A4 für Copyshop GB.indd - Bayerische Landesbank

A4 für Copyshop GB.indd - Bayerische Landesbank

A4 für Copyshop GB.indd - Bayerische Landesbank

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Key ratios of the business area<br />

Gross income was generated in equal measures domestically and abroad. This illus-<br />

trates the strong international orientation of the business area and the great impor-<br />

tance attached to activities in the foreign markets. Great Britain, America and France<br />

are among the strongest. In these markets, the Corporate Banking and Structured<br />

Finance Divisions generated roughly 50 percent each of total income.<br />

At around EUR 33 billion, risk positions were down by 14 percent in comparison to<br />

2003. Net interest income also fell against 2003 as a consequence of this reduction in<br />

risk assets. Net commission income remained more or less unchanged in comparison<br />

to the previous year’s level.<br />

Qualitative / structural enhancement of earnings, evident from the transactions carried<br />

out in 2004, was a decisive factor in the success of the business area.<br />

Specific examples<br />

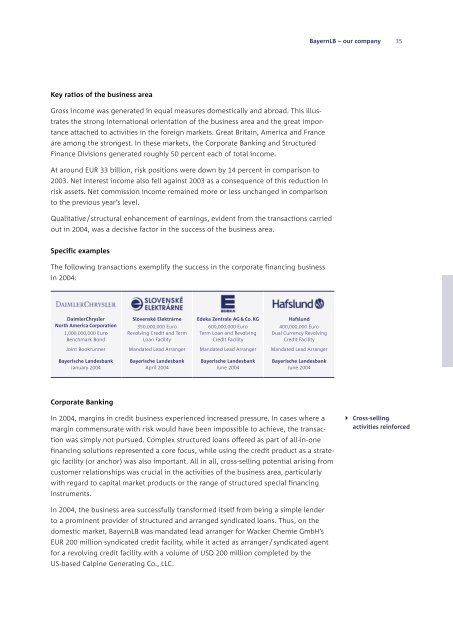

The following transactions exemplify the success in the corporate financing business<br />

in 2004:<br />

DaimlerChrysler<br />

North America Corporation<br />

1,000,000,000 Euro<br />

Benchmark Bond<br />

Joint Bookrunner<br />

<strong>Bayerische</strong> <strong>Landesbank</strong><br />

January 2004<br />

Corporate Banking<br />

Slovenské Elektrárne<br />

350,000,000 Euro<br />

Revolving Credit and Term<br />

Loan Facility<br />

Mandated Lead Arranger<br />

<strong>Bayerische</strong> <strong>Landesbank</strong><br />

April 2004<br />

Edeka Zentrale AG & Co. KG<br />

600,000,000 Euro<br />

Term Loan and Revolving<br />

Credit Facility<br />

Mandated Lead Arranger<br />

<strong>Bayerische</strong> <strong>Landesbank</strong><br />

June 2004<br />

Hafslund<br />

400,000,000 Euro<br />

Dual Currency Revolving<br />

Credit Facility<br />

Mandated Lead Arranger<br />

<strong>Bayerische</strong> <strong>Landesbank</strong><br />

June 2004<br />

In 2004, margins in credit business experienced increased pressure. In cases where a<br />

margin commensurate with risk would have been impossible to achieve, the transac-<br />

tion was simply not pursued. Complex structured loans offered as part of all-in-one<br />

financing solutions represented a core focus, while using the credit product as a strate-<br />

gic facility (or anchor) was also important. All in all, cross-selling potential arising from<br />

customer relationships was crucial in the activities of the business area, particularly<br />

with regard to capital market products or the range of structured special financing<br />

instruments.<br />

In 2004, the business area successfully transformed itself from being a simple lender<br />

to a prominent provider of structured and arranged syndicated loans. Thus, on the<br />

domestic market, BayernLB was mandated lead arranger for Wacker Chemie GmbH’s<br />

EUR 200 million syndicated credit facility, while it acted as arranger / syndicated agent<br />

for a revolving credit facility with a volume of USD 200 million completed by the<br />

US-based Calpine Generating Co., LLC.<br />

BayernLB – our company<br />

35<br />

} Cross-selling<br />

activities reinforced