A4 für Copyshop GB.indd - Bayerische Landesbank

A4 für Copyshop GB.indd - Bayerische Landesbank

A4 für Copyshop GB.indd - Bayerische Landesbank

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

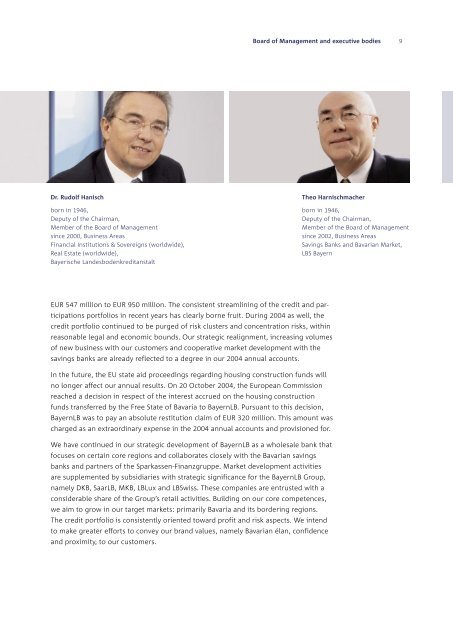

Dr. Rudolf Hanisch<br />

born in 1946,<br />

Deputy of the Chairman,<br />

Member of the Board of Management<br />

since 2000, Business Areas<br />

Financial Institutions & Sovereigns (worldwide),<br />

Real Estate (worldwide),<br />

<strong>Bayerische</strong> Landesbodenkreditanstalt<br />

EUR 547 million to EUR 950 million. The consistent streamlining of the credit and par-<br />

ticipations portfolios in recent years has clearly borne fruit. During 2004 as well, the<br />

credit portfolio continued to be purged of risk clusters and concentration risks, within<br />

reasonable legal and economic bounds. Our strategic realignment, increasing volumes<br />

of new business with our customers and cooperative market development with the<br />

savings banks are already reflected to a degree in our 2004 annual accounts.<br />

In the future, the EU state aid proceedings regarding housing construction funds will<br />

no longer affect our annual results. On 20 October 2004, the European Commission<br />

reached a decision in respect of the interest accrued on the housing construction<br />

funds transferred by the Free State of Bavaria to BayernLB. Pursuant to this decision,<br />

BayernLB was to pay an absolute restitution claim of EUR 320 million. This amount was<br />

charged as an extraordinary expense in the 2004 annual accounts and provisioned for.<br />

We have continued in our strategic development of BayernLB as a wholesale bank that<br />

focuses on certain core regions and collaborates closely with the Bavarian savings<br />

banks and partners of the Sparkassen-Finanzgruppe. Market development activities<br />

are supplemented by subsidiaries with strategic significance for the BayernLB Group,<br />

namely DKB, SaarLB, MKB, LBLux and LBSwiss. These companies are entrusted with a<br />

considerable share of the Group’s retail activities. Building on our core competences,<br />

we aim to grow in our target markets: primarily Bavaria and its bordering regions.<br />

The credit portfolio is consistently oriented toward profit and risk aspects. We intend<br />

to make greater efforts to convey our brand values, namely Bavarian élan, confidence<br />

and proximity, to our customers.<br />

Board of Management and executive bodies<br />

Theo Harnischmacher<br />

born in 1946,<br />

Deputy of the Chairman,<br />

Member of the Board of Management<br />

since 2002, Business Areas<br />

Savings Banks and Bavarian Market,<br />

LBS Bayern<br />

9