VINCI - 2008 annual report

VINCI - 2008 annual report

VINCI - 2008 annual report

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Consolidated fi nancial statements<br />

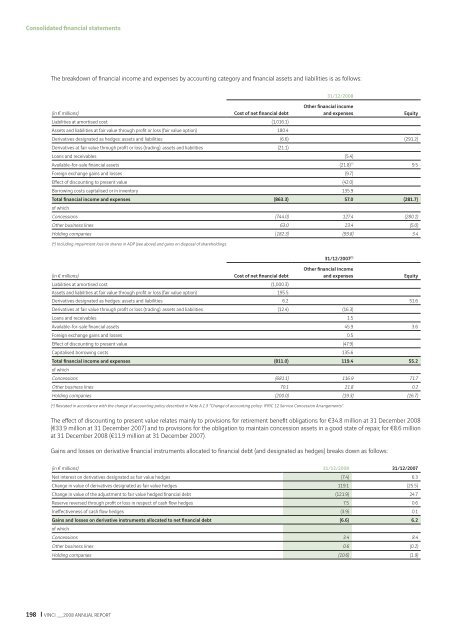

The breakdown of fi nancial income and expenses by accounting category and fi nancial assets and liabilities is as follows:<br />

(in € millions) Cost of net fi nancial debt<br />

Liabilities at amortised cost (1,016.1)<br />

Assets and liabilities at fair value through profi t or loss (fair value option) 180.4<br />

198 <strong>VINCI</strong> __ <strong>2008</strong> ANNUAL REPORT<br />

31/12/<strong>2008</strong><br />

Other fi nancial income<br />

and expenses Equity<br />

Derivatives designated as hedges: assets and liabilities (6.6) (291.2)<br />

Derivatives at fair value through profi t or loss (trading): assets and liabilities (21.1)<br />

Loans and receivables (5.4)<br />

Available-for-sale fi nancial assets (21.8) (*) 9.5<br />

Foreign exchange gains and losses (9.7)<br />

Eff ect of discounting to present value (42.0)<br />

Borrowing costs capitalised or in inventory 135.9<br />

Total fi nancial income and expenses (863.3) 57.0 (281.7)<br />

of which<br />

Concessions (744.0) 127.4 (280.1)<br />

Other business lines 63.0 23.4 (5.0)<br />

Holding companies (182.3) (93.8) 3.4<br />

(*) Including impairment loss on shares in ADP (see above) and gains on disposal of shareholdings.<br />

(in € millions) Cost of net fi nancial debt<br />

Liabilities at amortised cost (1,000.3)<br />

Assets and liabilities at fair value through profi t or loss (fair value option) 195.5<br />

31/12/2007 (*)<br />

Other fi nancial income<br />

and expenses Equity<br />

Derivatives designated as hedges: assets and liabilities 6.2 51.6<br />

Derivatives at fair value through profi t or loss (trading): assets and liabilities (12.4) (16.3)<br />

Loans and receivables 1.5<br />

Available-for-sale fi nancial assets 45.9 3.6<br />

Foreign exchange gains and losses 0.5<br />

Eff ect of discounting to present value (47.9)<br />

Capitalised borrowing costs 135.6<br />

Total fi nancial income and expenses (811.0) 119.4 55.2<br />

of which<br />

Concessions (681.1) 116.9 71.7<br />

Other business lines 70.1 21.8 0.2<br />

Holding companies (200.0) (19.3) (16.7)<br />

(*) Restated in accordance with the change of accounting policy described in Note A.1.3 “Change of accounting policy: IFRIC 12 Service Concession Arrangements”.<br />

The eff ect of discounting to present value relates mainly to provisions for retirement benefi t obligations for €34.8 million at 31 December <strong>2008</strong><br />

(€33.9 million at 31 December 2007) and to provisions for the obligation to maintain concession assets in a good state of repair, for €8.6 million<br />

at 31 December <strong>2008</strong> (€11.9 million at 31 December 2007).<br />

Gains and losses on derivative fi nancial instruments allocated to fi nancial debt (and designated as hedges) breaks down as follows:<br />

(in € millions) 31/12/<strong>2008</strong> 31/12/2007<br />

Net interest on derivatives designated as fair value hedges (7.4) 6.3<br />

Change in value of derivatives designated as fair value hedges 119.1 (25.5)<br />

Change in value of the adjustment to fair value hedged fi nancial debt (121.9) 24.7<br />

Reserve reversed through profi t or loss in respect of cash fl ow hedges 7.5 0.6<br />

Ineff ectiveness of cash fl ow hedges (3.9) 0.1<br />

Gains and losses on derivative instruments allocated to net fi nancial debt<br />

of which<br />

(6.6) 6.2<br />

Concessions 3.4 8.4<br />

Other business lines 0.6 (0.2)<br />

Holding companies (10.6) (1.9)