A4 für Copyshop GB.indd - Bayerische Landesbank

A4 für Copyshop GB.indd - Bayerische Landesbank

A4 für Copyshop GB.indd - Bayerische Landesbank

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

94 Report on the Bank and the Group<br />

} Strong increase<br />

in amounts due<br />

from banks;<br />

customer<br />

receivables<br />

unchanged<br />

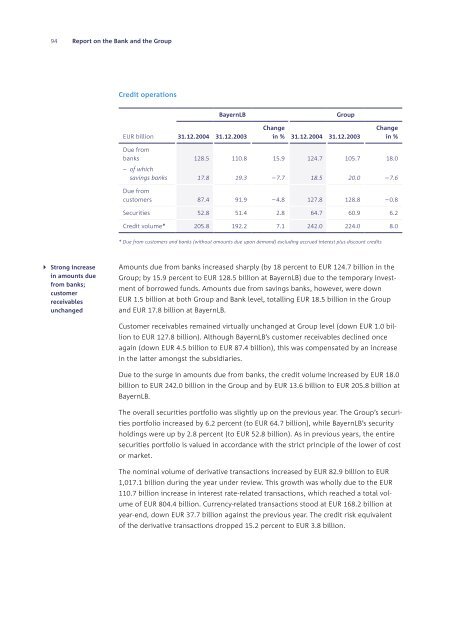

Credit operations<br />

EUR billion<br />

Due from<br />

banks<br />

– of which<br />

savings banks<br />

31.12.2004 31.12.2003<br />

128.5<br />

17.8<br />

BayernLB Group<br />

110.8<br />

19.3<br />

Change<br />

in % 31.12.2004 31.12.2003<br />

15.9<br />

– 7.7<br />

124.7<br />

18.5<br />

105.7<br />

20.0<br />

Change<br />

in %<br />

Due from<br />

customers 87.4 91.9 – 4.8 127.8 128.8 – 0.8<br />

Securities 52.8 51.4 2.8 64.7 60.9 6.2<br />

Credit volume* 205.8 192.2 7.1 242.0 224.0 8.0<br />

* Due from customers and banks (without amounts due upon demand) excluding accrued interest plus discount credits<br />

Amounts due from banks increased sharply (by 18 percent to EUR 124.7 billion in the<br />

Group; by 15.9 percent to EUR 128.5 billion at BayernLB) due to the temporary invest-<br />

ment of borrowed funds. Amounts due from savings banks, however, were down<br />

EUR 1.5 billion at both Group and Bank level, totalling EUR 18.5 billion in the Group<br />

and EUR 17.8 billion at BayernLB.<br />

Customer receivables remained virtually unchanged at Group level (down EUR 1.0 bil-<br />

lion to EUR 127.8 billion). Although BayernLB’s customer receivables declined once<br />

again (down EUR 4.5 billion to EUR 87.4 billion), this was compensated by an increase<br />

in the latter amongst the subsidiaries.<br />

Due to the surge in amounts due from banks, the credit volume increased by EUR 18.0<br />

billion to EUR 242.0 billion in the Group and by EUR 13.6 billion to EUR 205.8 billion at<br />

BayernLB.<br />

The overall securities portfolio was slightly up on the previous year. The Group’s securi-<br />

ties portfolio increased by 6.2 percent (to EUR 64.7 billion), while BayernLB’s security<br />

holdings were up by 2.8 percent (to EUR 52.8 billion). As in previous years, the entire<br />

securities portfolio is valued in accordance with the strict principle of the lower of cost<br />

or market.<br />

The nominal volume of derivative transactions increased by EUR 82.9 billion to EUR<br />

1,017.1 billion during the year under review. This growth was wholly due to the EUR<br />

110.7 billion increase in interest rate-related transactions, which reached a total vol-<br />

ume of EUR 804.4 billion. Currency-related transactions stood at EUR 168.2 billion at<br />

year-end, down EUR 37.7 billion against the previous year. The credit risk equivalent<br />

of the derivative transactions dropped 15.2 percent to EUR 3.8 billion.<br />

18.0<br />

– 7.6