VINCI - 2008 annual report

VINCI - 2008 annual report

VINCI - 2008 annual report

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Consolidated fi nancial statements<br />

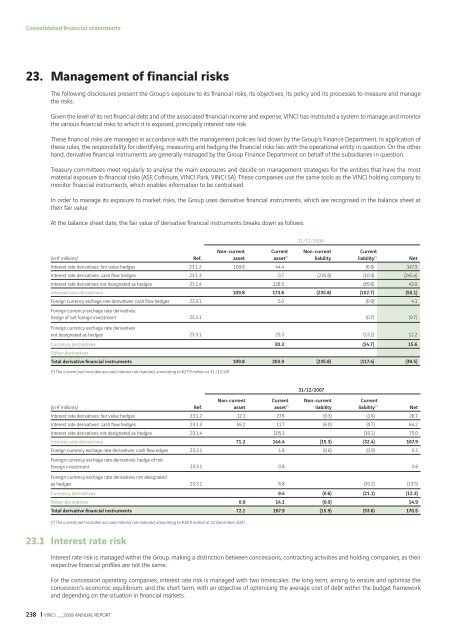

23. Management of financial risks<br />

The following disclosures present the Group’s exposure to its fi nancial risks, its objectives, its policy and its processes to measure and manage<br />

the risks.<br />

Given the level of its net fi nancial debt and of the associated fi nancial income and expense, <strong>VINCI</strong> has instituted a system to manage and monitor<br />

the various fi nancial risks to which it is exposed, principally interest rate risk.<br />

These fi nancial risks are managed in accordance with the management policies laid down by the Group’s Finance Department. In application of<br />

these rules, the responsibility for identifying, measuring and hedging the fi nancial risks lies with the operational entity in question. On the other<br />

hand, derivative fi nancial instruments are generally managed by the Group Finance Department on behalf of the subsidiaries in question.<br />

Treasury committees meet regularly to analyse the main exposures and decide on management strategies for the entities that have the most<br />

material exposure to fi nancial risks (ASF, Cofi route, <strong>VINCI</strong> Park, <strong>VINCI</strong> SA). These companies use the same tools as the <strong>VINCI</strong> holding company to<br />

monitor fi nancial instruments, which enables information to be centralised.<br />

In order to manage its exposure to market risks, the Group uses derivative fi nancial instruments, which are recognised in the balance sheet at<br />

their fair value.<br />

At the balance sheet date, the fair value of derivative fi nancial instruments breaks down as follows:<br />

Non-current<br />

Current<br />

31/12/<strong>2008</strong><br />

(in € millions) Ref.<br />

asset<br />

asset (*)<br />

Non-current<br />

Current<br />

liability<br />

liability (*) Net<br />

Interest rate derivatives: fair value hedges 23.1.2 109.8 44.4 (6.8) 147.3<br />

Interest rate derivatives: cash fl ow hedges 23.1.3 0.7 (235.8) (10.3) (245.4)<br />

Interest rate derivatives not designated as hedges 23.1.4 128.5 (85.6) 43.0<br />

Interest rate derivatives 109.8 173.6 (235.8) (102.7) (55.1)<br />

Foreign currency exchage rate derivatives: cash fl ow hedges<br />

Foreign currency exchage rate derivatives:<br />

23.3.1 5.0 (0.9) 4.1<br />

hedge of net foreign investment 23.3.1 (0.7) (0.7)<br />

Foreign currency exchage rate derivatives<br />

not designated as hedges 23.3.1 25.3 (13.1) 12.2<br />

Currency derivatives<br />

Other derivatives<br />

30.3 (14.7) 15.6<br />

Total derivative fi nancial instruments 109.8 203.9 (235.8) (117.4) (39.5)<br />

(*) The current part includes accrued interest not matured, amounting to €27.9 million at 31./12/.08.<br />

238 <strong>VINCI</strong> __ <strong>2008</strong> ANNUAL REPORT<br />

31/12/2007<br />

Non-current<br />

Current<br />

(in € millions) Ref.<br />

asset<br />

asset (*)<br />

Non-current<br />

Current<br />

liability<br />

liability (*) Net<br />

Interest rate derivatives: fair value hedges 23.1.2 12.1 27.6 (9.3) (1.6) 28.7<br />

Interest rate derivatives: cash fl ow hedges 23.1.3 59.2 11.7 (6.0) (0.7) 64.2<br />

Interest rate derivatives not designated as hedges 23.1.4 105.1 (30.1) 75.0<br />

Interest rate derivatives 71.2 144.4 (15.3) (32.4) 167.9<br />

Foreign currency exchage rate derivatives: cash fl ow edges<br />

Foreign currency exchage rate derivatives: hedge of net<br />

23.3.1 1.8 (0.6) (0.9) 0.3<br />

foreign investment 23.3.1 0.8 0.8<br />

Foreign currency exchage rate derivatives not designated<br />

as hedges 23.3.1 6.8 (20.2) (13.5)<br />

Currency derivatives 9.4 (0.6) (21.1) (12.3)<br />

Other derivatives 0.9 14.1 (0.0) 14.9<br />

Total derivative fi nancial instruments 72.1 167.9 (15.9) (53.6) 170.5<br />

(*) The current part includes accrued interest not matured, amounting to €38.9 million at 31 December 2007.<br />

23.1 Interest rate risk<br />

Interest rate risk is managed within the Group, making a distinction between concessions, contracting activities and holding companies, as their<br />

respective fi nancial profi les are not the same.<br />

For the concession operating companies, interest rate risk is managed with two timescales: the long term, aiming to ensure and optimise the<br />

concession’s economic equilibrium, and the short term, with an objective of optimising the average cost of debt within the budget framework<br />

and depending on the situation in fi nancial markets.