VINCI - 2008 annual report

VINCI - 2008 annual report

VINCI - 2008 annual report

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Report of the Board of Directors<br />

Eurovia’s operating profi t from ordinary activities was down by 11.8% at €346 million (a 4.2% margin), compared with €392 million in 2007<br />

(a 5.1% margin), due to more diffi cult market conditions in France and a reduction of major site activities.<br />

<strong>VINCI</strong> Construction’s operating profi t from ordinary activities was €773 million (a 4.9% margin), up 15.6% compared with 2007 (€668 million,<br />

a 4.9% margin).<br />

In addition to the positive eff ects of the acquisitions made in 2007, most of the division’s entities <strong>report</strong>ed improved performances, in particular<br />

outside France.<br />

Following an exceptional 2007, <strong>VINCI</strong> Construction France again made the greatest contribution to this division, with operating profi t from<br />

ordinary activities of €290 million (a 4.3% margin), up 3.6% compared with 2007 (€280 million, a 4.5% margin).<br />

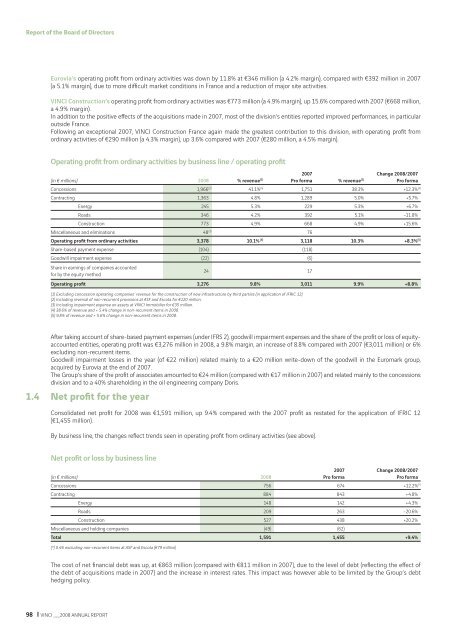

Operating profi t from ordinary activities by business line / operating profi t<br />

(in € millions) <strong>2008</strong> % revenue (1)<br />

2007<br />

Pro forma % revenue (1)<br />

Change <strong>2008</strong>/2007<br />

Pro forma<br />

Concessions 1,966 (2) 41.1% (4) 1,751 38.3% +12.3% (4)<br />

Contracting 1,363 4.8% 1,289 5.0% +5.7%<br />

Energy 245 5.3% 229 5.3% +6.7%<br />

Roads 346 4.2% 392 5.1% –11.8%<br />

Construction 773 4.9% 668 4.9% +15.6%<br />

Miscellaneous and eliminations 48 (3) 76<br />

Operating profi t from ordinary activities 3,378 10.1% (5) 3,118 10.3% +8.3% (5)<br />

Share-based payment expense (104) (118)<br />

Goodwill impairment expense (22) (6)<br />

Share in earnings of companies accounted<br />

for by the equity method<br />

24 17<br />

Operating profi t 3,276 9.8% 3,011 9.9% +8.8%<br />

(1) Excluding concession operating companies’ revenue for the construction of new infrastructure by third parties (in application of IFRIC 12).<br />

(2) Including reversal of non-recurrent provisions at ASF and Escota for €120 million.<br />

(3) Including impairment expense on assets at <strong>VINCI</strong> Immobilier for €35 million.<br />

(4) 38.6% of revenue and + 5.4% change in non-recurrent items in <strong>2008</strong>.<br />

(5) 9.8% of revenue and + 5.6% change in non-recurrent items in <strong>2008</strong>.<br />

After taking account of share-based payment expenses (under IFRS 2), goodwill impairment expenses and the share of the profi t or loss of equityaccounted<br />

entities, operating profi t was €3,276 million in <strong>2008</strong>, a 9.8% margin, an increase of 8.8% compared with 2007 (€3,011 million) or 6%<br />

excluding non-recurrent items.<br />

Goodwill impairment losses in the year (of €22 million) related mainly to a €20 million write-down of the goodwill in the Euromark group,<br />

acquired by Eurovia at the end of 2007.<br />

The Group’s share of the profi t of associates amounted to €24 million (compared with €17 million in 2007) and related mainly to the concessions<br />

division and to a 40% shareholding in the oil engineering company Doris.<br />

1.4 Net profi t for the year<br />

Consolidated net profi t for <strong>2008</strong> was €1,591 million, up 9.4% compared with the 2007 profi t as restated for the application of IFRIC 12<br />

(€1,455 million).<br />

By business line, the changes refl ect trends seen in operating profi t from ordinary activities (see above).<br />

Net profi t or loss by business line<br />

2007<br />

Change <strong>2008</strong>/2007<br />

(in € millions) <strong>2008</strong><br />

Pro forma<br />

Pro forma<br />

Concessions 756 674 +12.2% (*)<br />

Contracting 884 843 +4.8%<br />

Energy 148 142 +4.3%<br />

Roads 209 263 –20.6%<br />

Construction 527 438 +20.2%<br />

Miscellaneous and holding companies (49) (62)<br />

Total<br />

(*) 0.4% excluding non-recurrent items at ASF and Escota (€79 million)<br />

1,591 1,455 +9.4%<br />

The cost of net fi nancial debt was up, at €863 million (compared with €811 million in 2007), due to the level of debt (refl ecting the eff ect of<br />

the debt of acquisitions made in 2007) and the increase in interest rates. This impact was however able to be limited by the Group’s debt<br />

hedging policy.<br />

98 <strong>VINCI</strong> __ <strong>2008</strong> ANNUAL REPORT