VINCI - 2008 annual report

VINCI - 2008 annual report

VINCI - 2008 annual report

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Parent company fi nancial statements<br />

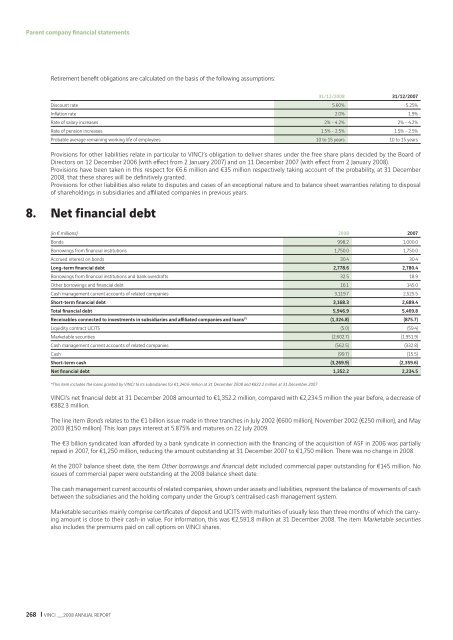

Retirement benefi t obligations are calculated on the basis of the following assumptions:<br />

268 <strong>VINCI</strong> __ <strong>2008</strong> ANNUAL REPORT<br />

31/12/<strong>2008</strong> 31/12/2007<br />

Discount rate 5.60% 5.25%<br />

Infl ation rate 2.0% 1.9%<br />

Rate of salary increases 2% - 4.2% 2% - 4.2%<br />

Rate of pension increases 1.5% - 2.5% 1.5% - 2.5%<br />

Probable average remaining working life of employees 10 to 15 years 10 to 15 years<br />

Provisions for other liabilities relate in particular to <strong>VINCI</strong>’s obligation to deliver shares under the free share plans decided by the Board of<br />

Directors on 12 December 2006 (with eff ect from 2 January 2007) and on 11 December 2007 (with eff ect from 2 January <strong>2008</strong>).<br />

Provisions have been taken in this respect for €6.6 million and €35 million respectively taking account of the probability, at 31 December<br />

<strong>2008</strong>, that these shares will be defi nitively granted.<br />

Provisions for other liabilities also relate to disputes and cases of an exceptional nature and to balance sheet warranties relating to disposal<br />

of shareholdings in subsidiaries and affi liated companies in previous years.<br />

8. Net financial debt<br />

(in € millions) <strong>2008</strong> 2007<br />

Bonds 998.2 1,000.0<br />

Borrowings from fi nancial institutions 1,750.0 1,750.0<br />

Accrued interest on bonds 30.4 30.4<br />

Long-term fi nancial debt 2,778.6 2,780.4<br />

Borrowings from fi nancial institutions and bank overdrafts 32.5 18.9<br />

Other borrowings and fi nancial debt 16.1 145.0<br />

Cash management current accounts of related companies 3,119.7 2,525.5<br />

Short-term fi nancial debt 3,168.3 2,689.4<br />

Total fi nancial debt 5,946.9 5,469.8<br />

Receivables connected to investments in subsidiaries and affi liated companies and loans (*) (1,324.8) (875.7)<br />

Liquidity contract UCITS (5.0) (59.4)<br />

Marketable securities (2,602.7) (1,951.9)<br />

Cash management current accounts of related companies (562.5) (332.8)<br />

Cash (99.7) (15.5)<br />

Short-term cash (3,269.9) (2,359.6)<br />

Net fi nancial debt 1,352.2 2,234.5<br />

*This item includes the loans granted by <strong>VINCI</strong> to its subsidiaries for €1,240.6 million at 31 December <strong>2008</strong> and €822.2 million at 31 December 2007<br />

<strong>VINCI</strong>’s net fi nancial debt at 31 December <strong>2008</strong> amounted to €1,352.2 million, compared with €2,234.5 million the year before, a decrease of<br />

€882.3 million.<br />

The line item Bonds relates to the €1 billion issue made in three tranches in July 2002 (€600 million), November 2002 (€250 million), and May<br />

2003 (€150 million). This loan pays interest at 5.875% and matures on 22 July 2009.<br />

The €3 billion syndicated loan aff orded by a bank syndicate in connection with the fi nancing of the acquisition of ASF in 2006 was partially<br />

repaid in 2007, for €1,250 million, reducing the amount outstanding at 31 December 2007 to €1,750 million. There was no change in <strong>2008</strong>.<br />

At the 2007 balance sheet date, the item Other borrowings and fi nancial debt included commercial paper outstanding for €145 million. No<br />

issues of commercial paper were outstanding at the <strong>2008</strong> balance sheet date.<br />

The cash management current accounts of related companies, shown under assets and liabilities, represent the balance of movements of cash<br />

between the subsidiaries and the holding company under the Group’s centralised cash management system.<br />

Marketable securities mainly comprise certifi cates of deposit and UCITS with maturities of usually less than three months of which the carrying<br />

amount is close to their cash-in value. For information, this was €2,591.8 million at 31 December <strong>2008</strong>. The item Marketable securities<br />

also includes the premiums paid on call options on <strong>VINCI</strong> shares.