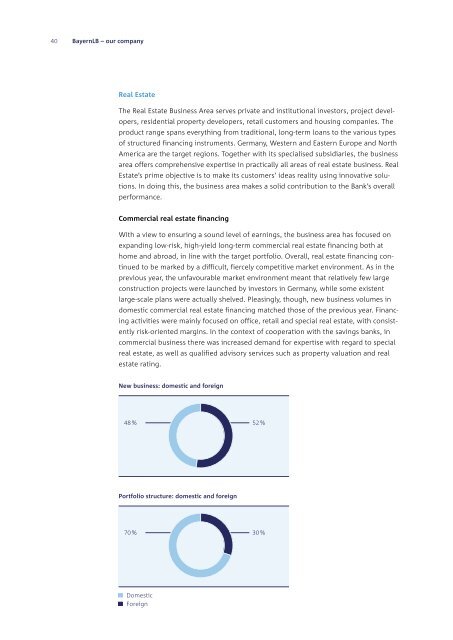

New business: domestic and foreign<br />

48 %<br />

Portfolio structure: domestic and foreign<br />

70 %<br />

Domestic<br />

Foreign<br />

52 %<br />

30 %