Income Security: A Roadmap for Change

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

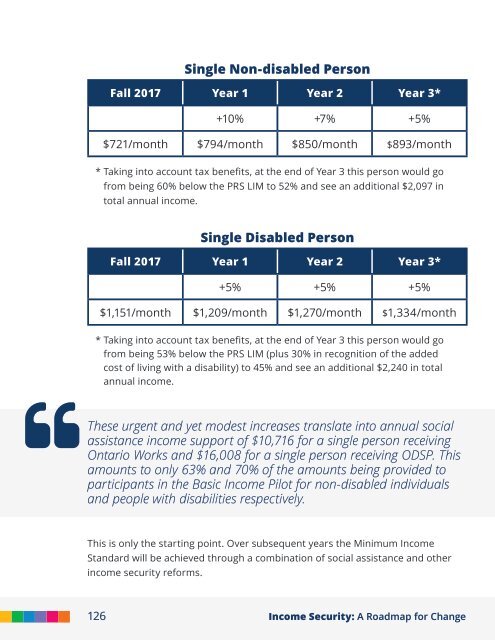

Single Non-disabled Person<br />

Fall 2017 Year 1 Year 2 Year 3*<br />

+10% +7% +5%<br />

$721/month $794/month $850/month $893/month<br />

* Taking into account tax benefits, at the end of Year 3 this person would go<br />

from being 60% below the PRS LIM to 52% and see an additional $2,097 in<br />

total annual income<br />

Single Disabled Person<br />

Fall 2017 Year 1 Year 2 Year 3*<br />

+5% +5% +5%<br />

$1,151/month $1,209/month $1,270/month $1,334/month<br />

* Taking into account tax benefits, at the end of Year 3 this person would go<br />

from being 53% below the PRS LIM (plus 30% in recognition of the added<br />

cost of living with a disability) to 45% and see an additional $2,240 in total<br />

annual income<br />

<br />

These urgent and yet modest increases translate into annual social<br />

assistance income support of $10,716 <strong>for</strong> a single person receiving<br />

Ontario Works and $16,008 <strong>for</strong> a single person receiving ODSP. This<br />

amounts to only 63% and 70% of the amounts being provided to<br />

participants in the Basic <strong>Income</strong> Pilot <strong>for</strong> non-disabled individuals<br />

and people with disabilities respectively.<br />

This is only the starting point Over subsequent years the Minimum <strong>Income</strong><br />

Standard will be achieved through a combination of social assistance and other<br />

income security re<strong>for</strong>ms<br />

126 <strong>Income</strong> <strong>Security</strong>: A <strong>Roadmap</strong> <strong>for</strong> <strong>Change</strong>