A4 für Copyshop GB.indd - Bayerische Landesbank

A4 für Copyshop GB.indd - Bayerische Landesbank

A4 für Copyshop GB.indd - Bayerische Landesbank

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

46 BayernLB – our company<br />

New issue business fell far short of estimates in 2004. Instead, the focus was on other<br />

types of capital market transaction. These included complex squeeze-outs (such as the<br />

squeeze-out of EON Bayern AG) and capital increases (such as those carried out by<br />

Lufthansa AG and SGL Carbon AG). Here, the Bank succeeded in positioning itself well.<br />

In order to strengthen our competitive position and to benefit European issuers and<br />

German private customers, a cooperative agreement was reached with five leading<br />

landesbanks. In addition to an additive underwriting commitment, the agreement<br />

facilitates the offer of European share issues to German private customers in line with<br />

European prospectus guidelines.<br />

Following their record performance in 2003, the success of structured retail products<br />

continued in 2004. BayernLB’s status as product developer for the Bavarian savings<br />

banks was further enhanced by 12 jumbo retail issues and various individual issues.<br />

The Bank showed real innovation in expanding the product range, from pure equities<br />

right up to interest rate and hybrid products. This trend is set to continue with the<br />

issue of a family of certificates in 2005. Customer demand for plain vanilla options<br />

showed healthy growth in 2004, with a concomitant increase in traded premium<br />

volumes.<br />

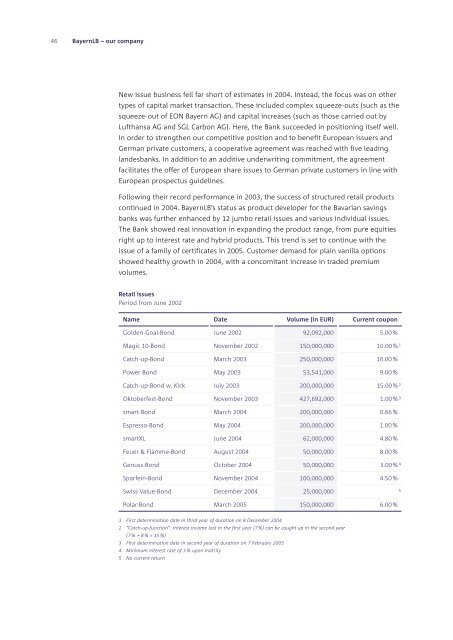

Retail issues<br />

Period from June 2002<br />

Name Date Volume (in EUR) Current coupon<br />

Golden-Goal-Bond June 2002 92,092,000 5.00 %<br />

Magic 10-Bond November 2002 150,000,000 10.00 % 1<br />

Catch-up-Bond March 2003 250,000,000 10.00 %<br />

Power Bond May 2003 53,541,000 9.00 %<br />

Catch-up-Bond w. Kick July 2003 200,000,000 15.00 % 2<br />

Oktoberfest-Bond November 2003 427,692,000 1.00 % 3<br />

smart-Bond March 2004 200,000,000 0.66 %<br />

Espresso-Bond May 2004 200,000,000 1.00 %<br />

smartXL June 2004 62,000,000 4.80 %<br />

Feuer & Flamme-Bond August 2004 50,000,000 8.00 %<br />

Genuss-Bond October 2004 50,000,000 3.00 % 4<br />

Sparfein-Bond November 2004 100,000,000 4.50 %<br />

Swiss Value-Bond December 2004 25,000,000 5<br />

Polar-Bond March 2005 150,000,000 6.00 %<br />

1 First determination date in third year of duration on 8 December 2004<br />

2 “Catch-up-function”: interest income lost in the first year (7 %) can be caught up in the second year<br />

(7 % + 8 % = 15 %)<br />

3 First determination date in second year of duration on 7 February 2005<br />

4 Minimum interest rate of 3 % upon matrity<br />

5 No current return