Volume 1 Cedric - revised luca Final - RUIG-GIAN

Volume 1 Cedric - revised luca Final - RUIG-GIAN

Volume 1 Cedric - revised luca Final - RUIG-GIAN

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

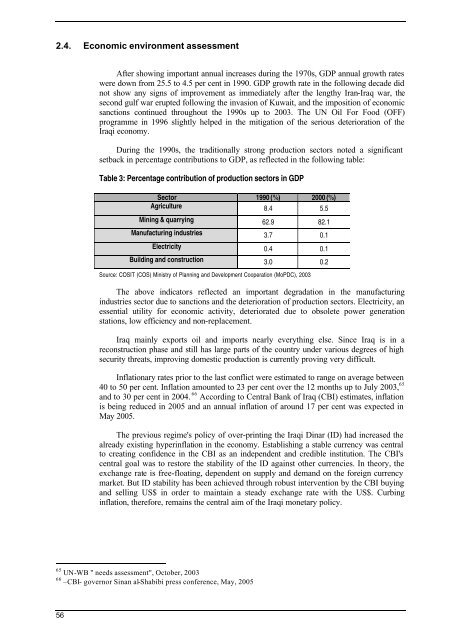

2.4. Economic environment assessmentAfter showing important annual increases during the 1970s, GDP annual growth rateswere down from 25.5 to 4.5 per cent in 1990. GDP growth rate in the following decade didnot show any signs of improvement as immediately after the lengthy Iran-Iraq war, thesecond gulf war erupted following the invasion of Kuwait, and the imposition of economicsanctions continued throughout the 1990s up to 2003. The UN Oil For Food (OFF)programme in 1996 slightly helped in the mitigation of the serious deterioration of theIraqi economy.During the 1990s, the traditionally strong production sectors noted a significantsetback in percentage contributions to GDP, as reflected in the following table:Table 3: Percentage contribution of production sectors in GDPSector 1990 (%) 2000 (%)Agriculture 8.4 5.5Mining & quarrying 62.9 82.1Manufacturing industries 3.7 0.1Electricity 0.4 0.1Building and construction 3.0 0.2Source: COSIT (COS) Ministry of Planning and Development Cooperation (MoPDC), 2003The above indicators reflected an important degradation in the manufacturingindustries sector due to sanctions and the deterioration of production sectors. Electricity, anessential utility for economic activity, deteriorated due to obsolete power generationstations, low efficiency and non-replacement.Iraq mainly exports oil and imports nearly everything else. Since Iraq is in areconstruction phase and still has large parts of the country under various degrees of highsecurity threats, improving domestic production is currently proving very difficult.Inflationary rates prior to the last conflict were estimated to range on average between40 to 50 per cent. Inflation amounted to 23 per cent over the 12 months up to July 2003, 65and to 30 per cent in 2004. 66 According to Central Bank of Iraq (CBI) estimates, inflationis being reduced in 2005 and an annual inflation of around 17 per cent was expected inMay 2005.The previous regime's policy of over-printing the Iraqi Dinar (ID) had increased thealready existing hyperinflation in the economy. Establishing a stable currency was centralto creating confidence in the CBI as an independent and credible institution. The CBI'scentral goal was to restore the stability of the ID against other currencies. In theory, theexchange rate is free-floating, dependent on supply and demand on the foreign currencymarket. But ID stability has been achieved through robust intervention by the CBI buyingand selling US$ in order to maintain a steady exchange rate with the US$. Curbinginflation, therefore, remains the central aim of the Iraqi monetary policy.65 UN-WB " needs assessment", October, 200366 –CBI- governor Sinan al-Shabibi press conference, May, 200556