VINCI - 2008 annual report

VINCI - 2008 annual report

VINCI - 2008 annual report

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

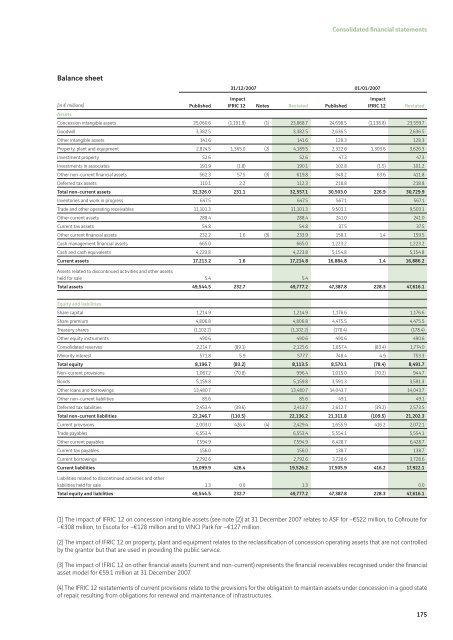

Balance sheet<br />

(in € millions) Published<br />

Consolidated fi nancial statements<br />

31/12/2007 01/01/2007<br />

Impact<br />

IFRIC 12 Notes Restated Published<br />

Impact<br />

IFRIC 12 Restated<br />

Assets<br />

Concession intangible assets 25,060.6 (1,191.9) (1) 23,868.7 24,698.5 (1,138.8) 23,559.7<br />

Goodwill 3,382.5 3,382.5 2,636.5 2,636.5<br />

Other intangible assets 141.6 141.6 128.3 128.3<br />

Property, plant and equipment 2,824.5 1,365.0 (2) 4,189.5 2,322.6 1,303.6 3,626.3<br />

Investment property 52.6 52.6 47.3 47.3<br />

Investments in associates 191.9 (1.8) 190.1 102.8 (1.5) 101.2<br />

Other non-current fi nancial assets 562.3 57.5 (3) 619.8 348.2 63.6 411.8<br />

Deferred tax assets 110.1 2.2 112.3 218.8 218.8<br />

Total non-current assets 32,326.0 231.1 32,557.1 30,503.0 226.9 30,729.9<br />

Inventories and work in progress 647.5 647.5 567.1 567.1<br />

Trade and other operating receivables 11,101.3 11,101.3 9,503.1 9,503.1<br />

Other current assets 288.4 288.4 241.0 241.0<br />

Current tax assets 54.8 54.8 37.5 37.5<br />

Other current fi nancial assets 232.2 1.6 (3) 233.9 158.1 1.4 159.5<br />

Cash management fi nancial assets 665.0 665.0 1,223.2 1,223.2<br />

Cash and cash equivalents 4,223.8 4,223.8 5,154.8 5,154.8<br />

Current assets 17,213.2 1.6 17,214.8 16,884.8 1.4 16,886.2<br />

Assets related to discontinued activities and other assets<br />

held for sale 5.4 5.4<br />

Total assets 49,544.5 232.7 49,777.2 47,387.8 228.3 47,616.1<br />

Equity and liabilities<br />

Share capital 1,214.9 1,214.9 1,176.6 1,176.6<br />

Share premium 4,806.8 4,806.8 4,475.5 4,475.5<br />

Treasury shares (1,102.2) (1,102.2) (178.4) (178.4)<br />

Other equity instruments 490.6 490.6 490.6 490.6<br />

Consolidated reserves 2,214.7 (89.1) 2,125.6 1,857.4 (83.4) 1,774.0<br />

Minority interest 571.8 5.9 577.7 748.4 4.9 753.3<br />

Total equity 8,196.7 (83.2) 8,113.5 8,570.1 (78.4) 8,491.7<br />

Non-current provisions 1,067.2 (70.8) 996.4 1,015.0 (70.2) 944.7<br />

Bonds 5,159.8 5,159.8 3,591.3 3,591.3<br />

Other loans and borrowings 13,480.7 13,480.7 14,043.7 14,043.7<br />

Other non-current liabilities 85.6 85.6 49.1 49.1<br />

Deferred tax liabilities 2,453.4 (39.6) 2,413.7 2,612.7 (39.2) 2,573.5<br />

Total non-current liabilities 22,246.7 (110.5) 22,136.2 21,311.8 (109.5) 21,202.3<br />

Current provisions 2,003.0 426.4 (4) 2,429.4 1,655.9 416.2 2,072.1<br />

Trade payables 6,553.4 6,553.4 5,554.1 5,554.1<br />

Other current payables 7,594.9 7,594.9 6,428.7 6,428.7<br />

Current tax payables 156.0 156.0 138.7 138.7<br />

Current borrowings 2,792.6 2,792.6 3,728.6 3,728.6<br />

Current liabilities 19,099.9 426.4 19,526.2 17,505.9 416.2 17,922.1<br />

Liabilities related to discontinued activities and other<br />

liabilities held for sale 1.3 0.0 1.3 0.0<br />

Total equity and liabilities 49,544.5 232.7 49,777.2 47,387.8 228.3 47,616.1<br />

(1) The impact of IFRIC 12 on concession intangible assets (see note (2)) at 31 December 2007 relates to ASF for –€522 million, to Cofi route for<br />

–€308 million, to Escota for –€128 million and to <strong>VINCI</strong> Park for –€127 million.<br />

(2) The impact of IFRIC 12 on property, plant and equipment relates to the reclassifi cation of concession operating assets that are not controlled<br />

by the grantor but that are used in providing the public service.<br />

(3) The impact of IFRIC 12 on other fi nancial assets (current and non-current) represents the fi nancial receivables recognised under the fi nancial<br />

asset model for €59.1 million at 31 December 2007.<br />

(4) The IFRIC 12 restatements of current provisions relate to the provisions for the obligation to maintain assets under concession in a good state<br />

of repair, resulting from obligations for renewal and maintenance of infrastructures.<br />

175