VINCI - 2008 annual report

VINCI - 2008 annual report

VINCI - 2008 annual report

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

5. Standards and Interpretations not applied early<br />

Consolidated fi nancial statements<br />

The Group has not applied the Standards and Interpretations early that are not mandatory at 1 January <strong>2008</strong>, except for those described in Note<br />

A.1.2. “Change of accounting policy: accounting for loans at below-market rate of interest” and Note A.1.3 “Change of accounting policy: IFRIC<br />

12 Service Concession Arrangements”:<br />

- IAS 1 Revised Presentation of Financial Statements<br />

- Amendment to IAS 1 Revised / IAS 32 Puttable Financial Instruments and Obligations Arising on Liquidation<br />

- Amendments to IAS 23 Borrowing Costs<br />

- IFRS 2 Amendment Vesting Conditions and Cancellations<br />

- IAS 27 Revised Consolidated and Separate Financial Statements<br />

- IFRS 3 Revised Business Combinations<br />

- IAS 28 Investments in Associates<br />

- IAS 31 Interests in Joint Ventures<br />

- IFRS 8 Operating segments<br />

- IFRIC 13 Customer Loyalty Programmes<br />

- IFRIC 15 Agreements for the Construction of Real Estate<br />

- IFRIC 16 Hedges of a Net Investment in a Foreign Operation<br />

- IFRIC 17 Distributions of Non-cash Assets to Owners<br />

- IAS 39 Amendment: Recognition and Measurement of Eligible Hedged Items<br />

- Amendments under the IFRS Annual Improvements Project<br />

The potential impacts on the Group’s consolidated fi nancial statements of these Standards and Interpretations are being determined.<br />

B. Business combinations<br />

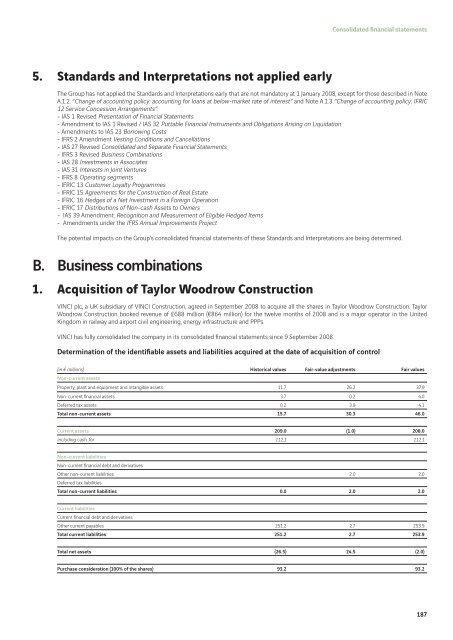

1. Acquisition of Taylor Woodrow Construction<br />

<strong>VINCI</strong> plc, a UK subsidiary of <strong>VINCI</strong> Construction, agreed in September <strong>2008</strong> to acquire all the shares in Taylor Woodrow Construction. Taylor<br />

Woodrow Construction booked revenue of £688 million (€864 million) for the twelve months of <strong>2008</strong> and is a major operator in the United<br />

Kingdom in railway and airport civil engineering, energy infrastructure and PPPs.<br />

<strong>VINCI</strong> has fully consolidated the company in its consolidated fi nancial statements since 9 September <strong>2008</strong>.<br />

Determination of the identifi able assets and liabilities acquired at the date of acquisition of control<br />

(in € millions)<br />

Non-current assets<br />

Historical values Fair-value adjustments Fair values<br />

Property, plant and equipment and intangible assets 11.7 26.2 37.9<br />

Non-current fi nancial assets 3.7 0.2 4.0<br />

Deferred tax assets 0.2 3.9 4.1<br />

Total non-current assets 15.7 30.3 46.0<br />

Current assets 209.0 (1.0) 208.0<br />

including cash, for 112.1 112.1<br />

Non-current liabilities<br />

Non-current fi nancial debt and derivatives<br />

Other non-current liabilities<br />

Deferred tax liabilities<br />

2.0 2.0<br />

Total non-current liabilities 0.0 2.0 2.0<br />

Current liabilities<br />

Current fi nancial debt and derivatives<br />

Other current payables 251.2 2.7 253.9<br />

Total current liabilities 251.2 2.7 253.9<br />

Total net assets (26.5) 24.5 (2.0)<br />

Purchase consideration (100% of the shares) 93.2 93.2<br />

187