- Page 1 and 2:

2013-2014U N D E R G R A D U A T E

- Page 3 and 4:

Letter from the PresidentDear Stude

- Page 5 and 6:

Park UniversityMaps - Parkville Cam

- Page 7 and 8:

Park UniversityMission, Vision, His

- Page 9 and 10:

PARKVILLE and KANSAS CITYPark Unive

- Page 11 and 12:

• Association of Veterans Educati

- Page 13 and 14:

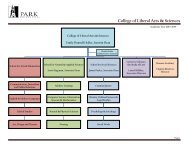

Park UniversityColleges and Schools

- Page 15 and 16:

College of Liberal Arts and Science

- Page 17 and 18:

College of Liberal Arts and Science

- Page 19 and 20:

College of Liberal Arts and Science

- Page 21 and 22:

School of BusinessBrad A. Kleindl,

- Page 23 and 24:

School for EducationMichelle Myers,

- Page 25 and 26:

List of FacultySchool for Education

- Page 27 and 28:

School for EducationAll students, i

- Page 29 and 30:

School for Education• Application

- Page 31 and 32:

Hauptmann School of Public AffairsL

- Page 33 and 34: Park UniversityPark Distance Learni

- Page 35 and 36: Bachelor of Science (B.S.)(selected

- Page 37 and 38: AR AZ CA GA ID IL MA MO MT NM NC ND

- Page 39 and 40: Park Accelerated ProgramsKC AreaS.L

- Page 41 and 42: Classes and Examination PeriodsPark

- Page 43 and 44: Park UniversityAcademic Calendar -

- Page 45 and 46: Park UniversityContact InformationC

- Page 47 and 48: General InformationInformation Tech

- Page 49 and 50: General InformationInformation Tech

- Page 51 and 52: International StudentsLegal Require

- Page 53 and 54: Please keep in touch with us to let

- Page 55 and 56: limited to the following:• Studen

- Page 57 and 58: ehavior by a person of either sex a

- Page 59 and 60: 3. Loss of Privileges - Denial of s

- Page 61 and 62: campus must have an ID parking pass

- Page 63 and 64: or whether the complainant does not

- Page 65 and 66: Park UniversityAdmissions Policies

- Page 67 and 68: Admission Policies and ProceduresPa

- Page 69 and 70: Admission Policies and ProceduresPa

- Page 71 and 72: Admission Policies and ProceduresPa

- Page 73 and 74: Park UniversityPrior Learning Asses

- Page 75 and 76: Park UniversityPrior Learning Asses

- Page 77 and 78: Park UniversityTuition, Fees, Grant

- Page 79 and 80: STUDENT INSURANCEThe Health and Acc

- Page 81 and 82: The policies of the California Stud

- Page 83: the form of an electronic award not

- Page 87 and 88: Park UniversityCampus Life and Stud

- Page 89 and 90: ENROLLMENT SERVICESEnrollment Servi

- Page 91 and 92: Boot Camp, and more. The gym area i

- Page 93 and 94: Assistant Dean of Student Life serv

- Page 95 and 96: ACADEMIC ADVISINGAcademic advising

- Page 97 and 98: IF THE STUDENT DOES NOT DISPUTETHE

- Page 99 and 100: Parkville campus students will be n

- Page 101 and 102: accelerated eight-week format, five

- Page 103 and 104: the requirements. Each three hour c

- Page 105 and 106: These courses will be identified as

- Page 107 and 108: Park UniversityAcademic Degree Prog

- Page 109 and 110: Academic Degree ProgramsBachelor of

- Page 111 and 112: Park UniversityAcademic Degrees Off

- Page 113 and 114: Park UniversityAcademic Degrees Off

- Page 115 and 116: SPECIAL ACADEMIC PROGRAMSUndergradu

- Page 117 and 118: Completion of the Program• Once a

- Page 119 and 120: English Placement ExamAll Internati

- Page 121 and 122: votes on candidates meeting these c

- Page 123 and 124: Park UniversityDegree Requirements1

- Page 125 and 126: School for Natural and Applied Scie

- Page 127 and 128: School for Natural and Applied Scie

- Page 129 and 130: School of BusinessAvailable:B.S.Min

- Page 131 and 132: School of BusinessBusiness Administ

- Page 133 and 134: School of Natural and Applied Scien

- Page 135 and 136:

School for Arts and HumanitiesCommu

- Page 137 and 138:

School for Natural and Applied Scie

- Page 139 and 140:

School for Social SciencesCriminal

- Page 141 and 142:

School for Social SciencesCriminal

- Page 143 and 144:

School for EducationEarly Childhood

- Page 145 and 146:

School for EducationElementary Educ

- Page 147 and 148:

School for EducationElementary Educ

- Page 149 and 150:

School for EducationMiddle School E

- Page 151 and 152:

School for EducationSecondary Educa

- Page 153 and 154:

School for EducationSecondary Educa

- Page 155 and 156:

School for EducationSecondary Educa

- Page 157 and 158:

School for EducationEducation Studi

- Page 159 and 160:

School for EducationEducation Studi

- Page 161 and 162:

School for EducationEducation Studi

- Page 163 and 164:

School for EducationEducation Studi

- Page 165 and 166:

School for Arts and HumanitiesEngli

- Page 167 and 168:

School for Arts and HumanitiesEngli

- Page 169 and 170:

School for Arts and HumanitiesFine

- Page 171 and 172:

School for Natural and Applied Scie

- Page 173 and 174:

School for Natural and Applied Scie

- Page 175 and 176:

College of Liberal Arts and Science

- Page 177 and 178:

School for Arts and HumanitiesGraph

- Page 179 and 180:

School for Social SciencesAvailable

- Page 181 and 182:

School for Social SciencesHistoryme

- Page 183 and 184:

School for Natural and Applied Scie

- Page 185 and 186:

School for Natural and Applied Scie

- Page 187 and 188:

School for Arts and HumanitiesInter

- Page 189 and 190:

School for Arts and HumanitiesLeade

- Page 191 and 192:

School for Arts and HumanitiesLiber

- Page 193 and 194:

School for Arts and HumanitiesLiber

- Page 195 and 196:

School of BusinessManagementAvailab

- Page 197 and 198:

School of BusinessManagement/Accoun

- Page 199 and 200:

School of BusinessManagement/Engine

- Page 201 and 202:

School of BusinessAvailable:B.S.Req

- Page 203 and 204:

School of BusinessManagement/Logist

- Page 205 and 206:

School of BusinessAvailable:B.S.Req

- Page 207 and 208:

School for Natural and Applied Scie

- Page 209 and 210:

School for Arts and HumanitiesMusic

- Page 211 and 212:

School for Natural and Applied Scie

- Page 213 and 214:

School for Natural and Applied Scie

- Page 215 and 216:

School for Natural and Applied Scie

- Page 217 and 218:

School for Arts and HumanitiesPhilo

- Page 219 and 220:

School for Social SciencesAvailable

- Page 221 and 222:

Hauptmann School of Public AffairsP

- Page 223 and 224:

School for Social SciencesSocial Ps

- Page 225 and 226:

School for Social SciencesSocial Ps

- Page 227 and 228:

School for Social SciencesSocial Wo

- Page 229 and 230:

School for Arts and HumanitiesSpani

- Page 231 and 232:

School for Arts and HumanitiesTheat

- Page 233 and 234:

Park UniversityCourse Descriptions2

- Page 235 and 236:

Park University’sCourse Descripti

- Page 237 and 238:

(ss) Social and Administrative Scie

- Page 239 and 240:

(H) Humanities and Performing ArtsA

- Page 241 and 242:

(H) Humanities and Performing ArtsA

- Page 243 and 244:

(H) Humanities and Performing ArtsA

- Page 245 and 246:

(NS) Natural and Life SciencesAT -

- Page 247 and 248:

(SS) Social and Administrative Scie

- Page 249 and 250:

(NS) Natural and Life SciencesBI -

- Page 251 and 252:

(H) Humanities and Performing ArtsC

- Page 253 and 254:

(H) Humanities and Performing ArtsC

- Page 255 and 256:

(H) Humanities and Performing ArtsC

- Page 257 and 258:

(NS) Natural and Applied SciencesCH

- Page 259 and 260:

(SS) Social and Administrative Scie

- Page 261 and 262:

(SS) Social and Administrative Scie

- Page 263 and 264:

(SS) Social and Administrative Scie

- Page 265 and 266:

(NS) Natural and Applied SciencesCS

- Page 267 and 268:

(NS) Natural and Applied SciencesCS

- Page 269 and 270:

(SS) Social and Administrative Scie

- Page 271 and 272:

(SS) Social and Administrative Scie

- Page 273 and 274:

(SS) Social and Administrative Scie

- Page 275 and 276:

(SS) Social and Administrative Scie

- Page 277 and 278:

(SS) Social and Administrative Scie

- Page 279 and 280:

(SS) Social and Administrative Scie

- Page 281 and 282:

(SS) Social and Administrative Scie

- Page 283 and 284:

(H) Humanities and Performing ArtsE

- Page 285 and 286:

(H) Humanities and Performing ArtsE

- Page 287 and 288:

(H) Humanities and Performing ArtsE

- Page 289 and 290:

(NS) Natural and Applied SciencesFW

- Page 291 and 292:

(SS) Social and Administrative Scie

- Page 293 and 294:

(NS) Natural and Applied SciencesGO

- Page 295 and 296:

(SS) Social and Administrative Scie

- Page 297 and 298:

(SS) Social and Administrative Scie

- Page 299 and 300:

(SS) Social and Administrative Scie

- Page 301 and 302:

(PDCC) Parkville Daytime Campus Cen

- Page 303 and 304:

(SS) Social and Administrative Scie

- Page 305 and 306:

(H) Humanities and Performing ArtsL

- Page 307 and 308:

(H) Humanities and Performing ArtsL

- Page 309 and 310:

(NS) Natural and Applied SciencesMA

- Page 311 and 312:

(SS) Social and Administrative Scie

- Page 313 and 314:

(SS) Social and Administrative Scie

- Page 315 and 316:

(SS) Social and Administrative Scie

- Page 317 and 318:

(SS) Social and Administrative Scie

- Page 319 and 320:

(H) Humanities and Performing ArtsM

- Page 321 and 322:

(H) Humanities and Performing ArtsM

- Page 323 and 324:

(H) Humanities and Performing ArtsM

- Page 325 and 326:

(NS) Natural and Applied SciencesNU

- Page 327 and 328:

(NS) Natural and Applied SciencesNU

- Page 329 and 330:

(H) Humanities and Performing ArtsP

- Page 331 and 332:

(H) Humanities and Performing ArtsP

- Page 333 and 334:

Park UniversityPK - Park Basic Skil

- Page 335 and 336:

(SS) Social and Administrative Scie

- Page 337 and 338:

(SS) Social and Administrative Scie

- Page 339 and 340:

(SS) Social and Administrative Scie

- Page 341 and 342:

(H) Humanities and Performing ArtsR

- Page 343 and 344:

(SS) Social and Administrative Scie

- Page 345 and 346:

(SS) Social and Administrative Scie

- Page 347 and 348:

(SS) Social and Administrative Scie

- Page 349 and 350:

(H) Humanities and Performing ArtsT

- Page 351 and 352:

Park UniversitySchool of Graduate a

- Page 353 and 354:

Park UniversityTrustees, Faculty an

- Page 355 and 356:

Park UniversitySenior OfficersMicha

- Page 357 and 358:

Park UniversityFull-Time FacultyRic

- Page 359 and 360:

Park UniversityFull-Time FacultyEmi

- Page 361 and 362:

Park UniversityFull-Time FacultyKim

- Page 363 and 364:

Park UniversityFull-Time FacultyAda

- Page 365 and 366:

Park UniversityFull-Time FacultyGui

- Page 367 and 368:

Park UniversityAppendix and Index36

- Page 369 and 370:

Park UniversityIndexAAcademic Calen

- Page 371 and 372:

Park UniversityIndexEDU ---Educatio

- Page 373 and 374:

Park UniversityIndexFinal Exams, Mi

- Page 375 and 376:

Park UniversityIndexMilitary Traini

- Page 377 and 378:

Park UniversityIndexStudent Governm

- Page 379 and 380:

Park UniversityNotes378

- Page 381:

PARK’S PROMISE:SERVING THOSE WHO