e-GOVERNMENT IN FINLAND - ePractice.eu

e-GOVERNMENT IN FINLAND - ePractice.eu

e-GOVERNMENT IN FINLAND - ePractice.eu

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

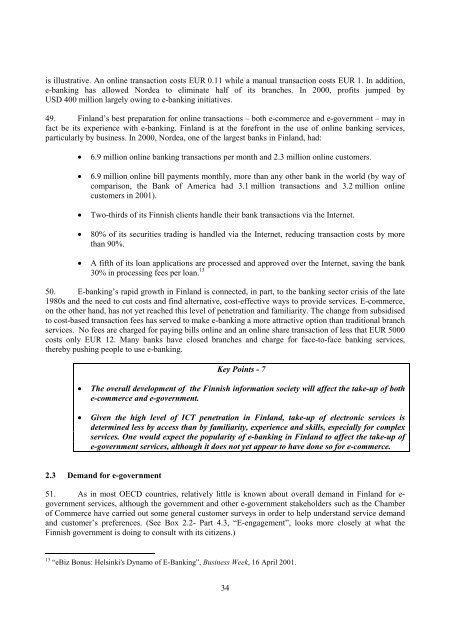

is illustrative. An online transaction costs EUR 0.11 while a manual transaction costs EUR 1. In addition,<br />

e-banking has allowed Nordea to eliminate half of its branches. In 2000, profits jumped by<br />

USD 400 million largely owing to e-banking initiatives.<br />

49. Finland’s best preparation for online transactions – both e-commerce and e-government – may in<br />

fact be its experience with e-banking. Finland is at the forefront in the use of online banking services,<br />

particularly by business. In 2000, Nordea, one of the largest banks in Finland, had:<br />

x 6.9 million online banking transactions per month and 2.3 million online customers.<br />

x 6.9 million online bill payments monthly, more than any other bank in the world (by way of<br />

comparison, the Bank of America had 3.1 million transactions and 3.2 million online<br />

customers in 2001).<br />

x Two-thirds of its Finnish clients handle their bank transactions via the Internet.<br />

x 80% of its securities trading is handled via the Internet, reducing transaction costs by more<br />

than 90%.<br />

x A fifth of its loan applications are processed and approved over the Internet, saving the bank<br />

30% in processing fees per loan. 13<br />

50. E-banking’s rapid growth in Finland is connected, in part, to the banking sector crisis of the late<br />

1980s and the need to cut costs and find alternative, cost-effective ways to provide services. E-commerce,<br />

on the other hand, has not yet reached this level of penetration and familiarity. The change from subsidised<br />

to cost-based transaction fees has served to make e-banking a more attractive option than traditional branch<br />

services. No fees are charged for paying bills online and an online share transaction of less that EUR 5000<br />

costs only EUR 12. Many banks have closed branches and charge for face-to-face banking services,<br />

thereby pushing people to use e-banking.<br />

Key Points - 7<br />

x The overall development of the Finnish information society will affect the take-up of both<br />

e-commerce and e-government.<br />

x Given the high level of ICT penetration in Finland, take-up of electronic services is<br />

determined less by access than by familiarity, experience and skills, especially for complex<br />

services. One would expect the popularity of e-banking in Finland to affect the take-up of<br />

e-government services, although it does not yet appear to have done so for e-commerce.<br />

2.3 Demand for e-government<br />

51. As in most OECD countries, relatively little is known about overall demand in Finland for egovernment<br />

services, although the government and other e-government stakeholders such as the Chamber<br />

of Commerce have carried out some general customer surveys in order to help understand service demand<br />

and customer’s preferences. (See Box 2.2- Part 4.3, “E-engagement”, looks more closely at what the<br />

Finnish government is doing to consult with its citizens.)<br />

13 “eBiz Bonus: Helsinki's Dynamo of E-Banking”, Business Week, 16 April 2001.<br />

34