Volume 1 Cedric - revised luca Final - RUIG-GIAN

Volume 1 Cedric - revised luca Final - RUIG-GIAN

Volume 1 Cedric - revised luca Final - RUIG-GIAN

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

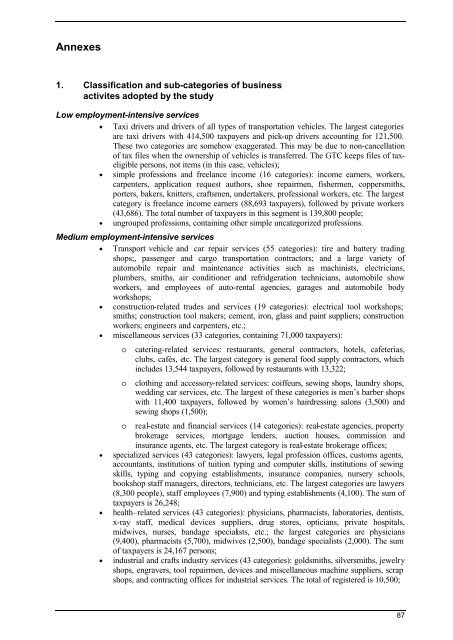

Annexes1. Classification and sub-categories of businessactivites adopted by the studyLow employment-intensive services• Taxi drivers and drivers of all types of transportation vehicles. The largest categoriesare taxi drivers with 414,500 taxpayers and pick-up drivers accounting for 121,500.These two categories are somehow exaggerated. This may be due to non-cancellationof tax files when the ownership of vehicles is transferred. The GTC keeps files of taxeligiblepersons, not items (in this case, vehicles);• simple professions and freelance income (16 categories): income earners, workers,carpenters, application request authors, shoe repairmen, fishermen, coppersmiths,porters, bakers, knitters, craftsmen, undertakers, professional workers, etc. The largestcategory is freelance income earners (88,693 taxpayers), followed by private workers(43,686). The total number of taxpayers in this segment is 139,800 people;• ungrouped professions, containing other simple uncategorized professions.Medium employment-intensive services• Transport vehicle and car repair services (55 categories): tire and battery tradingshops;, passenger and cargo transportation contractors; and a large variety ofautomobile repair and maintenance activities such as machinists, electricians,plumbers, smiths, air conditioner and refridgeration technicians, automobile showworkers, and employees of auto-rental agencies, garages and automobile bodyworkshops;• construction-related trades and services (19 categories): electrical tool workshops;smiths; construction tool makers; cement, iron, glass and paint suppliers; constructionworkers; engineers and carpenters, etc.;• miscellaneous services (33 categories, containing 71,000 taxpayers):o catering-related services: restaurants, general contractors, hotels, cafeterias,clubs, cafés, etc. The largest category is general food supply contractors, whichincludes 13,544 taxpayers, followed by restaurants with 13,322;o clothing and accessory-related services: coiffeurs, sewing shops, laundry shops,wedding car services, etc. The largest of these categories is men’s barber shopswith 11,400 taxpayers, followed by women’s hairdressing salons (3,500) andsewing shops (1,500);o real-estate and financial services (14 categories): real-estate agencies, propertybrokerage services, mortgage lenders, auction houses, commission andinsurance agents, etc. The largest category is real-estate brokerage offices;• specialized services (43 categories): lawyers, legal profession offices, customs agents,accountants, institutions of tuition typing and computer skills, institutions of sewingskills, typing and copying establishments, insurance companies, nursery schools,bookshop staff managers, directors, technicians, etc. The largest categories are lawyers(8,300 people), staff employees (7,900) and typing establishments (4,100). The sum oftaxpayers is 26,248;• health–related services (43 categories): physicians, pharmacists, laboratories, dentists,x-ray staff, medical devices suppliers, drug stores, opticians, private hospitals,midwives, nurses, bandage specialists, etc.; the largest categories are physicians(9,400), pharmacists (5,700), midwives (2,500), bandage specialists (2,000). The sumof taxpayers is 24,167 persons;• industrial and crafts industry services (43 categories): goldsmiths, silversmiths, jewelryshops, engravers, tool repairmen, devices and miscellaneous machine suppliers, scrapshops, and contracting offices for industrial services. The total of registered is 10,500;87