VINCI - 2008 annual report

VINCI - 2008 annual report

VINCI - 2008 annual report

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

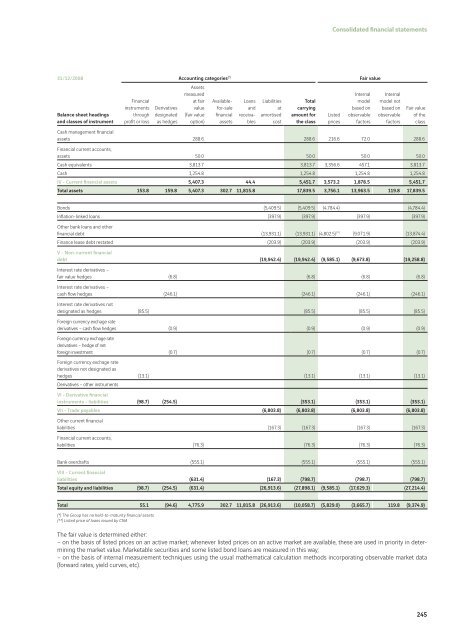

Consolidated fi nancial statements<br />

31/12/<strong>2008</strong> Accounting categories (*) Fair value<br />

Balance sheet headings<br />

and classes of instrument<br />

Financial<br />

instruments<br />

through<br />

profi t or loss<br />

Derivatives<br />

designated<br />

as hedges<br />

Assets<br />

measured<br />

at fair<br />

value<br />

(fair value<br />

option)<br />

Availablefor-sale<br />

fi nancial<br />

assets<br />

Loans<br />

and<br />

receivables<br />

Liabilities<br />

at<br />

amortised<br />

cost<br />

Total<br />

carrying<br />

amount for<br />

the class<br />

Listed<br />

prices<br />

Internal<br />

model<br />

based on<br />

observable<br />

factors<br />

Internal<br />

model not<br />

based on<br />

observable<br />

factors<br />

Fair value<br />

of the<br />

class<br />

Cash management fi nancial<br />

assets 288.6 288.6 216.6 72.0 288.6<br />

Financial current accounts,<br />

assets 50.0 50.0 50.0 50.0<br />

Cash equivalents 3,813.7 3,813.7 3,356.6 457.1 3,813.7<br />

Cash 1,254.8 1,254.8 1,254.8 1,254.8<br />

IV - Current fi nancial assets 5,407.3 44.4 5,451.7 3,573.2 1,878.5 5,451.7<br />

Total assets 153.8 159.8 5,407.3 302.7 11,815.8 17,839.5 3,756.1 13,963.5 119.8 17,839.5<br />

Bonds (5,409.5) (5,409.5) (4,784.4) (4,784.4)<br />

Infl ation-linked loans (397.9) (397.9) (397.9) (397.9)<br />

Other bank loans and other<br />

fi nancial debt (13,931.1) (13,931.1) (4,802.5) (**) (9,071.9) (13,874.4)<br />

Finance lease debt restated (203.9) (203.9) (203.9) (203.9)<br />

V - Non-current fi nancial<br />

debt (19,942.4) (19,942.4) (9,585.1) (9,673.8) (19,258.8)<br />

Interest rate derivatives –<br />

fair value hedges (6.8) (6.8) (6.8) (6.8)<br />

Interest rate derivatives –<br />

cash fl ow hedges (246.1) (246.1) (246.1) (246.1)<br />

Interest rate derivatives not<br />

designated as hedges (85.5) (85.5) (85.5) (85.5)<br />

Foreign currency exchage rate<br />

derivatives – cash fl ow hedges (0.9) (0.9) (0.9) (0.9)<br />

Foreign currency exchage rate<br />

derivatives – hedge of net<br />

foreign investment (0.7) (0.7) (0.7) (0.7)<br />

Foreign currency exchage rate<br />

derivatives not designated as<br />

hedges<br />

Derivatives – other instruments<br />

(13.1) (13.1) (13.1) (13.1)<br />

VI - Derivative fi nancial<br />

instruments - liabilities (98.7) (254.5) (353.1) (353.1) (353.1)<br />

VII - Trade payables (6,803.8) (6,803.8) (6,803.8) (6,803.8)<br />

Other current fi nancial<br />

liabilities (167.3) (167.3) (167.3) (167.3)<br />

Financial current accounts,<br />

liabilities (76.3) (76.3) (76.3) (76.3)<br />

Bank overdrafts (555.1) (555.1) (555.1) (555.1)<br />

VIII - Current fi nancial<br />

liabilities (631.4) (167.3) (798.7) (798.7) (798.7)<br />

Total equity and liabilities (98.7) (254.5) (631.4) (26,913.6) (27,898.1) (9,585.1) (17,629.3) (27,214.4)<br />

Total 55.1 (94.6) 4,775.9 302.7 11,815.8 (26,913.6) (10,058.7) (5,829.0) (3,665.7) 119.8 (9,374.9)<br />

(*) The Group has no held-to-maturity fi nancial assets<br />

(**) Listed price of loans issued by CNA<br />

The fair value is determined either:<br />

– on the basis of listed prices on an active market; whenever listed prices on an active market are available, these are used in priority in determining<br />

the market value. Marketable securities and some listed bond loans are measured in this way;<br />

– on the basis of internal measurement techniques using the usual mathematical calculation methods incorporating observable market data<br />

(forward rates, yield curves, etc).<br />

245