A4 für Copyshop GB.indd - Bayerische Landesbank

A4 für Copyshop GB.indd - Bayerische Landesbank

A4 für Copyshop GB.indd - Bayerische Landesbank

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

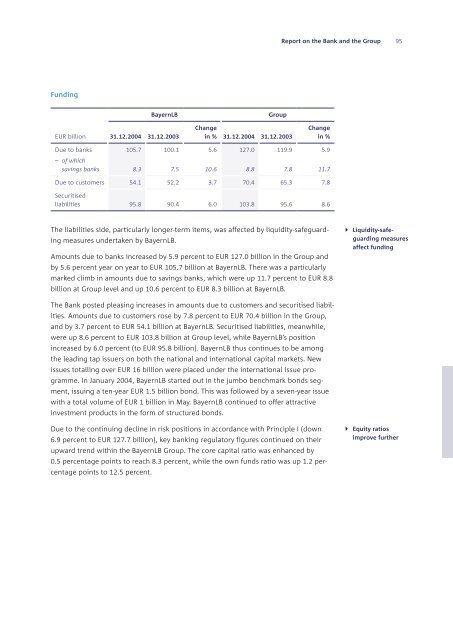

Funding<br />

EUR billion<br />

Due to banks<br />

– of which<br />

savings banks<br />

31.12.2004 31.12.2003<br />

105.7<br />

8.3<br />

BayernLB Group<br />

100.1<br />

7.5<br />

Change<br />

in % 31.12.2004 31.12.2003<br />

5.6<br />

10.6<br />

127.0<br />

8.8<br />

119.9<br />

7.8<br />

Change<br />

in %<br />

Due to customers 54.1 52.2 3.7 70.4 65.3 7.8<br />

Securitised<br />

liabilities 95.8 90.4 6.0 103.8 95.6 8.6<br />

The liabilities side, particularly longer-term items, was affected by liquidity-safeguard-<br />

ing measures undertaken by BayernLB.<br />

Amounts due to banks increased by 5.9 percent to EUR 127.0 billion in the Group and<br />

by 5.6 percent year on year to EUR 105.7 billion at BayernLB. There was a particularly<br />

marked climb in amounts due to savings banks, which were up 11.7 percent to EUR 8.8<br />

billion at Group level and up 10.6 percent to EUR 8.3 billion at BayernLB.<br />

The Bank posted pleasing increases in amounts due to customers and securitised liabil-<br />

ities. Amounts due to customers rose by 7.8 percent to EUR 70.4 billion in the Group,<br />

and by 3.7 percent to EUR 54.1 billion at BayernLB. Securitised liabilities, meanwhile,<br />

were up 8.6 percent to EUR 103.8 billion at Group level, while BayernLB’s position<br />

increased by 6.0 percent (to EUR 95.8 billion). BayernLB thus continues to be among<br />

the leading tap issuers on both the national and international capital markets. New<br />

issues totalling over EUR 16 billion were placed under the international issue pro-<br />

gramme. In January 2004, BayernLB started out in the jumbo benchmark bonds seg-<br />

ment, issuing a ten-year EUR 1.5 billion bond. This was followed by a seven-year issue<br />

with a total volume of EUR 1 billion in May. BayernLB continued to offer attractive<br />

investment products in the form of structured bonds.<br />

Due to the continuing decline in risk positions in accordance with Principle I (down<br />

6.9 percent to EUR 127.7 billion), key banking regulatory figures continued on their<br />

upward trend within the BayernLB Group. The core capital ratio was enhanced by<br />

0.5 percentage points to reach 8.3 percent, while the own funds ratio was up 1.2 per-<br />

centage points to 12.5 percent.<br />

Report on the Bank and the Group<br />

5.9<br />

11.7<br />

95<br />

} Liquidity-safeguarding<br />

measures<br />

affect funding<br />

} Equity ratios<br />

improve further