A4 für Copyshop GB.indd - Bayerische Landesbank

A4 für Copyshop GB.indd - Bayerische Landesbank

A4 für Copyshop GB.indd - Bayerische Landesbank

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

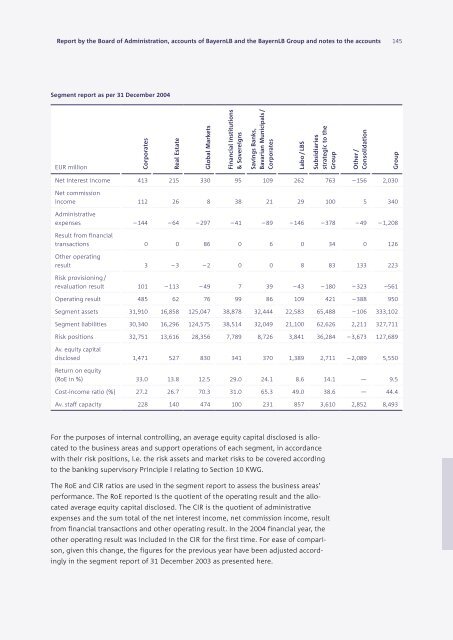

Report by the Board of Administration, accounts of BayernLB and the BayernLB Group and notes to the accounts<br />

Segment report as per 31 December 2004<br />

EUR million Corporates<br />

Real Estate<br />

Global Markets<br />

Financial Institutions<br />

& Sovereigns<br />

Savings Banks,<br />

Bavarian Municipals /<br />

Corporates<br />

Labo / LBS<br />

Subsidiaries<br />

strategic to the<br />

Group<br />

Net interest income 413 215 330 95 109 262 763 – 156 2,030<br />

Net commission<br />

income 112 26 8 38 21 29 100 5 340<br />

Administrative<br />

expenses – 144 – 64 – 297 – 41 – 89 – 146 – 378 – 49 – 1,208<br />

Result from financial<br />

transactions 0 0 86 0 6 0 34 0 126<br />

Other operating<br />

result 3 – 3 – 2 0 0 8 83 133 223<br />

Risk provisioning /<br />

revaluation result 101 – 113 – 49 7 39 – 43 – 180 – 323 –561<br />

Operating result 485 62 76 99 86 109 421 – 388 950<br />

Segment assets 31,910 16,858 125,047 38,878 32,444 22,583 65,488 – 106 333,102<br />

Segment liabilities 30,340 16,296 124,575 38,514 32,049 21,100 62,626 2,211 327,711<br />

Risk positions 32,751 13,616 28,356 7,789 8,726 3,841 36,284 – 3,673 127,689<br />

Av. equity capital<br />

disclosed 1,471 527 830 341 370 1,389 2,711 – 2,089 5,550<br />

Return on equity<br />

(RoE in %) 33.0 13.8 12.5 29.0 24.1 8.6 14.1 — 9.5<br />

Cost-income ratio (%) 27.2 26.7 70.3 31.0 65.3 49.0 38.6 — 44.4<br />

Av. staff capacity 228 140 474 100 231 857 3,610 2,852 8,493<br />

For the purposes of internal controlling, an average equity capital disclosed is allo-<br />

cated to the business areas and support operations of each segment, in accordance<br />

with their risk positions, i.e. the risk assets and market risks to be covered according<br />

to the banking supervisory Principle I relating to Section 10 KWG.<br />

The RoE and CIR ratios are used in the segment report to assess the business areas’<br />

performance. The RoE reported is the quotient of the operating result and the allo-<br />

cated average equity capital disclosed. The CIR is the quotient of administrative<br />

expenses and the sum total of the net interest income, net commission income, result<br />

from financial transactions and other operating result. In the 2004 financial year, the<br />

other operating result was included in the CIR for the first time. For ease of compari-<br />

son, given this change, the figures for the previous year have been adjusted accord-<br />

ingly in the segment report of 31 December 2003 as presented here.<br />

Other /<br />

Consolidation<br />

145<br />

Group